Retention of Staff Quarters

BDG-20/1/2023 -Building-DOP

Government of India

Department of Posts

Estates Division

Dak Bhawan, Sansad Marg

New Delhi-110001

Dated: 04.05.2023

To

All Chief Postmasters General,

Subject: Guidelines for Retention of Staff Quarters after Transfer/ Retirement /Death

Madam/Sir,

Representations have been received in this Directorate on the subject of retention of Staff Quarters after transfer/ retirement/ death wherein it has been observed that different Circles are adopting different practices for retention of quarters in such cases.

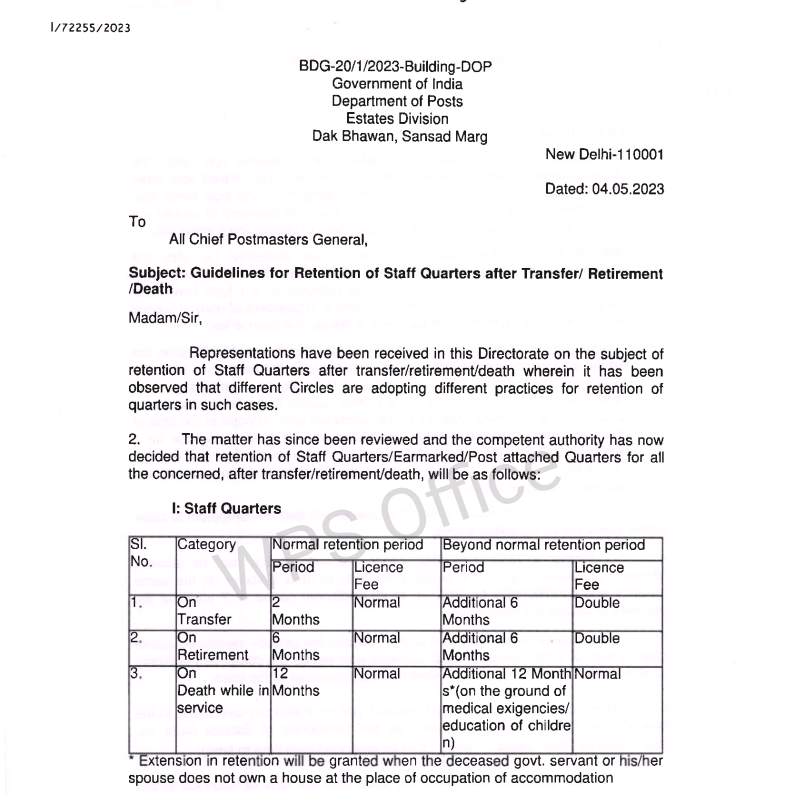

2. The matter has since been reviewed and the competent authority has now decided that retention of Staff Quarters/ Earmarked/ Post attached Quarters for all the concerned, after transfer/ retirement/ death, will be as follows:

1. Staff Quarters

| S.No | Normal retention period | Beyond normal retention period |

| Category | Period | Licence Fee | Period | Licence Fee | |

| 1. | On Transfer | 2 Months | Normal | Additional 6 Months | Double |

| 2. | On Retirement | 6 Months | Normal | Additional 6 Months | Double |

| 3. | On Death while in service | 12 Months | Normal | Additional 12 Months* (on the ground of medical exigencies/ education of children) | Normal |

* Extension in retention will be granted when the deceased govt. servant or his/ her spouse does not own a house at the place of occupation of accommodation

II Earmarked/ Post Attached Quarters:

- All ear-marked /Post Attached Quarters will be mandatorily vacated after availing the normal retention period. The normal retention period in the case of transfer or retirement of the occupant of earmarked/ post attached quarters will be 30 days, while in case of death during service, normal retention period will be 90 days.

- The occupant, in the case of transfer, may thereafter i.e. after the aforementioned normal retention period of 30 days be offered any other vacant house, at the station, of the entitled category or any type lower than the entitled one for a period of additional 1 month at payment of normal the licence fee and further 6 months on the payment of double the licence fee.

- The occupant, in the case of retirement, may thereafter i.e. after the aforementioned normal retention period of 30 days be offered any other vacant house, at the station, of the entitled category or any type lower than the entitled one for a period of further 5 months at payment of normal licence fee and additional 6 months on payment of double the licence fee.

- In case of death of the occupant of the Post Attached/ Earmarked Quarter, the family/ spouse of the deceased govt. servant may thereafter i.e. after the aforementioned normal retention period of 90 days be offered any other vacant house at the station (or at any other station if the family/ spouse so requests) of the entitled category of the deceased govt. servant at the time of death or of any type lower, than the entitled one for further retention for a period of additional 09 months at payment of normal licence fee, and another 12 months at payment of normal licence fee provided that the Spouse does not own a house at that station.

3. The authority competent to allot the quarter will also be competent to allow further retention as stipulated above.

4. Further, in respect of death cases, the widow/ family may be allowed retention of quarter beyond the period prescribed in para 2 above on the same grounds and conditionality by HoC up to an additional period of 2 years at the payment of double the licence fee.

5. All requests of retention of a quarter beyond the periods mentioned above shall lie with Director General Postal Services who will be the competent authority to allow further retention keeping in view the circumstances of the case.

6. Beyond the above mentioned retention period, if anybody overstays, in the quarter, damage rent will be imposed (as per Directorate of Estates order no. 18011/1/2015-Pol.III dated 7th Sept, 2016 as amended from time to time).

7. These guidelines will come into force from the date of issuance of this letter.

8. This issues with the approval of competent authority.

Yours sincerely,

(SIDDHARTHR-BUCHCHAN)

Director (Estates & MM)

Leave a Reply