Latest DoPT Orders 2020 Applications for the Post of Chairman, National Institute of Open School (NIOS) having the 7th CPC pay scale of Rs.144,220-2,18,000 (Level-14) (pre-revised pay scale Rs. 37,400 - 67,000 with grade pay of Rs.10,000) for tenure of 05 years or attaining age of 60 years, whoever is earlier. F.No.21/07/ 2019-CS-I(P) Ministry of Personnel, Public … [Read more...] about Latest DoPT Orders 2020 – Proposal for appointment to the post of Chairman, National Institute of Open School (NIOS)

CENTRAL GOVERNMENT HOLIDAY LIST 2024

| 46% DA Order for Central Government Employees wef 1st July 2023 PDF |

| CGHS Updated Rate Card PDF Download |

| Latest List of KV Schools in India |

| Expected DA 2023 |

| 7th Pay Commission Latest News 2024 |

| MACP for the Central Government Employees |

7th CPC Pay Scale

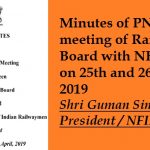

NFIR & Railway Board Meeting – Shri Guman Singh, President raised following issues

NFIR & Railway Board Meeting - Shri Guman Singh, President raised following issues Every Railwayman should work to curb avoidable expenses, he said and raised following issues for taking speedy action: Also read: Highlights of PNM Meeting Dr. M. Raghavaiah, General Secretary / NFIR The allowances to all the staff was paid from 1st of July 2016 but the KMA and … [Read more...] about NFIR & Railway Board Meeting – Shri Guman Singh, President raised following issues

Revised proposal for filling up of the 11 posts (subject to change) of Deputy Director of Airworthiness in Level 12, Rs. 78800-209200/- of the pay matrix on Deputation (including short term contract) basis in DGCA

DoPT Orders 2019 Revised proposal for filling up of the 11 posts (subject to change) of Deputy Director of Airworthiness in Level 12, Rs. 78800-209200/- of the pay matrix on Deputation (including short term contract) basis in DGCA F.No.21/07/2019-CS-I(P) Ministry of Personnel, Public Grievances Pension Department of Personnel & Training (C.S.l Division) 2nd Floor, … [Read more...] about Revised proposal for filling up of the 11 posts (subject to change) of Deputy Director of Airworthiness in Level 12, Rs. 78800-209200/- of the pay matrix on Deputation (including short term contract) basis in DGCA

Payment of DA to the CDA pattern employees of CPSEs, drawing pay in 7th CPC pay scales

CPSE: DA from July, 2017 to the CDA pattern employees of CPSEs, drawing pay in 7th CPC Scale F. No. W-02/0038/2017-DPE (WC)-GL-XXI/ 18 Government of India Ministry of Heavy Industries & Public Enterprises Department of Public Enterprises Public Enterprises Bhawan, Block 14, CGO Complex, Lodi Road, New Delhi-l 10003, the 10th September, 2018 OFFICE … [Read more...] about Payment of DA to the CDA pattern employees of CPSEs, drawing pay in 7th CPC pay scales

Cabinet Cabinet approves revision of pay and allowances of Lieutenant Governors of Union Territories

Cabinet Cabinet approves revision of pay and allowances of Lieutenant Governors of Union Territories 11 APR 2018 The Union Cabinet chaired by Prime Minister Shri Narendra Modi has given its approval for revision of pay and allowances of Lieutenant Governors of Union Territories. It will bring the pay and allowances of LGs at par with that of the Secretary to the … [Read more...] about Cabinet Cabinet approves revision of pay and allowances of Lieutenant Governors of Union Territories

Sources Confirmed Allowance Committee Report Submitted

Sources Confirmed Allowance Committee Report Submitted One of the NJCA leader, On Condition of Anonymity, told that the committee constituted to examine the allowance has finalized its reports and submitted it to the Government on 22nd February 2017. On asking whether the NJCA knew the details of the committee report, he said that they were not provided with the committee … [Read more...] about Sources Confirmed Allowance Committee Report Submitted

Grant of 7th CPC pay scale to Temporary Status Casual labourers

7th CPC pay scale to Temporary Status Casual labourers : Confederation writes to Ministry of Personnel, Public Grievances & Pension. CONFEDERATION OF CENTRAL GOVT. EMPLOYEES & WORKERS 1St Floor, North Avenue PO Building, New Delhi - 110001 Ref: Confdn/7th CPC/2016 Dated - 16.11.2016 To The Secretary Ministry of Personnel, Public Grievances & … [Read more...] about Grant of 7th CPC pay scale to Temporary Status Casual labourers

Seventh Central Pay Commission’s recommendations – revision of Pay scales – amendment of Service Rules/Recruitment Rules

Seventh Central Pay Commission's recommendations - revision of Pay scales - amendment of Service Rules/Recruitment Rules File No.AB-14017/13/2016-Estt.(RR) Government of India Ministry of Personnel, P.G. & Pensions Department of Personnel and Training Estt(RR) Section *** North Block, New Delhi Dated: 25th Oct, 2016 OFFICE MEMORANDUM Subject: Seventh Central Pay … [Read more...] about Seventh Central Pay Commission’s recommendations – revision of Pay scales – amendment of Service Rules/Recruitment Rules

Seventh Central Pay Commission’s recommendations – revision of pay scales – amendment of Service Rules/Recruitment Rules

Seventh Central Pay Commission's recommendations — revision of pay scales- amendment of Service Rules/Recruitment Rules No. AB.14017/13/2016-Estt. (RR) Government of India Ministry of Personnel, Public Grievances and Pensions Department of Personnel and Training New Delhi Dated: 29th August, 2016 OFFICE MEMORANDUM Seventh Central Pay Commission's recommendations — … [Read more...] about Seventh Central Pay Commission’s recommendations – revision of pay scales – amendment of Service Rules/Recruitment Rules

Settlement of the long pending issues and appropriate recommendations on 7th CPC related matters: AICCEA

Settlement of the long pending issues and appropriate recommendations on 7th CPC related matters: AICCEA All India Civil Accounts Employees Association (RECOGNISED BY GOVT. OF INDIA) CENTRAL HEADQUARTER: NEW DELHI All India Civil Accounts Employees Association Category -II CENTRAL HEADQUARTERS: COCHIN Zonal Accounts Office, CBDT, Sanjuan Towers, Old Railway Station Road … [Read more...] about Settlement of the long pending issues and appropriate recommendations on 7th CPC related matters: AICCEA

Latest DoPT Orders 2023

CENTRAL GOVT HOLIDAY LIST 2023

Indian Railway Holiday List 2023 PDF | Postal Holidays List 2023 India Post | Bank Holidays List 2023 India | LIC Office Holiday List 2023 PDF Download | EPFO Holiday List 2023 PDF Download | ESIC Holiday List 2023 PDF Download | CGHS Holiday Calendar List 2023 | Post Office Holidays 2023 | Railway Holidays CG Office Holidays 2023 | TN Govt Holidays 2023 | KVS Holiday List 2023-2024 PDF