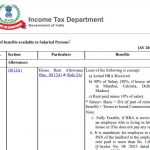

List of benefits available to Salaried Persons* [AY 2023-24] S.N.SectionParticularsBenefitsA.Allowances1.10(13A)House Rent Allowance (Sec. 10(13A) & Rule 2A)Least of the following is exempt: a) Actual HRA Receivedb) 40% of Salary (50%, if house situated in Mumbai, Calcutta, Delhi or Madras)c) Rent paid minus 10% of salary* Salary= Basic + DA (if part of … [Read more...] about List of benefits available to Salaried Persons for AY 2023-24 FY 2022-23 under Income Tax as amended by Finance Act, 2022

| 46% DA Order for Central Government Employees wef 1st July 2023 PDF |

4% DA for Central Government Employees wef 1st July 2023

Railway Employees Bonus 2023

Bonus for central government employees 2023 pdf

CENTRAL GOVERNMENT HOLIDAY LIST 2024

| 42% DA Order for Central Government Employees wef 1st January 2023 PDF |

| 42% DR Order for Central Government Pensioners wef 1st January 2023 PDF |

Daily Allowance

Travelling Allowance Rules – Production of receipts vouchers for reimbursement of Travelling charges for travel within the city admissible under Daily Allowance on tour

Travelling Allowance Rules - Production of receipts vouchers for reimbursement of Travelling charges for travel within the city admissible under Daily Allowance on tour Travelling Allowance Rules No. 19030/2/2020-E.IVGovernment of IndiaMinistry of FinanceDepartment of Expenditure North Block, New DelhiDated 22nd December, 2020 OFFICE MEMORANDUM Subject: … [Read more...] about Travelling Allowance Rules – Production of receipts vouchers for reimbursement of Travelling charges for travel within the city admissible under Daily Allowance on tour

No Travel Allowance and Daily Allowance for Tamil Nadu State Government Employees

Tamil Nadu State Government Employees Due to the COVID-19 situation , the government of Tamil Nadu has taken various measures to reduce cost expenditure, TN Government has released the office memorandum vide G.O. No.249 of 21 May 2020 to restrict travel allowance and daily allowance. The following measures shall take effect, as provided for in the Government Order, from … [Read more...] about No Travel Allowance and Daily Allowance for Tamil Nadu State Government Employees

Revision of rates of Daily Allowance (T.A.) to Railway employees on tour – Reimbursement of Hotel charges when no rest house facility made available

Revision of rates of Daily Allowance (T.A.) to Railway employees on tour - Reimbursement of Hotel charges when no rest house facility made available NFIR No. I/5 (F) Dated: 20/08/2018 The Secretary (E), Railway Board. New Delhi Dear Sir, Sub: Revision of rates of Daily Allowance (T.A.) to Railway employees on tour - Reimbursement of Hotel charges when no rest house … [Read more...] about Revision of rates of Daily Allowance (T.A.) to Railway employees on tour – Reimbursement of Hotel charges when no rest house facility made available

Time limit for submission of claims for Travelling Allowances (TA)

Time limit for submission of claims for Travelling Allowances (TA) No.19030/1/2017-E.IV Government of India Ministry of Finance Department of Expenditure New Delhi, the 13th March, 2018 Office Memorandum Sub: Time-limit for submission of claims for Travelling Allowances - regarding. Consequent upon the issuance of General Financial Rule (GFR)-2017, vide Rule 290 of … [Read more...] about Time limit for submission of claims for Travelling Allowances (TA)

7th CPC: Travelling Allowance Rules – Implementation of the Recommendations of the Seventh Pay Commission

7th CPC: Travelling Allowance Rules - Implementation of the Recommendations of the Seventh Pay Commission F.No.19030/1/2017-E.IV Government of India Department of Expenditure E.IV Branch North Block, New Delhi. Dated 01st February, 2018 Office Memorandum Sub: Travelling Allowance Rules - Implementation of the Recommendations of the Seventh Pay … [Read more...] about 7th CPC: Travelling Allowance Rules – Implementation of the Recommendations of the Seventh Pay Commission

Instruction regarding overpayment in r/o of TA/DA on account of Temporary Duty/Tour

25% increase in TA DA rate was not for them who was opting/claiming old rate in 6th CPC: CGDA orders for recovery CGDA, Ulan Batar Road, Palam, Delhi Cantt-110010 IMPORTANT CIRCULAR No. AN/XIV/14162/TA/DA/CTG/Vol-IV Dated:07/09/2017 To All PCsDA/CsDA/CFA (Fys) Sub: Instruction regarding overpayment in r/o of TA/DA on account of Temporary Duty/Tour. During the … [Read more...] about Instruction regarding overpayment in r/o of TA/DA on account of Temporary Duty/Tour

Travelling Allowance Rules – Implementation of the Recommendations of the 7th Central Pay Commission – Dated 04.09.2017

7th CPC Travelling Allowance Rules - Clarification: Finance Ministry OM dated 04.09.2017 F. No. 19030/1/2017-E.IV Government of India Ministry of Finance Department of Expenditure New Delhi, dated the 04th September, 2017 OFFICE MEMORANDUM Subject : Travelling Allowance Rules - Implementation of the Recommendations of the Seventh Central Pay Commission. Consequent … [Read more...] about Travelling Allowance Rules – Implementation of the Recommendations of the 7th Central Pay Commission – Dated 04.09.2017

Grant of TA/DA to retired Railway servants, re-engaged after retirement

Grant of TA/DA to retired Railway servants, re-engaged after retirement Government of India/Bharat Sarkar Ministry of Railways/Rail Mantralaya Railway Board No.F(E)I/2015/AL-28/58 RBE No.24/17 New Delhi, dated 16.03.2017. General Managers, All Indian Railways etc, (As per Standard Mailing List) Sub: Grant of TA/DA to retired Railway servants, re-engaged after … [Read more...] about Grant of TA/DA to retired Railway servants, re-engaged after retirement

TA/DA and Honorarium payable to Official and Non-official Members/experts: UGC

TA/DA and Honorarium payable to Official and Non-official Members/experts UNIVERSITY GRANTS COMMISSION BAHADUR SHAH ZAFAR MARG NEW DELHI - 110 002 No.F.21-1/2015 (FD-I/B) 16th March, 2016 OFFICE MEMORANDUM TA/DA AND HONORARIUM PAYABLE TO OFFICIAL AND NON-OFFICIAL MEMBERS/EXPERTS In supersession of UGC OM. No.21-1/20l5 (FD-l/B) dated … [Read more...] about TA/DA and Honorarium payable to Official and Non-official Members/experts: UGC

Latest DoPT Orders 2023

CENTRAL GOVT HOLIDAY LIST 2023

Indian Railway Holiday List 2023 PDF | Postal Holidays List 2023 India Post | Bank Holidays List 2023 India | LIC Office Holiday List 2023 PDF Download | EPFO Holiday List 2023 PDF Download | ESIC Holiday List 2023 PDF Download | CGHS Holiday Calendar List 2023 | Post Office Holidays 2023 | Railway Holidays CG Office Holidays 2023 | TN Govt Holidays 2023 | KVS Holiday List 2023-2024 PDF