Festival Advance for Central Govt Employees – Non-Gazetted Government servant whose basic pay and dearness pay taken together does not exceed Rs. 12,450

Grant of Advance – Special Festival Package to employees working in Autonomous Bodies.

The undersigned is directed to say that with a view to enable Government employees to meet expenses relating to festivals and to encourage spending thereby giving a boost to economic activities, in pursuance of decision taken by the Government, this Department vide O.M. of even No. dated 12th October, 2020 (copy enclosed) has issued order for grant of interest free advance amounting to Rs. 10,000/- as a Special Festival Package to be paid in advance to Government employees.

Interest free advance amount Rs. 10,000/- as a Special Festival Package to be paid in advance to Central Government employees

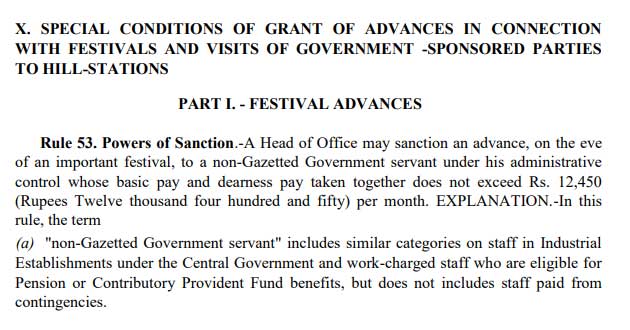

SPECIAL CONDITIONS OF GRANT OF ADVANCES IN CONNECTION WITH FESTIVALS AND VISITS OF GOVERNMENT- SPONSORED PARTIES TO HILL-STATIONS

FESTIVAL ADVANCES

Rule 53. Powers of Sanction.– A Head of Office may sanction an advance, on the eve of an important festival, to a non-Gazetted Government servant under his administrative control whose basic pay and dearness pay taken together does not exceed Rs. 12,450 (Rupees Twelve thousand four hundred and fifty) per month. EXPLANATION.- In this rule, the term

- (a) “non-Gazetted Government servant” includes similar categories on staff in Industrial Establishments under the Central Government and work-charged staff who are eligible for Pension or Contributory Provident Fund benefits, but does not includes staff paid from contingencies.

- (b) “important festival” means such festival or one of such festivals, as a Head of Department/an Industrial Establishment may declare in respect of establishments under his/its administrative control.

GOVERNMENT OF INDIA’S DECISIONS

(1) Fixing of festival occasions by Head of Department.- A Head of Department/ an Industrial Establishment should fix the festival occasions on which festival advances will be allowed after taking into consideration the importance attached locally to such festivals and in consultation with recognized associations of staff where such associations exist. For this purpose, offices including sub-offices of an office located at different stations should be treated as separate establishments.

[G.I., M.F., O.M. No. F. 18 (1)-E. II (A)/62, dated the 19th April, 1962.]

(2) Republic Day and Independence Day included.- For the purpose of Rule 53, the Republic Day and the Independence Day may also be treated as festival occasions.

[ G.I., M.F., O.M. No. F. 16-C (3)-E. II (A)/61, dated the 30th March, 1961. ]

Rule 54. Conditions of Eligibility.- An advance under rules in this part may be granted to Government servant, if he is on duty, or on leave on average pay or any other leave equivalent thereto including maternity leave, but excluding leave preparatory to retirement, on the date on which the advance is disbursed.

Rule 55. An advance under rules in this part shall not be granted to a Government servant more than once in a financial year even if the festival qualifying for advance falls twice in a year.

GOVERNMENT OF INDIA’S DECISION

Certificate to be furnished in cases of officials having come on transfer.- Where a Government servant, who has drawn an advance on the eve of an important festival, is transferred from one establishment to another, after completion of the recovery of the advance, – if any, applies to the latter for the grant of a similar advance, he should furnish in his application for the grant of such an advance, a certificate to the effect that he had not drawn the advance applied for prior to his transfer within the same calendar year. Such a certificate may be test-checked by the Head of Office where it is considered necessary.

[ G.I., M.F., O.M. No. F. 19 (4)-E. II (A)/62, dated the 21st November, 1962. ]

Rule 56. An advance under rules in this part shall not be granted to a Government servant unless an advance already granted to him under rules in this part or Rule 63 has been fully recovered.

Rule 57. An advance under rules in this part shall not be granted to a temporary Government servant unless he is likely to continue in service for a period of at least six months beyond the month in which the advance is disbursed.

Rule 58. Amount of Advance.- The amount of advance which may be granted to a Government servant shall not exceed Rs. 1,500 (Rupees one thousand five hundred) provided that a Government servant who is granted an advance under Rule 63 shall not be granted an advance under this rule in the same financial year.

Rule 59. Disbursement of Advance.- A Drawing and Disbursing Officer shall draw the amount of advance sanctioned under rules in this part before the festival in respect of which the advance is sanctioned.

Rule 60. Recovery of Advance.- The amount of advance granted under rules in this part shall be recovered in not more than ten equal monthly installments.

Rule 61. The recovery of the amount of advance shall commence with the issue of pay for the month following that in which such amount is drawn.

GOVERNMENT OF INDIA’S DECISION

Date of disbursement to be date of drawal.– The date of drawal of the advance should be the date on which the amount of advance is actually disbursed to the Government servant. The time-lag between dates of drawal and disbursement should be reduced to the minimum.

Rule 62. Account of Advances.-The procedure for the maintenance of accounts and watching the recoveries of festival advances is as laid down in Rule 12(c) and Annexure ‘A’ to this Compendium.