FAQ on LTC Cash Voucher Scheme – Central Government Employees

No. 12 2/2020 – E.II A

Government of India

Ministry of Finance

Department of Expenditure

North Block, New Delhi

Dated 20th October, 2020

Office Memorandum

Subject: Clarification regarding queries being received in respect of Special cash package equivalent in lieu of Leave Travel Concession Fare for Central Government Employees during the Block 2018-21

The undersigned is directed to refer to this Department’s O.M of even no. dated 12th October, 2020 and to say that this Department has been receiving queries seeking clarification relating to Special package equivalent in lieu of Leave Travel Concession Fare for Central Government Employees during the Block 2018-21 announced by the Government. A statement giving answers/ clarifications to the queries is attached as annexure to this O.M.

FinMin Order – Special cash package equivalent in lieu of Leave Travel Concession Fare for Central Government Employees during the Block 2018-21

2. This issues with the approval of Secretary Expenditure.

S.Naganathan

Deputy Secretary, E.II A

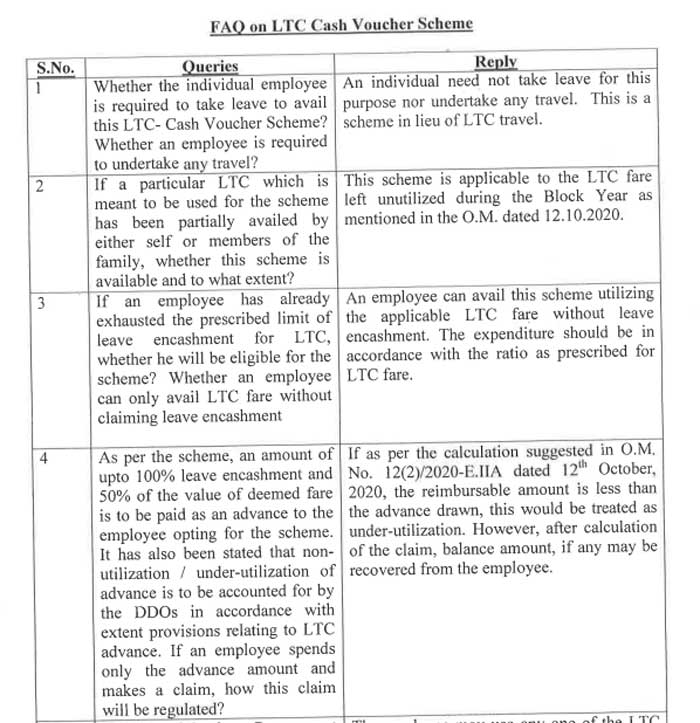

FAQ on LTC Cash Voucher Scheme

| S.No. | Queries | Reply |

| 1 | Whether the individual employee is required to take leave to avail this LTC- Cash Voucher Scheme? Whether an employee is required to undertake any travel? | An individual need not take leave for this purpose nor undertake any travel. This is a scheme in lieu of LTC travel. |

| 2 | If a particular LTC which is meant to be used for the scheme has been partially availed by either self or members of the family, whether this scheme available and to what extent? | This scheme is applicable to the LTC fare left unutilized during the Block Year as mentioned in the O.M. dated 12.10.2020. |

| 3 | If an employee has already exhausted the prescribed limit of leave encashment for LTC, whether he will be eligible for the scheme? Whether an employee can only avail LTC fare without claiming leave encashment | An employee can avail this scheme utilizing the applicable LTC fare without leave encashment. The expenditure should be in accordance with the ratio as prescribed for LTC fare. |

| 4 | As per the scheme, an amount of upto 100% leave encashment and 50% of the value of deemed fare is to be paid as an advance to the employee opting for the scheme. It has also been stated that non-utilization / under-utilization of advance is to be accounted for by the DDOs in accordance with extent provisions relating to LTC advance. If an employee spends only the advance amount and makes a claim, how this claim will be regulated? | If as per the calculation suggested in O.M. No. 12(2)/2020-E.IIA dated 12th October, 2020, the reimbursable amount is less than the advance drawn, this would be treated as under-utilization. However, after calculation of the claim, balance amount, if any may be recovered from the employee. |

| 5 | Newly joined Government employees are entitled for three Home Town and one Anywhere in India in a Block of four year. How this will be regulated? | The employee may use any one of the LTC available in a Block Year. |

| 6 | As per Special LTC provisions, an employee irrespective of his eligibility can travel by Air to places like Andaman & Nicobar, J&K and North-East under anywhere in India fare. In this case what will be the deemed fare? | The deemed fare has been calculated based on the normal eligibility of an employee and the special packages would not be applicable for this scheme. |

| 7 | Whether a single bill of purchase of goods or services is to be submitted or multiple bills can be submitted? | Multiple Bills are accepted. The purchase should have been done from the date of issue of the O.M. till the end of the current Financial Year. The purchase should carry a GST of 12% and above and payment should have been made to digital mode. |

| 8 | Whether there is any prescribed format for applying for this scheme. | There is no prescribed format. A simple application conveying the desire of the employee for availing the scheme, if advance is required for the purpose the same is to be mentioned. |

| 9 | What are the items which will qualify for reimbursement under this scheme? | Any goods and services which attract GST of 12% and above would qualify. The invoice with GST details should be submitted and payment should have been made through digital mode. |

| 10 | An employee having four family members eligible for LTC wants to avail this facility for less than 4 members. Further he wants to avail LTC for rest of the Members later. | As replied to query at S.No. 2, an employee can avail the scheme in partial, i.e. of the LTC of part of the eligible family. Since this is an optional scheme, if the LTC fare of any member of the family has not been utilized for this purpose, those members can avail LTC subject to extent instructions under LTC rules. |

| 11 | An employee incurs the expenditure on or before 31/3/2021 on the basis of invoice. Actual product or service received in April, 2021. | The reimbursement is based on production of invoice with details of GST. As far as possible, the claim should be made and settled well before 31st March, 2021 to avoid any last minute rush and resultant lapse. |

| 12 | For digital payment an employee uses credit card of his / her spouse or any family members. | It is clarified that the invoice which is being submitted for reimbursement under the scheme should be in the name of the employee who is availing the scheme. |

| 13 | Can services like interior decoration and phone bills be included? | Any service which is having a GST component of more than 12% is permissible. |

| 14 | Any limit of number of transaction? | As far as possible, the number of transactions may be limited to a minimum extent to avoid any difficulty / delay. |

| 15 | Is it allowed to do purchase from e-commerce platform? | Procurement from e-commerce platform is also permissible provided the relevant invoice / details are submitted. |

FinMin Order – Grant of Festival Advance to Central Government Employees

Source: DoE

Leave a Reply