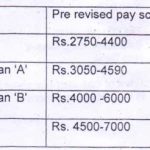

Defence 6th CPC up-graded pay scales to the Fire Fighting Employees No.Pay/Tech-I/ 01(6th CPC), Cir No - 2 Dated 12/02/2020 TodThe All CFAs Subject: Grant of up-graded pay scales to the Fire Fighting staff in Ministry of Defence as per 6th CPC recommendation A copy of Government of India MoD letter No F. No.50266/6/PC/ EMECiv(C-2)178- F/D (O-II)2019, dated- … [Read more...] about 6th CPC up-graded pay scales to the Fire Fighting Employees in Ministry of Defence

| 46% DA Order for Central Government Employees wef 1st July 2023 PDF |

4% DA for Central Government Employees wef 1st July 2023

Railway Employees Bonus 2023

Bonus for central government employees 2023 pdf

CENTRAL GOVERNMENT HOLIDAY LIST 2024

| 42% DA Order for Central Government Employees wef 1st January 2023 PDF |

| 42% DR Order for Central Government Pensioners wef 1st January 2023 PDF |

seventh CPC

7th CPC DR: 12% Dearness Relief to KV Pensioners effective from 1.1.2019

7th CPC DR: 12% Dearness Relief to KV Pensioners effective from 1.1.2019 Grant of Dearness Relief to Central Government pensioners/ family pensioners- Revised rate effective from 01.01.2019 under Seventh CPC KENDRIYA VlDYALAYA SANGATHAN 18, lnstitutional Area, Shaheed Jeet Singh Marg New Delhi 110 016 F.110230(Misc)2016/KVS(HQ)P&I/1615 Dated: 15.04.2019 The … [Read more...] about 7th CPC DR: 12% Dearness Relief to KV Pensioners effective from 1.1.2019

7th CPC: Revision of Entitlement of TA/DA to JCM Members

7th CPC: Revision of Entitlement of TA/DA to JCM Members Revision of Entitlement of TA/DA to JCM Members after implementation of Seventh CPC recommendations F. No. 8/10/2008-JCA Government of India Ministry of Personnel, P.G. & Pensions Department of Personnel & Training Establishment (JCA) Section North Block, New Delhi Dated 20th August, 2018 OFFICE … [Read more...] about 7th CPC: Revision of Entitlement of TA/DA to JCM Members

Restoration of pension in respect of Defence Service Personnel – delinking of qualifying service of 33 years for revised pension with effect from 1.1.2006 reg

Restoration of pension in respect of Defence Service Personnel - delinking of qualifying service of 33 years for revised pension with effect from 1.1.2006 reg No.1(04)/2007/D(Pen/Pol) Government of India Ministry of Defence Department of Ex-Servicemen Welfare New Delhi,Dated:20th June,2018 To The Chief of the Army Staff The Chief of the Naval Staff The Chief of the … [Read more...] about Restoration of pension in respect of Defence Service Personnel – delinking of qualifying service of 33 years for revised pension with effect from 1.1.2006 reg

CLASS ORIENTED MILITANT STRUGGLE OF THREE LAKHS GRAMIN DAK SEVAKS

CLASS ORIENTED MILITANT STRUGGLE OF THREE LAKHS GRAMIN DAK SEVAKS "CHANGE THE POLICY OR WE SHALL CHANGE THE GOVERNMENT" M.Krishnan Secretary General, Confederation Ex-Secretary General, NFPE The unprecedented strike of three lakhs Gramin Dak Sevaks of Postal department will enter the 14th day on Monday. Functioning of rural postal services has come to a grinding halt. Out … [Read more...] about CLASS ORIENTED MILITANT STRUGGLE OF THREE LAKHS GRAMIN DAK SEVAKS

LTC to Railway employees (and Government servants whose spouses are Railway servants)

LTC to Railway employees (and Government servants whose spouses are Railway servants) No.31011/1512017-Estt.A-IV Government of India Ministry of Personnel, Public Grievances & Pensions Department of Personnel & Training Establishment A-IV Desk North Block New Delhi Dated March 27, 2018 OFFICE MEMORANDUM Subject: LTC to Railway employees (and Government … [Read more...] about LTC to Railway employees (and Government servants whose spouses are Railway servants)

Loco Running Staff – Rajya Sabha Q&A

GOVERNMENT OF INDIA MINISTRY OF RAILWAYS RAJYA SABHA UNSTARRED QUESTION NO. 960 ANSWERED ON 09.02.2018 LOCO RUNNING STAFF 960. SHRI C.P. NARAYANAN: Will the Minister of RAILWAYS be pleased to state: (a) the number of loco running staff in Railways at present; (b) their average work load per week; (c) the maximum hours of continuous work they have to do … [Read more...] about Loco Running Staff – Rajya Sabha Q&A

7th CPC: Revision of provisional pension sanctioned under Rule 69 of the CCS (Pension) Rules, 1972

7th CPC: Revision of provisional pension sanctioned under Rule 69 of the CCS (Pension) Rules, 1972 No. 38/49/ 16 - P&PW (A) Government of India Ministry of Personnel, PG & Pensions Department of Pension & Pensioners' Welfare 3rd Floor, Lok Nayak Bhawan Khan Market, New Delhi Dated the 12th February, 2018 Office Memorandum Sub: - Revision of provisional … [Read more...] about 7th CPC: Revision of provisional pension sanctioned under Rule 69 of the CCS (Pension) Rules, 1972

Recommendations of Seventh CPC with regard to EDP Cadre

Recommendation of 7th CPC with regard to EDP Cadre - Dopt Orders No.AB-14017/14/2016-Estt.(RR)(Pt.) Government of India Ministry of Personnel P.G & pensions Department of Personnel and Training North Block, New Delhi Dated: 30th November, 2017 Office Memorandum Sub: Recommendations of Seventh CPC with regard to EDP Cadre. The undersigned is directed to refer to … [Read more...] about Recommendations of Seventh CPC with regard to EDP Cadre

GDS News: Demanding Immediate Implementation of The Kamalesh Chandra Committee Report

GDS News: Demanding Immediate Implementation of The Kamalesh Chandra Committee Report MEMORANDUM SUBMITTED TO THE HON'BLE DY.MINISTER OF FINANCE, UNION OF INDIA, CAMP AT NAGERCOIL-629001 BY THE CIRCLE SECRETARY OF TAMIL NADU, ALL INDIA GRAMIN DAK SEVAKS UNION Respected Sir, I. As per the decision of the Central Government one man committee was appointed to submit the … [Read more...] about GDS News: Demanding Immediate Implementation of The Kamalesh Chandra Committee Report

Latest DoPT Orders 2023

CENTRAL GOVT HOLIDAY LIST 2023

Indian Railway Holiday List 2023 PDF | Postal Holidays List 2023 India Post | Bank Holidays List 2023 India | LIC Office Holiday List 2023 PDF Download | EPFO Holiday List 2023 PDF Download | ESIC Holiday List 2023 PDF Download | CGHS Holiday Calendar List 2023 | Post Office Holidays 2023 | Railway Holidays CG Office Holidays 2023 | TN Govt Holidays 2023 | KVS Holiday List 2023-2024 PDF