CCS LTC Rules 1988 DoP&T Order dated 10.08.2023 - Clarifications /modifications in the LTC instructions F.No. 31011/17/ 2023- Estt.A-IVGovernment of IndiaMinistry of Personnel, Public Grievances & PensionsDepartment of Personnel & TrainingPers. Policy (A-IV) North Block, New Delhi.Dated: 10th August, 2023 OFFICE MEMORANDUM Subject: Central Civil Services … [Read more...] about Central Civil Services (Leave Travel Concession) Rules, 1988 – clarifications/ modifications in the LTC instructions

CENTRAL GOVERNMENT HOLIDAY LIST 2024

| 46% DA Order for Central Government Employees wef 1st July 2023 PDF |

| CGHS Updated Rate Card PDF Download |

| Latest List of KV Schools in India |

| Expected DA 2023 |

| 7th Pay Commission Latest News 2024 |

| MACP for the Central Government Employees |

Leave Travel Concession

Reimbursement of leave encashment – CCS (LTC) Rules 1988 – Fulfilment of procedural requirements

Reimbursement of leave encashment Government employees are allowed to encash 10 days earned leave at the time of availing of LTC to the extent of 60 days during the entire service F.No.31011/06/2023 -Estt.(A-IV)Government of IndiaMinistry of Personnel, Public Grievances & PensionsDepartment of Personnel & TrainingEstablishment A-IV Desk North Block, New … [Read more...] about Reimbursement of leave encashment – CCS (LTC) Rules 1988 – Fulfilment of procedural requirements

LTC Relaxation to travel by air to visit North East Region, Jammu, Kashmir, Ladakh and Andaman & Nicobar extended for 2 years DoPT

Relaxation to travel by air to visit North East Region, Jammu & Kashmir, Ladakh and Andaman & Nicobar Islands extension for a further period of 25.09.2022 till 25.09.2024 - DoPT Order Latest DoPT Orders 2022 F.No. 31011/15/2022 -Estt-A-IVGovernment of IndiaMinistry of Personnel, Public Grievances & PensionsDepartment of Personnel & Training(Establishment … [Read more...] about LTC Relaxation to travel by air to visit North East Region, Jammu, Kashmir, Ladakh and Andaman & Nicobar extended for 2 years DoPT

LTC – Instructions on booking of Air Tickets on Government Account in respect of Leave Travel Concession

LTC Air Tickets Booking Latest DoPT Orders 2022 F. No. 31011/12/2022 -Estt.A-IVGovernment of IndiaMinistry of Personnel, Public Grievances & PensionsDepartment of Personnel & TrainingEstablishment A-IV Desk North Block, New Delhi.Dated 29th August, 2022 OFFICE MEMORANDUM Subject: Instructions on booking of Air Tickets on Government Account in respect of … [Read more...] about LTC – Instructions on booking of Air Tickets on Government Account in respect of Leave Travel Concession

Central Civil Services (Leave Travel Concession) Rules, 1988 Fulfillment of procedural requirements clarification

CCS LTC Rules 1988 No. 31011/ 3/ 2015-Estt.(A.IV)Government of IndiaMinistry of Personnel, Public Grievances and PensionsDepartment of Personnel and TrainingEstablishment A-IV Desk*** North Block, New Delhi-110001Dated: 04 February , 2021 OFFICE MEMORANDUM Subject:- Central Civil Services (Leave Travel Concession) Rules, 1988 Fulfillment of procedural requirements … [Read more...] about Central Civil Services (Leave Travel Concession) Rules, 1988 Fulfillment of procedural requirements clarification

FAQ 3 on LTC Cash Voucher Scheme – LTC Fare for Central Government Employees during the Block 2018-21

FAQ 3 on LTC Cash Voucher Scheme No.12(2)/2020/ E.II.AGovernment of IndiaMinistry of FinanceDepartment of Expenditure North Block, New DelhiDated 25th November, 2020 OFFICE MEMORANDUM Subject:- Clarification regarding queries being received in respect of Special Cash Package equivalent in lieu of Leave Travel Concession Fare for Central Government Employees during … [Read more...] about FAQ 3 on LTC Cash Voucher Scheme – LTC Fare for Central Government Employees during the Block 2018-21

Furnishing information regarding number of employees opting for LTC Cash Voucher Scheme and Festival Advance Scheme

LTC Cash Voucher Scheme and Festival Advance Scheme - Central Government Employees News No.4/3/2020-Bt. DG/Misc/352Government of IndiaDirectorate General of WorksCentral Public Works Department(Budget Section) New Delhi, the 5th November 2020. Office Memorandum Subject: Furnishing information regarding no. of employees opting for LTC Cash Voucher Scheme and Festival … [Read more...] about Furnishing information regarding number of employees opting for LTC Cash Voucher Scheme and Festival Advance Scheme

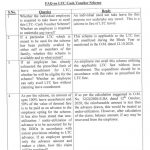

FAQ No.2 on LTC Cash Voucher Scheme – LTC Fare for Central Government Employees during the Block 2018-21

FAQ No.2 on LTC Cash Voucher Scheme - Central Government Employees No. 12(2)/2020- E.II(A)Government of IndiaMinistry of FinanceDepartment of Expenditure North Block, New DelhiDated 10th November, 2020 OFFICE MEMORANDUM Subject: Clarification regarding queries being received in respect of Special cash package equivalent of Leave Travel Concession Fare for Central … [Read more...] about FAQ No.2 on LTC Cash Voucher Scheme – LTC Fare for Central Government Employees during the Block 2018-21

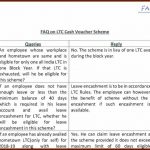

FAQ on LTC Cash Voucher Scheme – LTC Fare for Central Government Employees during the Block 2018-21

FAQ on LTC Cash Voucher Scheme - Central Government Employees No. 12 2/2020 - E.II AGovernment of IndiaMinistry of FinanceDepartment of Expenditure North Block, New DelhiDated 20th October, 2020 Office Memorandum Subject: Clarification regarding queries being received in respect of Special cash package equivalent in lieu of Leave Travel Concession Fare for Central … [Read more...] about FAQ on LTC Cash Voucher Scheme – LTC Fare for Central Government Employees during the Block 2018-21

LTC Rules 1988 – Relaxation to travel by air to visit North East Region

LTC No. 31011/3/2018 -Estt.(A-IV)Government of IndiaMinistry of Personnel, Public Grievances and PensionsDepartment of Personnel and TrainingEstablishment A-IV Desk North Block, New Delhi-110 001Dated: October 8, 2020 OFFICE MEMORANDUM Subject: Central Civil Services (Leave Travel Concession) Rules, 1988 - Relaxation to travel by air to visit North East Region, … [Read more...] about LTC Rules 1988 – Relaxation to travel by air to visit North East Region

Latest DoPT Orders 2023

CENTRAL GOVT HOLIDAY LIST 2023

Indian Railway Holiday List 2023 PDF | Postal Holidays List 2023 India Post | Bank Holidays List 2023 India | LIC Office Holiday List 2023 PDF Download | EPFO Holiday List 2023 PDF Download | ESIC Holiday List 2023 PDF Download | CGHS Holiday Calendar List 2023 | Post Office Holidays 2023 | Railway Holidays CG Office Holidays 2023 | TN Govt Holidays 2023 | KVS Holiday List 2023-2024 PDF