PLB 2023 for Postal Department

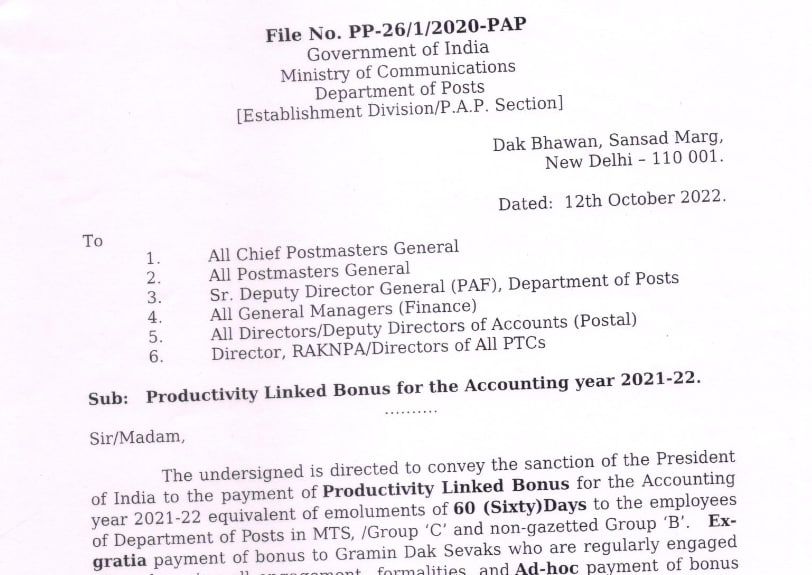

Postal employees are eagerly awaiting Bonus Order 2022-2023. Last year PLB For Postal Department issued order for 60 days for the Adoc Bonus. Order No. PP26-1/2020-PAP Dated 12-10-2022. This year, postal employees are also expecting a bonus order from the government. Diwali is on November 12, 2023, and the bonus order is expected to be announced prior to Dussehra, on October 24, 2023. Once the 2023 Postal Bonus Order is announced, we will update this page. For your convenience, the Bonus Calculation Formula for Central Government Employees is provided below.

Awaiting 60 Days Diwali Bonus for Postal Employees 2023

Central Government Employees Bonus Order 2023 PDF – Grant of Non-Productivity Linked Bonus (ad-hoc bonus)

PLB For Postal Department issued order for 60 days for the Adoc Bonus. Order No. PP26-1/2020-PAP Dated 12-10-2022

Productivity Linked Bonus to postal employees 2022 PDF

File No. PP-26/1/2020-PAP

Government of India

Ministry of Communications

Department of Posts

[Establishment Division/P.A.P. Section]

Dak Bhawan, Sansad Marg,

New Delhi – 110 001.

Dated: 12th October 2022.

To

All Chief Postmasters General

All Postmasters General

Sr. Deputy Director General (PAF), Department of Posts

All General Managers (Finance)

All Directors/Deputy Directors of Accounts (Postal)

Director, RAKNPA/Directors of All PTCs

Sub: Productivity Linked Bonus for the Accounting year 2021-22.

Sir/Madam,

The undersigned is directed to convey the sanction of the President of India to the payment of Productivity Linked Bonus for the Accounting year 2021-22 equivalent of emoluments of 60 (Sixty)Days to the employees of Department of Posts in MTS, /Group ‘C’ and non-gazetted Group ‘B’. Ex-gratia payment of bonus to Gramin Dak Sevaks who are regularly engaged after observing all engagement formalities, and Ad-hoc payment of bonus to Casual laborers who have been conferred Temporary Status are also to be paid equivalent to allowance/wages respectively for 60 (Sixty) Days for the same period.

1.1 The calculation for the purpose of payment of bonus under each category will be done as indicated below:-

- REGULAR EMPLOYEES:

2.1 Productivity Linked Bonus will be calculated on the basis of the following formula:-

Average emoluments X Number of days of bonus

30.4 (average no. of days in a month)

2.2 The terms “emoluments” for regular Departmental employees includes Basic Pay in the Pay matrix, Dearness Pay, S.B. Allowance, Deputation (Duty) Allowance, Dearness Allowance and Training Allowance to Faculty Members in Training Institutes. In case of drawal of salary exceeding Rs.7000/- (Rupees Seven Thousand only) in any month during the accounting year 2021-22, the emoluments shall be restricted to

Rs.7000/- (Rupees Seven Thousand only) per month only.

