Income Tax at source is not be deducted from pension in respect of Gallantry Awardees - CPAO GOVERNMENT OF INDIAMINISTRY OF FINANCEDEPARTMENT OF EXPENDITURECENTRAL PENSION ACCOUNTING OFFICETRIKOOT-II, BHIKAJI CAMA PLACE,NEW DELHI -110066 CPAO/IT&Tech/ Misc.Corres/35 (Vol-II) (PF)/10370/ 2023-24/ 109 22.08.2023 OFFICE MEMORANDUM Attention is invited to this … [Read more...] about Income Tax Deduction for Gallantry Awardees Pension – CPAO Clarification

CENTRAL GOVERNMENT HOLIDAYS IN 2025

| 2% DA Hike Order for Central Government Employees wef 1st Jan 2025 PDF |

| CGHS Updated Rate Card PDF Download |

| Latest List of KV Schools in India |

| 7th Pay Commission Latest News 2025 |

| MACP for the Central Government Employees |

Income Tax - Central Government Employees

Extension of time limits for submission of certain TDS/TCS Statements – CBDT

Deduction of tax for the first quarter of the financial year 2023-24, may be furnished on or before 30th September, 2023. Circular No. 9/2023 F.No.370149/ 109/ 2023 -TPLGovernment of IndiaMinistry of FinanceDepartment of RevenueCentral Board of Direct Tax North Block, New Delhi 28th June, 2023 Sub: Order under section 119 of the Income-tax Act, 1961 for extension … [Read more...] about Extension of time limits for submission of certain TDS/TCS Statements – CBDT

Increased limit for tax exemption on leave encashment on retirement or otherwise of non-government salaried employees to Rs.25 lakh w.e.f. 01.04.2023

Income tax exemption on leave encashment Increased limit for tax exemption on leave encashment for non-government salaried employees notified CBDT Government of IndiaMinistry of FinanceDepartment of RevenueCentral Board of Direct Taxes New Delhi, 25th May, 2023 PRESS RELEASE Increased limit for tax exemption on leave encashment for non-government salaried … [Read more...] about Increased limit for tax exemption on leave encashment on retirement or otherwise of non-government salaried employees to Rs.25 lakh w.e.f. 01.04.2023

Budget 2023 Major relief in the personal income tax

Budget 2023 - New tax regime Smt Nirmala Sitharaman provides major relief in the personal income tax. The indirect tax proposals contained in the budget aim to promote exports enhance domestic value addition, encourage green energy and mobility. Personal Income Tax There are five major announcements relating to the personal income tax. The rebate limit in the new tax … [Read more...] about Budget 2023 Major relief in the personal income tax

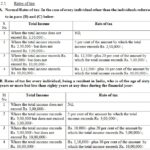

DEDUCTION OF TAX AT SOURCE INCOME-TAX DEDUCTION FROM SALARIES DURING THE FINANCIAL YEAR 2022-2023

INCOME-TAX DEDUCTION FROM SALARIES GOVERNMENT OF INDIAMINISTRY OF FINANCE(DEPARTMENT OF REVENUE)CENTRAL BOARD OF DIRECT TAXES DEDUCTION OF TAX AT SOURCE- INCOME-TAXDEDUCTION FROM SALARIESUNDER SECTION 192 OF THE INCOME-TAX ACT, 1961 DURING THE FINANCIAL YEAR 2022-23 CIRCULAR NO. 24/2022 NEW DELHI, the 07th December, 2022 Table of Contents 1. Definition of … [Read more...] about DEDUCTION OF TAX AT SOURCE INCOME-TAX DEDUCTION FROM SALARIES DURING THE FINANCIAL YEAR 2022-2023

DAD – Submission of Income Tax Savings Documents for the Financial Year 2022-2023

Income Tax Savings Documents GOVERNMENT OF INDIAMINISTRY OF DEFENCECONTROLLER OF DEFENCE ACCOUNTS, GUWAHATIUdayan Vihar, Narangi, Guwahati - 781171 CIRCULAR NO. 105THROUGH OFFICIAL WEBSITE Subject: Submission of Income Tax Savings Documents for the Financial Year 2022-2023: DAD For the purpose of assessment and regularization of Income Tax for the Financial Year … [Read more...] about DAD – Submission of Income Tax Savings Documents for the Financial Year 2022-2023

The amount received in any financial year shall be furnished in Form A to the Assessing Officer within nine months from the end of such financial year or 31.12.2022

CBDT specifies Conditions for exemption of money received from employer or any person for Covid-19 Treatment under Section 56 (2)(x) vide Notification No. 92/2022-Income Tax, Dated: 05.08.2022 MINISTRY OF FINANCE(Department of Revenue)(CENTRAL BOARD OF DIRECT TAXES)NOTIFICATIONNew Delhi, the 5th August, 2022 S.O. 3705(E). - In exercise of the powers conferred by clause … [Read more...] about The amount received in any financial year shall be furnished in Form A to the Assessing Officer within nine months from the end of such financial year or 31.12.2022

Tax Relief in the repercussion of Covid-19 treatment is tax-free under Section 56 (2)(x)

Tax Relief in the repercussion of Covid-19 Documents to be submitted by Employees for Tax Relief in the repercussion of Covid-19 under Section 56 (2)(x): IT Notification No. 90/2022 CBDT specifies Documents to be submitted by Employees for Tax Relief in the repercussion of Covid-19 under Section 56 (2)(x) vide Notification No. 90/2022-Income Tax, Dated: … [Read more...] about Tax Relief in the repercussion of Covid-19 treatment is tax-free under Section 56 (2)(x)

Income tax payers are not eligible to participate in Atal Pension Yojana

Atal Pension Yojana Gazette Notification dated 10.08.2022 MINISTRY OF FINANCE(Department of Financial Services)NOTIFICATION New Delhi, the 10th August, 2022 F. No. 16/1/2015-PR.- Atal Pension Yojana. - In partial modification of Ministry of Finance, Department of Financial Services Notification No. 16/1/2015-PR dated 16th October, 2015 on Atal Pension Yojana, published … [Read more...] about Income tax payers are not eligible to participate in Atal Pension Yojana

Reduction of time limit for verification of Income Tax Return (ITR) from 120 days to 30 days of transmitting the data of ITR electronically

Reduction of time limit for verification of Income Tax Return (ITR) Notification No. 05 of 2022 Government of IndiaMinistry of FinanceDepartment of RevenueCentral Board of Direct TaxesDirectorate of Systems New Delhi, dated : 29.07.2022 Subject: Reduction of time limit for verification of Income Tax Return (ITR) from within 120 days to 30 days of transmitting the … [Read more...] about Reduction of time limit for verification of Income Tax Return (ITR) from 120 days to 30 days of transmitting the data of ITR electronically

Latest DoPT Orders 2025

CENTRAL GOVT HOLIDAY LIST 2025

Indian Railway Holiday List 2025 PDF | Postal Holidays List 2025 India Post | Bank Holidays List 2025 India | LIC Office Holiday List 2025 PDF Download | EPFO Holiday List 2025 PDF Download | ESIC Holiday List 2025 PDF Download | CGHS Holiday Calendar List 2025 | Post Office Holidays 2025 | Railway Holidays CG Office Holidays 2025 |