Revision of interest rates for Small Savings Schemes w.e.f. 01.10.2023: Department of Posts SB Order No. 19/2023 dated 29.09.2023 SB Order No. 19/2023 F. No 113-03/ 2017-SB(Pt.1)Government of IndiaMinistry of CommunicationsDepartment of Posts(Financial Services Division) Dak Bhawan, New Delhi - 110001Dated: 29.09.2023 To All Head of Circles/ Regions Subject: … [Read more...] about Revision of interest rates for Small Savings Schemes w.e.f. 01.10.2023 – DoP

CENTRAL GOVERNMENT HOLIDAY LIST 2024

| 46% DA Order for Central Government Employees wef 1st July 2023 PDF |

| CGHS Updated Rate Card PDF Download |

| Latest List of KV Schools in India |

| Expected DA 2023 |

| 7th Pay Commission Latest News 2024 |

| MACP for the Central Government Employees |

DoP

DoP – Clarification on operation of SSA Sukanya Samriddhi Account in the cases of gender transformation of girl child

Gender transformation of girl child Clarification on operation of Sukanya Samriddhi Account (SSA) in the cases of gender transformation of girl child: Department of Post Order dated 18.09.2023 No.FS-10/17/ 2020-FS-Part(1)Government of IndiaMinistry of CommunicationsDepartment of Posts(F.S. Division) Dak Bhawan New Delhi - 110001Dated: 18.09.2023 To, All Heads of … [Read more...] about DoP – Clarification on operation of SSA Sukanya Samriddhi Account in the cases of gender transformation of girl child

Issuance of interest certificate for National Savings Certificate – DoP

NSC - Issuance of interest certificate for National Savings Certificate - SB Order No. 17/2023 SB Order No. 17/2023 No. FS-10/2 7/2020 -FS-DOPGovernment of IndiaMinistry of CommunicationsDepartment of Posts(Financial Services Division) Dak Bhawan, New Delhi - 110001Dated: 24.08.2023 ToAll Head of Cireles / Regions Subject: Issuance of interest certificate for … [Read more...] about Issuance of interest certificate for National Savings Certificate – DoP

Consideration of other eligible dependent family member of deceased GDS for compassionate engagement when case of the one dependent is rejected on compassionate ground

Consideration of other eligible dependent family member of deceased/missing GDS for compassionate engagement when case of the one dependent is rejected on compassionate ground 17-1/2017- GDS(Vol-II) 1/73597/2023 No 17-1/2017- GDS (Vol-II)Government of IndiaMinistry of CommunicationsDepartment of Posts(GDS Section) Dak Bhawan, Sansad Marg,New Delhi- 110 001Dated: … [Read more...] about Consideration of other eligible dependent family member of deceased GDS for compassionate engagement when case of the one dependent is rejected on compassionate ground

DoP Compassionate Appointment Scheme Relative Merit Points and Procedure for selection

Compassionate appointments in the Department of Posts - Clarification on Relative Merit Points and Procedure by DoP Order dated 20.07.2023 No.17-1/2022-SPG-IIGovernment of IndiaMinistry of CommunicationsDepartment of Posts Dak Bhawan, New Delhi-110001Dated the 20th July, 2023 To All Chief Postmasters General Subject: Scheme for compassionate appointment - … [Read more...] about DoP Compassionate Appointment Scheme Relative Merit Points and Procedure for selection

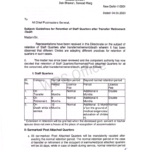

Revised sanctioned strength of Staff Car Drivers – DoP

Revised sanctioned strength of Staff Car Drivers - Department of Post order dated 26.06.2023 No. Y-17/2/ 2022-PE-IIGovernment of IndiaMinistry of CommunicationsDepartment of Posts(Establishment Division) Dak Bhawan, Sansad Marg,New Delhi-110001, Dated : 26 June, 2023. To All Chief Postmasters General. Subject: Revised sanctioned strength of Staff Car Drivers- … [Read more...] about Revised sanctioned strength of Staff Car Drivers – DoP

Revision of sanctioning limits related to claim cases arising out of Loss and Fraud Cases in the Department of Posts

Loss and Fraud Cases in the Department of Posts - Revision of sanctioning limits related to claim cases arising out: Order dated 05.06.2023 No. 17-07/2017 -InvGovernment of IndiaMinistry of CommunicationsDepartment of Posts Dak Bhawan, Sansad Marg,New Delhi - 110001.Dated:05.06.2023 To, All Heads of Postal Circles/Regions. Subject: Regarding revision of … [Read more...] about Revision of sanctioning limits related to claim cases arising out of Loss and Fraud Cases in the Department of Posts

Rs. 2000 Denomination Banknotes – Withdrawal from Circulation

Rs. 2000 Denomination Banknotes - Withdrawal from Circulation. DoP instructs that Rs.2000 denomination banknotes shall not be accepted for exchange in post offices - SB Order No. 11/2023 SB Order No. 11 / 2023 No. FS-10/21/2023 -FS-D Government of IndiaMinistry of Communications Department of Posts(F.S. Division) Dak Bhawan, New Delhi - 110001 Dated: … [Read more...] about Rs. 2000 Denomination Banknotes – Withdrawal from Circulation

Guidelines for Retention of Staff Quarters after Transfer/ Retirement /Death

Retention of Staff Quarters BDG-20/1/2023 -Building-DOPGovernment of IndiaDepartment of PostsEstates DivisionDak Bhawan, Sansad Marg New Delhi-110001Dated: 04.05.2023 To All Chief Postmasters General, Subject: Guidelines for Retention of Staff Quarters after Transfer/ Retirement /Death Madam/Sir, Representations have been received in this Directorate on the … [Read more...] about Guidelines for Retention of Staff Quarters after Transfer/ Retirement /Death

Clarification of DA admissible to employees in the case of residential Government sponsored training programmes

Food Bill reimbursement No. 01-24/2017 -Trg.Government of IndiaMinistry of CommunicationsDepartment of Posts(Training Division) Dak Bhawan, Sansad Marg,New Delhi - 110 001Dated: 04.05.2023 To,Accounts OfficerO/o Chief Postmaster GeneralTamilnadu Circle Subject: Regarding clarification of DA admissible to employees in the case of residential Government sponsored … [Read more...] about Clarification of DA admissible to employees in the case of residential Government sponsored training programmes

Latest DoPT Orders 2023

CENTRAL GOVT HOLIDAY LIST 2023

Indian Railway Holiday List 2023 PDF | Postal Holidays List 2023 India Post | Bank Holidays List 2023 India | LIC Office Holiday List 2023 PDF Download | EPFO Holiday List 2023 PDF Download | ESIC Holiday List 2023 PDF Download | CGHS Holiday Calendar List 2023 | Post Office Holidays 2023 | Railway Holidays CG Office Holidays 2023 | TN Govt Holidays 2023 | KVS Holiday List 2023-2024 PDF