2.3 “Average Emoluments” for a regular employee is arrived at by dividing by twelve, the total salary drawn during the year 2021-22 for the period from 1.4.2021 to 31.03.2022, by restricting each month’s salary to Rs. 7000/- per month. However, for the periods of EOL and Dies-Non in a given month, proportionate deduction is required to be made from the ceiling limit of Rs.7000/-

2.4 In case of those employees who were under suspension, or on whom dies-non was imposed or both, during the accounting year, the clarificatory orders issued vide Paras 1 & 3 respectively of this officer order No. 26-8/80- PAP (Pt.1) dated 11.6.1981 and No. 26-4/87- PAP(Pt.ID) dated 8.2.1988 will apply.

2.5 Those employees who have resigned/retired or left services or proceeded on deputation within the Department of Posts or those who have proceeded on deputation outside the Department of Posts after 31.03.2022 will also be entitled to bonus. In case of all such employees, the Productivity Linked Bonus admissible will be as per provisions of Paras 2.1 to 2.3 above.

GRAMIN DAK SEVAKS (GDSs)

3.1 In respect of GDSs who were on duty throughout the year during 2021-22, Average Monthly Time Related Continuity Allowance will be calculated taking into account the Time Related Continuity Allowance (TRCA) plus corresponding Dearness Allowance drawn by them for the period from 1.4.2021 to 31.3.2022 divided by 12. However, where the Time Related Continuity Allowance exceeds Rs. 7000/- in any month during this period, the allowance will be restricted to Rs.7000/- per month. Ex-gratia payment of bonus may be calculated by applying the bonus formula as mentioned below:

Average TRCA X Number of days of bonus

30.4 (average no. of days in a month)

3.2 The allowance drawn by a substitute will not be counted towards – bonus calculation for either the substitutes or the incumbent GDSs. In respect of those GDS who were engaged in short term vacancies in Postmen / MTS Cadre will be governed by instructions issued by this Directorate vide O.M. No. 23-01/2019-GDS dated 23.10.209

3.3 If a GDS has been on duty for a part of the year by way of a fresh engagement, or for having been put off duty, or for having left service, he will be paid proportionate ex-gratia bonus calculated by applying the procedure prescribed in Para 3.1 above.

3.4 Those Gramin Dak Sevaks who have resigned/ discharged or left service after 31.03.2022 will also be entitled to proportionate ex-gratia Bonus. In case of all such Gramin Dak Sevaks, the Ex-gratia Bonus admissible will be as per provisions of Para 3.1 above.

3.5 In case of those Gramin Dak Sevaks who were under put off, or on whom dies- non was imposed, or both, during the accounting year, the clarificatory orders issued vide Paras 1 & 3 respectively of this office order No 26-08/80-PAP (Pt-I)dated 11.6.1981 and No. 26-04/87-PAP(P.ID dated 8.2.1988 will apply.

4. FULL TIME CASUAL LABOURERS INCLUDING TEMPORARY STATUS CASUAL LABOURERS.

4.1 Full Time Casual Labourers including Temporary Status Casual Laborers who have worked for 8 hours a day, for at least 240 days in a year for three consecutive years or more (206 days in each year for three years or more in case of offices observing 5 days a week) as on 31.03.2022 will be paid ad-hoc bonus on notional monthly wages of Rs.1200/- (Rupees Twelve hundred only). The maximum ad-hoc bonus will be

calculated as below:

(Notional monthly wages of Rs.1200) X (Number of days of bonus)

30.4 (average no. of days in a month)

Accordingly, the rate of bonus per day will be worked out as indicated below:

Maximum ad-hoc bonus for the year

365

The above rate of bonus per day may be applied to the number of days for which the services of such casual laborers had been utilized during the period from 1.4.2021 to 31.03.2022. In cases where the actual wages in any month fall below Rs.1200/- during the period 1.4.2021 to 31.3.2022, the actual monthly wages drawn should be taken into account to arrive at the actual ad-hoc bonus due in such cases.

