Section 194 of income tax act 1961 - Central Government relaxes TDS restrictions under section 194A of the Income-tax Act, 1961. MINISTRY OF FINANCE(Department of Revenue)(CENTRAL BOARD OF DIRECT TAXES) NOTIFICATION New Delhi, the 17th September, 2021 INCOME TAX S.O. 3815(E). - In exercise of the powers conferred by sub-section (1F) of section 197A of the … [Read more...] about Central Government relaxes TDS restrictions under section 194A of the Income tax Act 1961 – CBDT

CENTRAL GOVERNMENT HOLIDAYS IN 2025

CENTRAL GOVERNMENT HOLIDAY LIST 2024

| 50% DA Order for Central Government Employees wef 1st Jan 2024 PDF |

| CGHS Updated Rate Card PDF Download |

| Latest List of KV Schools in India |

| 7th Pay Commission Latest News 2024 |

| MACP for the Central Government Employees |

IT Exemption - Income Tax Exemption - CENTRAL GOVERNMENT EMPLOYEES NEWS

Union Budget 2021 – Senior Citizens above 75 years of Age, Having Pension & Interest Income exempted from Filing Tax Return

Union Budget 2021 Ministry of Finance Senior Citizens above 75 years of Age, Having Pension & Interest Income exempted from Filing Tax Return Further push to Affordable / Rental housing Faceless dispute resolution committee in the offing Tax relaxations for attracting Foreign Investment in Infrastructure sector Tax incentives announced in Budget for … [Read more...] about Union Budget 2021 – Senior Citizens above 75 years of Age, Having Pension & Interest Income exempted from Filing Tax Return

IT Exemption for payment of deemed LTC fare for non-Central Government employees

IT Exemption for LTC fare Ministry of Finance Income-tax Exemption for payment of deemed LTC fare for non-Central Government employees 29 OCT 2020 In view of the COVID-19 pandemic and resultant nationwide lockdown as well as disruption of transport and hospitality sector, as also the need for observing social distancing, a number of employees are not able to avail … [Read more...] about IT Exemption for payment of deemed LTC fare for non-Central Government employees

Introduction of Taxable Floating Rate Savings Bonds 2020 – PIB

Ministry of Finance Introduction of Floating Rate Savings Bonds, 2020 (Taxable) 26 JUN 2020 The Government has notified the new Floating Rate Savings Bonds, 2020 (Taxable)Scheme in place of 7.75 percent Savings (Taxable) Bonds, 2018 Scheme which ceased for subscription from the close of banking business on May 28, 2020. The broad features of the new Floating Rate … [Read more...] about Introduction of Taxable Floating Rate Savings Bonds 2020 – PIB

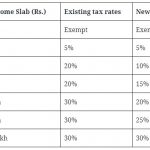

Budget 2020 – Personal Income Tax and tax simplification

Budget 2020 - Personal Income Tax and tax simplification In order to provide significant relief to individual taxpayers and to simplify the Income-Tax law, the Finance Minister proposed to introduce a new and simpler personal income tax system in which income tax rates will be substantially reduced for individual taxpayers who forgo such deductions and exemptions. The … [Read more...] about Budget 2020 – Personal Income Tax and tax simplification

Deduction of TDS in respect of Cash Withdrawal above One Crore by a National Savings Schemes account holder – DoP

Deduction of TDS in respect of Cash Withdrawal above One Crore by a National Savings Schemes account holder - DoP SB Order No. 02/2020 F.No 109-27/2019-SBGovt. of India Ministry of CommunicationDepartment of Posts (F.S. Division) Dak Bhawan, New Delhi-110001 Dated: 09.01.2020 To, All Head of Circles / Regions Addl. Director General, APS, New Delhi Subject :- … [Read more...] about Deduction of TDS in respect of Cash Withdrawal above One Crore by a National Savings Schemes account holder – DoP

Income tax exemption for gratuity increased from Rs.10 lakhs to 20 lakhs w.e.f. 29.3.2018

IT Exemption on Gratuity - 20 lakhs w.e.f. 29.3.2018 Income tax exemption for gratuity increased from Rs.10 lakhs to 20 lakhs w.e.f. 29.3.2018 Ministry of Finance has enhanced the income tax exemption for gratuity under section 10 (10) (iii) of the Income Tax Act, 1961 to Rs. 20 lakhs. Shri Santosh Kumar Gangwar, Minister of State for Labour and Employment has expressed hope … [Read more...] about Income tax exemption for gratuity increased from Rs.10 lakhs to 20 lakhs w.e.f. 29.3.2018

Budget 2019 : Income Tax exemption limit raised to Rs. 5 lakh

Budget 2019 : Income Tax exemption limit raised to Rs. 5 lakh Finance Minister Piyush goyal has proposed that individuals with income upto Rs 5 lakh will not have to pay any income tax for FY2019-20. In the previous budgets also, the Narendra Modi led-government provided tax relief to taxpayers. In Budget 2014, the minimum tax-exemption limit was raised from Rs 2 … [Read more...] about Budget 2019 : Income Tax exemption limit raised to Rs. 5 lakh

Income Tax benefits from Post Office Saving Schemes

Income Tax benefits from Post Office Saving Schemes Interest rates on these post office saving schemes move in line with the government's interest rates on small savings schemes.India Post or Department of Posts, which runs the postal network of the country, offers a number of saving schemes with income tax benefits. Using these saving schemes, investor can claim a deduction … [Read more...] about Income Tax benefits from Post Office Saving Schemes

Income Tax benefits In Sukanya Samriddhi Account (SSA)

Income Tax benefits In Sukanya Samriddhi Account (SSA) (i) Sukanya Samriddhi Account has been specified under clause (viii) of Sub Section (2) of Section 80(C) of Income Tax Act 1961 and deposits under these accounts enjoy benefit of this Income Tax Section up to the overall maximum limit of Rs. One lakh Fifty Thousand (1,50,000). (ii) By Finance Act 2015, a new clause … [Read more...] about Income Tax benefits In Sukanya Samriddhi Account (SSA)

Latest DoPT Orders 2024

CENTRAL GOVT HOLIDAY LIST 2024

Indian Railway Holiday List 2023 PDF | Postal Holidays List 2023 India Post | Bank Holidays List 2023 India | LIC Office Holiday List 2023 PDF Download | EPFO Holiday List 2023 PDF Download | ESIC Holiday List 2023 PDF Download | CGHS Holiday Calendar List 2023 | Post Office Holidays 2023 | Railway Holidays CG Office Holidays 2023 | TN Govt Holidays 2023 | KVS Holiday List 2023-2024 PDF