Retirement age of TN government employees The retirement age of state government employees in Tamil Nadu has increased from 59 to 60 years, Chief Minister Edappadi K. Palaniswami announced on Thursday 25.02.2021) In the Legislative Assembly, issuing a suo motu declaration, he said the order would apply to government and government-assisted school workers, legal and … [Read more...] about Retirement age of Tamil Nadu government employees increased to 60 years

CENTRAL GOVERNMENT HOLIDAY LIST 2024

| 46% DA Order for Central Government Employees wef 1st July 2023 PDF |

| CGHS Updated Rate Card PDF Download |

| Latest List of KV Schools in India |

| Expected DA 2023 |

| 7th Pay Commission Latest News 2024 |

| MACP for the Central Government Employees |

Retirement age central government employees

Retirement Benefits in One Click Download PDF – DEPARTMENT OF PENSION & PENSIONERS WELFARE

Retirement Benefits for Pensioners GOVERNMENT OF INDIADEPARTMENT OF PENSION & PENSIONERS’ WELFARE Retirement Benefits in One Click Our Efforts Towards Dignified Retirement MINISTRY OF PERSONNEL, PUBLIC GRIEVANCESDEPARTMENT OF PENSION & PENSIONERS’ WELFARELOK NAYAK BHAWAN, KHAN MARKET,NEW DELHI-110003 Dr. Kshatrapati Shivaji, IAS TRIASSecretary. … [Read more...] about Retirement Benefits in One Click Download PDF – DEPARTMENT OF PENSION & PENSIONERS WELFARE

Contempt of Court – Date of birth on completion of the age of retirement on superannuation

BHARAT PENSIONERS’ SAMAJ(All India Federation of Pensioners’ Associations)(Registered No. 2023of1962-63), Recognised by GOI-OOP&PW Associate NGO International Federation on Ageing. PREMATURE RETIREMENT BY Speed Post. No SG/BPS/notional/ 2020/5 Date: 16.10.2020 ToDr. C. Chandramouli,IAS Secretary,Department of Personnel and Training, North Block,New Delhi – … [Read more...] about Contempt of Court – Date of birth on completion of the age of retirement on superannuation

Premature retirement of central government employees before the date of superannuation

Premature retirement of central government employees before the date of superannuation GOVERNMENT OF INDIAMINISTRY OF PERSONNEL, PUBLIC GRIEVANCES AND PENSIONS(DEPARTMENT OF PERSONNEL & TRAINING)LOK SABHA UNSTARRED QUESTION NO. 1654 (TO BE ANSWERED ON 21.09.2020) PREMATURE RETIREMENT 1654. ADV. A.M. ARIFF:SHRI V.K.SREEKANDAN:SHRI P.P. CHAUDHARY:SHRI KAUSHAL … [Read more...] about Premature retirement of central government employees before the date of superannuation

No proposal to change the age of superannuation of Central Government employees

Latest Central Government employees News GOVERNMENT OF INDIAMINISTRY OF PERSONNEL, PUBLIC GRIEVANCES AND PENSIONS LOK SABHA UNSTARRED QUESTION NO: 576ANSWERED ON: 16.09.2020Retirement of EmployeesL.S. Tejasvi SuryaWill the Minister of PERSONNEL, PUBLIC GRIEVANCES AND PENSIONS be pleased to state:- (a) whether there is a proposal to retire employees of Central … [Read more...] about No proposal to change the age of superannuation of Central Government employees

Confederation strongly oppose premature retirement of Central Government Employees, completed 30 years of service and attained age of 50 – 55 years

Retirement of Central Government Employees The Department of Personnel and Training has issued an office memorandum on 28th August, 2020 that allows it to prematurely retire government servants even if they are within the 50 to 55 age groups or have completed 30 years of service. CONFEDERATION OF CENTRAL GOVT EMPLOYEES & WORKERS1st Floor, North Avenue PO Building, … [Read more...] about Confederation strongly oppose premature retirement of Central Government Employees, completed 30 years of service and attained age of 50 – 55 years

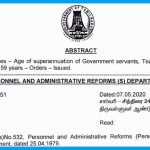

Age of superannuation of Government servants from 58 years to 59 years

PERSONNEL AND ADMINISTRATIVE REFORMS (S) DEPARTMENT G.0.(Ms)No.51 Dated: 07.05.2020 G.O.(Ms)No.532, Personnel and Administrative Reforms (Personnel-M) Department, dated 25.04.1979. ORDER: The Government have decided to increase the age of superannuation of Government servants from 58 years to 59 years and orders accordingly. This will apply to all those who are … [Read more...] about Age of superannuation of Government servants from 58 years to 59 years

The retirement age of Tamil Nadu state government employees increased from 58 to 59

TN state government employees retirement age increased Government of Tamil Nadu has raised the retirement age of employees of state government from 58 to 59. It will also extend to all teachers in government-assisted schools and colleges and government-assisted undertakings in the public sector. A press release says the order comes to force with immediate … [Read more...] about The retirement age of Tamil Nadu state government employees increased from 58 to 59

No move to reduce the retirement age of central government employees to 50 years

Any attempt to reduce government employees' retirement age, nor such a plan discussed or contemplated at any level of government: Dr. Jitendra Singh Press Information BureauGovernment of IndiaMinistry of Personnel, Public Grievances & Pensions 26-April, 2020 No move to reduce the retirement age of government employees, nor such a proposal discussed or … [Read more...] about No move to reduce the retirement age of central government employees to 50 years

Retirement of Government Employees on 31st March 2020 – DoPT Orders 2020

Latest DoPT Orders 2020 Central government employees who reach the age of retirement on 31 March 2020 under or under Fundamental Rule 56 and who are due to retirement. On 31 March 2020, they shall retire from the Central Government workforce, regardless of whether they working from home or working from office. F No.33/12/73 Estt-AGovernment of IndiaDepartment of … [Read more...] about Retirement of Government Employees on 31st March 2020 – DoPT Orders 2020

Latest DoPT Orders 2024

CENTRAL GOVT HOLIDAY LIST 2024

Indian Railway Holiday List 2023 PDF | Postal Holidays List 2023 India Post | Bank Holidays List 2023 India | LIC Office Holiday List 2023 PDF Download | EPFO Holiday List 2023 PDF Download | ESIC Holiday List 2023 PDF Download | CGHS Holiday Calendar List 2023 | Post Office Holidays 2023 | Railway Holidays CG Office Holidays 2023 | TN Govt Holidays 2023 | KVS Holiday List 2023-2024 PDF