- The amount of Productivity Linked Bonus/ ex-gratia payment/ Ad-hoc bonus payable under this order will be rounded off to the nearest rupee. The payment of Productivity Linked Bonus as well as the ex-gratia payment and ad-hoc payment will be chargeable to. the Head “Salaries” under the relevant Sub-Head of account to which pay and allowances of the staff are debited. The payment will be met from the sanctioned grant for the year 2022-23.

- After payment, the total expenditure incurred and the number of employees paid may be ascertained from all the units by Circles and consolidated figures are intimated to the Budget Section of the Department of Posts. The Budget Section will furnish consolidated information to PAP Section about the total amount of bonus paid and the total number employees (Category-wise) to whom it was disbursed for the Department as a whole.

- This has the approval of Hon’ble Finance Minister vide Ministry of Finance, Department of Expenditure’s ID Note No. 11/1/2017-E.111(A)(2831659/2022) dated 11.10.2022 and issue with the concurrence of AS & FA vide Diary No.101/2022-23/FA- CS(P) dated 12.10.2022.

Yours faithfully

Sapna

Assistant Director General (Estt.)

Download DoP Productivity Linked Bonus for the Accounting year 2021-2022 PDF

பாசமிகு சகோதரர்களே!

சகோதரிகளே!! சென்ற நிதியாண்டில் 01.04.2021 முதல் 31.03.2022முடிய (2021-2022)

புதிய பென்சன் திட்டத்தை ரத்து செய்ய வேண்டும், அரசுத் துறைகளை தனியார் மயமாக்குவதை கைவிட வேண்டும், உள்ளிட்ட பல கோரிக்கைகளை வலியுறுத்தி 28.03.2022 முதல் 29.03.2022 முடிய நடைபெற்ற வரலாற்று சிறப்புமிக்க இரண்டு நாள்கள் நாடுதழுவிய வேலை நிறுத்தத்தில் ஈடுபட்டவர்களுக்கான போனஸ்.

7000 x 11 = 77,000

7000/31*29= 6548

(77,000+6,767= 83458)

Total 83,767 / 12 = 6,962.33

6,962.33 x 60 / 30.4 = 13,741.44

Non-Productivity Linked Bonus ad hoc bonus to Central Government Employees 2022

Diwali bonus for central government employees

The calculation ceiling of monthly emoluments of Rs. 7000, Non-PLB (Ad-hoc Bonus) for 30 days would work out to Rs. 7000 × 30 / 30.4 = 6907.89 rounded off to Rs.6908.

Postal DA Order July 2022 PDF

DoP – Rate of Dearness Allowance payable to Central Government employees, shall be enhanced from 34% to 38% of the Basic Pay with effect from 1st July, 2022.

Post Office Employees Bonus 2021 – 60 Days Bonus for Postal Department 2021

Maximum of Rs.13816 (60 days wage)

The undersigned is directed to convey the sanction of the President of India to the payment of Productivity Linked Bonus for the Accounting year 2020-21 equivalent of emoluments of 60 (Sixty) Days to the employees of Department of Posts in MTS, /Group ‘C’ and non-gazetted Group ‘B’. Ex-gratia payment of bonus to Gramin Dak Sevaks who are regularly engaged after observing all engagement formalities, and Ad hoc payment of bonus to Casual laborers who have been conferred Temporary Status are also to be paid equivalent to allowance/wages respectively for 60 (Sixty) Days for the same period.

