Reimbursement of leave encashment Government employees are allowed to encash 10 days earned leave at the time of availing of LTC to the extent of 60 days during the entire service F.No.31011/06/2023 -Estt.(A-IV)Government of IndiaMinistry of Personnel, Public Grievances & PensionsDepartment of Personnel & TrainingEstablishment A-IV Desk North Block, New … [Read more...] about Reimbursement of leave encashment – CCS (LTC) Rules 1988 – Fulfilment of procedural requirements

CENTRAL GOVERNMENT HOLIDAY LIST 2024

| 46% DA Order for Central Government Employees wef 1st July 2023 PDF |

| CGHS Updated Rate Card PDF Download |

| Latest List of KV Schools in India |

| Expected DA 2023 |

| 7th Pay Commission Latest News 2024 |

| MACP for the Central Government Employees |

CCS

Date of next increment under Rule 10 of Central Civil Services (Revised Pay) Rules 2016 – Reminder

Fixation of DNI BPMS - Pay Fixation भारतीय प्रतिरक्षा मजदूर संघBharatiya Pratiraksha Mazdoor Sangh REF: BPMS/ MoF/ Pay Fixation/ 60(7/3/L) Dated: 01.03.2023 REMINDER 3 To, The SecretaryDepartment of ExpenditureGovt of India, Ministry of FinanceNorth Block, New Delhi- 110 001 Subject: Date of next increment under Rule 10 of Central Civil Services (Revised … [Read more...] about Date of next increment under Rule 10 of Central Civil Services (Revised Pay) Rules 2016 – Reminder

Recognition of CSS Associations under the CCS Rules 1993 – DoPT

Central Government Staff Car Drivers Latest DoPT Orders 2023 IMMEDIATE(Through DoPT's website) F.No. 17/1/2022 -R&R and DCGovernment of IndiaMinistry of Personnel, Public Grievances & PensionsDepartment of Personnel and Training(R&R and DC Division) 3rd Floor, Lok Nayak Bhawan,Khan Market, New Delhi -110003.Dated: 28th December, 2022 OFFICE … [Read more...] about Recognition of CSS Associations under the CCS Rules 1993 – DoPT

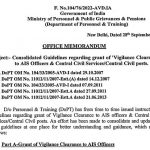

DoPT instructions / guidelines regarding grant of Vigilance Clearance to AIS officers & Central Civil Services/Central Civil posts

Vigilance Clearance to AIS officers Latest DoPT Orders 2022 F. No.104/76/2022- AVD.1AGovernment of IndiaMinistry of Personnel & Public Grievances & Pensions(Department of Personnel & Training) New Delhi, Dated 28th September, 2022 OFFICE MEMORANDUM Subject:- Consolidated Guidelines regarding grant of 'Vigilance Clearance' to AIS Officers & … [Read more...] about DoPT instructions / guidelines regarding grant of Vigilance Clearance to AIS officers & Central Civil Services/Central Civil posts

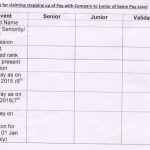

Claiming stepping up of Pay with Compare to Junior of Same Pay Level – PCDA

Fixation of pay on promotion from DNI in the lower rank Message on Website Subject: Stepping up of Pay of Seniors in comparison to Pay of Juniors Consequent to issue of Gol, MoF OM No 4-21/2017-IC/E.IIIA dated 28/11/2019, cases are coming to light wherein Junior Officer is drawing more pay than the Senior after earning Increment (after 6 months), in cases where … [Read more...] about Claiming stepping up of Pay with Compare to Junior of Same Pay Level – PCDA

Non-payment or delay in payment of retirement benefits on account of delay in verification of Caste Certificate in respect of retiring employees

Railway Services Pension Rules GOVERNMENT OF INDIA (भारत सरकार)MINISTRY OF RAILWAYS (रेल मंत्रालय)RAILWAY BOARD (रेलवे बोर्ड) No. D-43/43/2020-F(E)III New Delhi, dated: 22.03.2022. The General Managers/ Principal Financial Advisors,All Zonal Railways/ Production Units etc.,DGs of RDSO and NAIR. Sub:- Non-payment/Delay in payment of retirement benefits on … [Read more...] about Non-payment or delay in payment of retirement benefits on account of delay in verification of Caste Certificate in respect of retiring employees

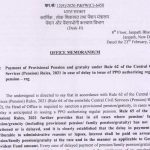

Payment of Provisional Pension and gratuity under Rule 62 of the CCS Pension Rules 2021 in case of delay in issue of PPO authorizing regular pension

Rule 62 CCS Pension Rules 2021 12(9)/2020-P&PW(C)-6450(Desk-H) 8th Floor, Janpath Bhawan,Janpath, New Delhi,Dated the 23rd February, 2022 OFFICE MEMORANDUM Sub: Payment of Provisional Pension and gratuity under Rule 62 of the Central Civil Services (Pension) Rules, 2021 in case of delay in issue of PPO authorizing regular pension - reg The undersigned is … [Read more...] about Payment of Provisional Pension and gratuity under Rule 62 of the CCS Pension Rules 2021 in case of delay in issue of PPO authorizing regular pension

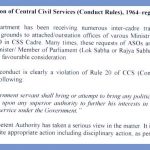

Violation of Rule 20 of CCS (Conduct Rules) 1964 DoPT

Latest DoPT Orders 2021 Violation of CCS Rule 20 - No Government servant shall bring or attempt to bring any political or other outside influence to bear upon any superior authority to further his interests in respect of matters pertaining to his service under the Government F.No.7/3/2020-CS.1 (A)Government of IndiaMinistry of Personnel, Public Grievances and … [Read more...] about Violation of Rule 20 of CCS (Conduct Rules) 1964 DoPT

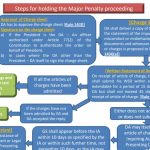

DoPT – Aid to processing of departmental proceedings under the CCS (CCA) Rules 1965

Rules of departmental proceedings - Latest DOPT Orders 2021 F.No.43020/14/2021-Estt.A-IIIGovernment of IndiaMinistry of Personnel, Public Grievance and PensionsDepartment of Personnel & TrainingEstablishment A-III North Block, New Delhi - 110001Dated the 3th November, 2021 OFFICE MEMORANDUM Subject: Aid to processing of departmental proceedings under the CCS … [Read more...] about DoPT – Aid to processing of departmental proceedings under the CCS (CCA) Rules 1965

Central Civil Services Payment of Gratuity under National Pension System Rules 2021

CCS Rules 2021 - Payment of Gratuity under NPS MINISTRY OF PERSONNEL, PUBLIC GRIEVANCES AND PENSIONS(Department of Pension and Pensioners’ Welfare) NOTIFICATION New Delhi, the 23rd September, 2021 G.S.R. 658(E). In exercise of the powers conferred by the proviso to article 309 and clause (5) of article 148 of the Constitution and after consultation with the … [Read more...] about Central Civil Services Payment of Gratuity under National Pension System Rules 2021

Latest DoPT Orders 2023

CENTRAL GOVT HOLIDAY LIST 2023

Indian Railway Holiday List 2023 PDF | Postal Holidays List 2023 India Post | Bank Holidays List 2023 India | LIC Office Holiday List 2023 PDF Download | EPFO Holiday List 2023 PDF Download | ESIC Holiday List 2023 PDF Download | CGHS Holiday Calendar List 2023 | Post Office Holidays 2023 | Railway Holidays CG Office Holidays 2023 | TN Govt Holidays 2023 | KVS Holiday List 2023-2024 PDF