Indian railways latest news today GOVERNMENT OF INDIAMINISTRY OF RAILWAYS(RAILWAY BOARD) PC-VII No. 179RBE No. 09/2022 F.No.F(E)II/2017/DE/1/2 New Delhi, dt.17.01.2022 The General Managers/Pr. Financial Advisors,All Indian Railways & Production Units incl. RDSO,(As per Standard Mailing List) Sub:- Grant of Deputation (Duty) Allowance in cases where the … [Read more...] about 7th CPC Deputation Allowance clarification in cases where the basic pay in parent cadre has been upgraded on account of NFU, MACP, NFSG, etc

CENTRAL GOVERNMENT HOLIDAY LIST 2024

| 46% DA Order for Central Government Employees wef 1st July 2023 PDF |

| CGHS Updated Rate Card PDF Download |

| Latest List of KV Schools in India |

| Expected DA 2023 |

| 7th Pay Commission Latest News 2024 |

| MACP for the Central Government Employees |

7th Central Pay Commission

Revision of rates as per 7th CPC Special Allowance/Qualification Pay in respect of Accounts cadre/services

No. 33-13/2018-SEA-IIIGovernment of India / भारत सरकारMinistry of Communications / संचार मंत्रालयDepartment of Telecommunications / दूरसंचार विभागSanchar Bhawan, 20 Ashoka Road, New Delhi - 110 001 Dated: 11 -03-2020 Sub: Admissibility of Special Allowance/Qualification Pay in respect of Accounts cadre/services - revision of rates as per 7th CPC The undersigned is … [Read more...] about Revision of rates as per 7th CPC Special Allowance/Qualification Pay in respect of Accounts cadre/services

Grant of 7th CPC Conveyance Allowance at the revised rates to Railway Medical Officers clarification

7th CPC Conveyance Allowance to Railway Medical Officers Government of India / (भारत सरकार)Ministry of Railways / (रेल मंत्रालय)(Railway Board) (रेलवे बोर्ड) PC-VII No. 165RBE No. 12/2021 No. F(E)I/2020/AL-7/1 New Delhi, dated 24.02.2021 The General Managers,All Indian Railways etc.,(As per Standard Mailing List). Sub: Recommendation of 7th Central Pay … [Read more...] about Grant of 7th CPC Conveyance Allowance at the revised rates to Railway Medical Officers clarification

7th Pay Commission – Junior officer gets equal to that of his senior and senior office not being eligible for bunching benefits

Bunching Benefit in 7th CPC No. 11030/1/ 2015-AIS-IIGovernment of IndiaMinistry of Personnel, Public Grievances & PensionsDepartment of Personnel & Training Dated: 5th November, 2020 ToThe Chief Secretary,All the States / Union Territories. Subject: Bunching of Pay consequent upon pay fixation in promotional grades of junior officers- reg. Sir, I am … [Read more...] about 7th Pay Commission – Junior officer gets equal to that of his senior and senior office not being eligible for bunching benefits

7th CPC recommendations on Risk Allowance to Central Government employees

7th CPC Risk Allowance No.A-27018/01/ 2017-Estt.(AL)Government of IndiaMinistry of Personnel, PG & PensionsDepartment of Personnel & Training Block No. IV, Room No. 409Old JNU Campus, New DelhiDated 3rd November, 2020 Office Memorandum Subject: Implementation of Govt. decision on 7th CPC recommendations on Risk Allowance to Central Govt. … [Read more...] about 7th CPC recommendations on Risk Allowance to Central Government employees

7th CPC Pay scales of Geo-Scientist Group ‘A’ and Scientist ‘B’ – Pay scales of JTS Entry Grade

7th Pay Commission Latest News 2020 7th central pay commission: Pay scales of JTS Entry Grade Group ‘A’ of Geological Survey of India and Scientist ‘B’ (Hydrogeology) Group ‘A’, Scientist ‘B’(Chemical) Group ‘A’ and Scientist ‘B’(Geophysics) Group ‘A’, Ministry of Jal Shakti Brief particulars relating to the post for which recruitment is being made through this … [Read more...] about 7th CPC Pay scales of Geo-Scientist Group ‘A’ and Scientist ‘B’ – Pay scales of JTS Entry Grade

7th CPC Night Duty Allowance – Payment of (NDA) pursuant to the recommendations of 7th Central Pay Commission

7th CPC Night Duty Allowance GOVERNMENT OF INDIAMINISTRY OF RAILWAYS(RAILWAY BOARD) S.No.PC-VII/159No.E(P&A)II-2017/HW-1 RBE No.83/2020New Delhi,dated 29.09.2020 The General Managers/CAOsAll Indian Railways & Production Units Sub: Payment of Night Duty Allowance (NDA) pursuant to the recommendations of 7th Central Pay Commission - reg. 1. Please … [Read more...] about 7th CPC Night Duty Allowance – Payment of (NDA) pursuant to the recommendations of 7th Central Pay Commission

Protection of pay to the Central Government Servant consequent to appointment to a new post in different service or cadre – 7th CPC DoPT Order

Central Government Employees News F. No. 12/2/2017-Estt(Pay-I)Government of IndiaMinistry of Personnel, Public Grievances and PensionsDepartment of Personnel and Training North Block, New DelhiDated: 5th August, 2020 OFFICE MEMORANDUM Latest DoPT Orders 2020 Subject: Protection of pay to the Central Government Servant consequent to appointment to a new post in … [Read more...] about Protection of pay to the Central Government Servant consequent to appointment to a new post in different service or cadre – 7th CPC DoPT Order

7th CPC revised conveyance allowance rates for Railway Medical Officers

Government of India/ Bharat SarkarMinistry of Railways / Rail Mantralaya(Railway Board) PC-VII No. 155RBE No. 43 No. F(E)I/2016/AL-7/1 New Delhi, dated 9.06.2020 The General Managers,All Indian Railways etc.,(As per Standard Mailing List). Sub: Recommendation of 7th Central Pay Commission - Grant of Conveyance Allowance at the revised rates to Railway Medical … [Read more...] about 7th CPC revised conveyance allowance rates for Railway Medical Officers

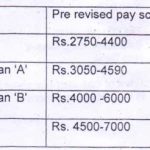

6th CPC up-graded pay scales to the Fire Fighting Employees in Ministry of Defence

Defence 6th CPC up-graded pay scales to the Fire Fighting Employees No.Pay/Tech-I/ 01(6th CPC), Cir No - 2 Dated 12/02/2020 TodThe All CFAs Subject: Grant of up-graded pay scales to the Fire Fighting staff in Ministry of Defence as per 6th CPC recommendation A copy of Government of India MoD letter No F. No.50266/6/PC/ EMECiv(C-2)178- F/D (O-II)2019, dated- … [Read more...] about 6th CPC up-graded pay scales to the Fire Fighting Employees in Ministry of Defence

Latest DoPT Orders 2024

CENTRAL GOVT HOLIDAY LIST 2024

Indian Railway Holiday List 2023 PDF | Postal Holidays List 2023 India Post | Bank Holidays List 2023 India | LIC Office Holiday List 2023 PDF Download | EPFO Holiday List 2023 PDF Download | ESIC Holiday List 2023 PDF Download | CGHS Holiday Calendar List 2023 | Post Office Holidays 2023 | Railway Holidays CG Office Holidays 2023 | TN Govt Holidays 2023 | KVS Holiday List 2023-2024 PDF