Postal Bonus PLB 2021 – Postal Bonus Order 2021 PDF

Bonus calculation for Postal Employees

1.1 The calculation for the purpose of payment of bonus under each category will be done as indicated below :-

Diwali Bonus for Postal Employees

2. REGULAR EMPLOYEES:

2.1 Productivity Linked Bonus will be calculated on the basis of the following formula:-

(Average emoluments X Number of days of bonus)

30.4 (average no. of days in a month)

2.2 The term “emoluments” for regular Departmental employees includes Basic Pay in the Pay matrix, Dearness Pay, S.B. Allowance, Deputation (Duty) Allowance, Dearness Allowance and Training Allowance to Faculty Members in Training Institutes. In case of drawl of salary exceeding Rs.7000 / – (Rupees Seven Thousand only) in any month during the accounting year 2020-21, the emoluments shall be restricted to Rs.7000 / – (Rupees Seven Thousand only) per month only.

2.3 “Average Emoluments” for a regular employee is arrived at by dividing by twelve, the total salary drawn during the year 2020-21 for the period from 1.4.2020 to 31.03.2021 , by restricting each month’s salary to Rs. 7000 / – per month. However, for the periods of EOL and Dies-Non in a given month, proportionate deduction is required to be made from the ceiling limit of Rs.7000 / –

2.4 In case of those employees who were under suspension, or on whom dies-non was imposed or both, during the accounting year, the clarificatory orders issued vide Paras 1 & 3 respectively of this officer order No. 26-8 / 80-PAP (Pt.I) dated 11.6.1981 and No. 26-4 / 87-PAP(Pt.II) dated 8.2.1988 will apply.

2.5 Those employees who have resigned / retired or left services or proceeded on deputation within the Department of Posts or those who have proceeded on deputation outside the Department of Posts after 31.03.2021 will also be entitled to bonus. In case of all such employees, the Productivity Linked Bonus admissible will be as per provisions of Paras 2.1 to 2.3 above.

3. GRAMIN DAK SEVAKS (GDS)

3.1 In respect of GDSs who were on duty throughout the year during 2020-21 , Average Monthly Time Related Continuity Allowance will be calculated taking into account the Time Related Continuity Allowance (TRCA) plus corresponding Dearness Allowance drawn by them for the period from 1.4.2020 to 31.3.2021 divided by 12. However, where the Time Related Continuity Allowance exceeds Rs. 7000 / – in any month during this period, the allowance will be restricted to Rs.7000 / – per month. Ex gratia payment of bonus may be calculated by applying the bonus formula as mentioned below:

(Average TRCA X Number of days of bonus)

30.4 (average no. of days in a month)

3.2 The allowance drawn by a substitute will not be counted towards exgratia bonus calculation for either the substitutes or the incumbent GDSs. In respect of those GDS who were engaged in short term vacancies in Postmen MTS Cadre will be governed by instructions issued by this Directorate vide O.M. No.23-01 / 2019-GDS dated 23.10.2019.

3.3 If a GDS has been on duty for a part of the year by way of a fresh engagement, or for having been put off duty, or for having left service, he will be paid proportionate ex gratia bonus calculated by applying the procedure prescribed in Para 3.1 above.

3.4 Those Gramin Dak Sevaks who have resigned / discharged or left service after 31.03 .2021 will also be entitled to proportionate ex-gratia Bonus. In case of all such Gramin Dak Sevaks, the Ex-gratia Bonus admissible will be as per provisions of Para 3.1 above.

3.5 In case of those Gramin Dak Sevaks who were under put off, or on whom dies non was imposed, or both, during the accounting year, the clarificatory orders issued vide Paras 1 & 3 respectively of this office order No 26-08 / 80-PAP (Pt-I)dated 11.6.1981 and No. 26-04 / 87 – PAP (P.II) dated 8.2.1988 will apply .

4. FULL TIME CASUAL LABOURERS INCLUDING TEMPORARY STATUS CASUAL LABOURERS.

4.1 Full Time Casual Labourers including Temporary Status Casual Laborers who have worked for 8 hours a day, for at least 240 days in a year for three consecutive years or more (206 days in each year for three years or more in case of offices observing 5 days a week) as on 31.03.2021 will be paid ad-hoc bonus on notional monthly wages of Rs.1200 (Rupees Twelve hundred only). The maximum ad-hoc bonus will be calculated as below:

(Notional monthly wages of Rs.1200) X (Number of days of bonus)

30.4 (average no. of days in a month)

Accordingly, the rate of bonus per day will be worked out as indicated below:

Maximum ad-hoc bonus for the year

365

The above rate of bonus per day may be applied to the number of days for which the services of such casual laborers had been utilized during the period from 1.4.2020 to 31.03.2021. In cases where the actual wages in any month fall below Rs.1200 during the period 1.4.2020 to 31.3.2021, the actual monthly wages drawn should be taken into account to arrive at the actual ad-hoc bonus due in such cases.

5. The amount of Productivity Linked Bonus / ex-gratia payment / Ad-hoc bonus payable under this order will be rounded off to the nearest rupee. The payment of Productivity Linked Bonus as well as the ex-gratia payment and ad-hoc payment will be chargeable to the Head “Salaries” under the relevant Sub-Head of account to which pay and allowances of the staff are debited. The payment will be met from the sanctioned grant for the year 2021-22.

Bonus Calculation for all Postal Employees and GDS who performed duty without strike

Bonus calculation for Postal Employees

Bonus calculations for postal employees 2019-20 who performed duty without strike will get the following amount as follows:

7000*60/30.4= Rs. 13,816/-

For those who performed 2 day strike will get the amount as follows:

700011=77000 7000/3129= 6548

(77000+6548= 83548)

Total 83548/12= 6962

6962 * 60 /30.4= 13740.78

Rs. 13741

For GDS, who performed 2 day and 4 day strike will get the amount as follows:

107000=70000 7000/3129= 6548

7000/31*27= 6097

70000+6548+6097= 82645

82645/12= 6887

6887*60/30.4= 13593

Rs. 13593

Central Government Employees Bonus News Latest Update

- EPFO Bonus 2022-2023 pdf October 25, 2023Read more…

- Payment of Productivity Linked Bonus to all eligible non-gazetted Railway employees 2023 October 19, 2023Read more…

- Railway Bonus 2023 – Cabinet approves Productivity Linked Bonus (PLB) for railway employees October 18, 2023Read more…

- Central Government Employees Bonus Order 2023 PDF – Grant of Non-Productivity Linked Bonus (ad-hoc bonus) October 17, 2023Read more…

- Request for Timely declaration of DA/DR hike and Bonus for Employees and Pensioners – Ministerial Staff Association October 11, 2023Read more…

- Confederation Of Central Government Employees Declaration of DA, PLB and Ad-Hoc Bonus October 8, 2023Read more…

- Festival Bonus 2023 – Early payment of BONUS before Pooja Festival – PLB for the 2022 – 2023 October 5, 2023Read more…

- Clarification on PLB for the Civilians of the Army Ordnance Corps (AOC) for the year 2020-2022 May 16, 2023Read more…

- Government of India Announces Bonus Payment for LIC Employees for 2018-2021 Period March 16, 2023Read more…

- BONUS TO NON-GAZETTED OFFICERS OF AUTONOMOUS INSTITUTIONS/ ORGANIZATIONS February 7, 2023Read more…

- Defence Ordnance Bonus – Sanction for payment of Productivity Linked Bonus (PLB)/Ad-Hoc Bonus for the year 2021-2022 January 24, 2023Read more…

- Pongal Bonus for TN Govt Employees 2023 December 27, 2022Read more…

- Defence civilians of the Army Ordnance Corps (AOC) Productivity Linked Bonus 2022 October 29, 2022Read more…

- Indian Air Force Productivity Linked Bonus 2022 for the eligible Industrial civilian employees October 29, 2022Read more…

- 24 days wages as Productivity Linked Bonus 2022 to the eligible civilian employees of the EME October 29, 2022Read more…

- Group ‘C’ RPF/RPSF personnel, ad-hoc bonus equivalent to 30 days emoluments for the financial year 2021-2022 without any wage eligibility ceiling October 26, 2022Read more…

- Employees Provident Fund EPFO Employees Bonus Order 2022 PDF October 21, 2022Read more…

- Non-Productivity Linked Bonus (ad-hoc bonus) 2022 to JCO/ORs in the Army and equivalent ranks in the Navy and Air Force October 15, 2022Read more…

- Productivity Linked Bonus equivalent to 78 days to railway employees 2022 – PIB October 12, 2022Read more…

- 60 Days Bonus for Postal Employees – Productivity Linked Bonus for the Accounting year 2021-2022 – DoP Bonus Order 2022 October 12, 2022Read more…

- Postal GDS Employees were disappointed since the bonus 2022 was not paid before the Durga Pooja October 11, 2022Read more…

- Bonus for Tamilnadu Government Employees October 10, 2022Read more…

- Non Productivity Linked Bonus ad hoc bonus to Central Government Employees 2022 October 6, 2022Read more…

- Payment of PLB 2022 to the employees Ordnance Factories, DGQA & DGAQA – BPMS September 29, 2022Read more…

- 78 Days Bonus for Railway Employees 2022 September 28, 2022Read more…

- 18 Days Bonus for the eligible Industrial civilian employee of the EME for the financial year 2020-2021 November 9, 2021Read more…

- Indian Air Force Productivity Linked Bonus 2021 for the eligible Industrial civilian employee November 9, 2021Read more…

- Defence Bonus 2021 – Payment of Productivity Linked Bonus (PLB) to Civilian Employees of Defence Production Establishments for the year 2020-21 November 7, 2021Read more…

- Indian Army Bonus 2021 – 40 days PLB for the year 2020-2021 to the eligible civilian employees of the AOC/Indian Army November 6, 2021Read more…

- Railway Ad-hoc Bonus for 30 days to the Group ‘C’ RPF/RPSF personnel for the financial year 2020-21 October 30, 2021Read more…

- EPFO Bonus Order 2021 – 60 Days Productivity Linked Bonus for the EPFO employees October 29, 2021Read more…

- Tamil Nadu Government Employees Diwali Bonus 2021 October 23, 2021Read more…

- Bonus for central government employees 2020-21 in Hindi October 19, 2021Read more…

- Bonus Order 2021 for Central Govt Employees PDF October 18, 2021Read more…

- Postal Bonus Order for 2020-2021, PLB 60 Days PDF Download October 14, 2021Read more…

- Postal Bonus 2021 – Productivity Linked Bonus for postal employees for the accounting year 2020-2021 October 13, 2021Read more…

- Payment of Productivity Linked Bonus to all eligible non-gazetted Railway employees for the financial year 2020-21 October 6, 2021Read more…

- Railway Bonus 2021 – Cabinet approves Productivity Linked Bonus to railway employees for the financial year 2020-21 October 6, 2021Read more…

- Festival Bonus 2021 – Central Government employees Productivity Linked Bonus (PLB) for 2021 October 6, 2021Read more…

- 7th CPC Productivity Linked Bonus PLB raising the minimum ceiling for the purpose of payment of Bonus to Rs 18000 August 9, 2021Read more…

- Bonus – Tamil Nadu Government employees Pongal Bonus 2021 – TN Govt Order issued January 8, 2021Read more…

- Grant of Pongal Prize to Group C and D Tamil Nadu Pensioners – Pongal Festival 2021 January 8, 2021Read more…

- Rajasthan state Government employees Ad-hoc bonus for the financial year 2019-2020 November 15, 2020Read more…

- Department of Military Affairs – Grant of Non Productivity Linked Bonus (ad-hoc bonus) to the Central Government Employees for the year 2019 -20 November 9, 2020Read more…

- Deepavali bonus for Tamil Nadu State Government Employees for all PSUs November 6, 2020Read more…

- Defence Bonus 2020 – Payment of PLB to Civilian Employees of Defence Production Establishments 2019-2020 October 24, 2020Read more…

- 60 Days Productivity Linked Bonus (P.L.B.) for the employees of the EPFO for the year 2019-2020 October 23, 2020Read more…

- Bonus calculations for Postal Employees 2020 who performed duty without strike October 23, 2020Read more…

- Postal Employees Bonus 2020 – Productivity Linked Bonus for postal employees for the accounting year 2019-2020 October 22, 2020Read more…

- Important FAQ regarding Bonus for Central Government Employees and regulation of Ad-hoc/Non-PLB Bonus – FinMin Order October 21, 2020Read more…