7th CPC revised pension pre-2016 ToThe Chief of the Army StaffThe Chief of the Naval StaffThe Chief of the Air Staff Sub: Implementation of Government’s decision on the recommendations of the Seventh Central Pay Commission - Revision of pension of pre-2016 retired Medical Officers of Army Medical Corps/ Army Dental Corps/ Remount & Veterinary … [Read more...] about 7th CPC revised pension pre-2016 retired Medical Officers of Army Medical Corps/Army Dental Corps/Remount & Veterinary Corps

CENTRAL GOVERNMENT HOLIDAY LIST 2024

| 46% DA Order for Central Government Employees wef 1st July 2023 PDF |

| CGHS Updated Rate Card PDF Download |

| Latest List of KV Schools in India |

| Expected DA 2023 |

| 7th Pay Commission Latest News 2024 |

| MACP for the Central Government Employees |

7CPC

7th Pay Commission – Junior officer gets equal to that of his senior and senior office not being eligible for bunching benefits

Bunching Benefit in 7th CPC No. 11030/1/ 2015-AIS-IIGovernment of IndiaMinistry of Personnel, Public Grievances & PensionsDepartment of Personnel & Training Dated: 5th November, 2020 ToThe Chief Secretary,All the States / Union Territories. Subject: Bunching of Pay consequent upon pay fixation in promotional grades of junior officers- reg. Sir, I am … [Read more...] about 7th Pay Commission – Junior officer gets equal to that of his senior and senior office not being eligible for bunching benefits

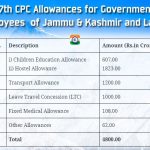

7th CPC Children Education Allowance / Hostel subsidy – Jammu and Kashmir Central Government Employees

Central Government Employees GOVERNMENT OF JAMMU AND KASHMIRFINANCE DEPARTMENTCIVIL SECRETARIAT, JAMMU No. A/Clar(2019)-676/J Dated: 14-08-2020 Subject: Clarification on Children Education Allowance / Hostel subsidy. Consequent upon the implementation of Seventh Pay Commission Allowances after the Reorganization of the State of Jammu & Kashmir, Finance … [Read more...] about 7th CPC Children Education Allowance / Hostel subsidy – Jammu and Kashmir Central Government Employees

Implementation of Government decision on 7th CPC recommendations on Night Duty Allowance (NDA)

7th CPC Night Duty Allowance Latest DoPT Orders 2020 No. A-27016/ 02/ 2017-Estt.(AL)Government of IndiaMinistry of Personnel, Public Grievances & PensionDepartment of Personnel& Training Block IV, Old JNU CampusNew Delhi dated 13th July, 2020 OFFICE MEMORANDUM Subject: Implementation of Government decision on 7th CPC’s recommendations on Night Duty … [Read more...] about Implementation of Government decision on 7th CPC recommendations on Night Duty Allowance (NDA)

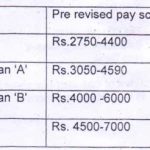

6th CPC up-graded pay scales to the Fire Fighting Employees in Ministry of Defence

Defence 6th CPC up-graded pay scales to the Fire Fighting Employees No.Pay/Tech-I/ 01(6th CPC), Cir No - 2 Dated 12/02/2020 TodThe All CFAs Subject: Grant of up-graded pay scales to the Fire Fighting staff in Ministry of Defence as per 6th CPC recommendation A copy of Government of India MoD letter No F. No.50266/6/PC/ EMECiv(C-2)178- F/D (O-II)2019, dated- … [Read more...] about 6th CPC up-graded pay scales to the Fire Fighting Employees in Ministry of Defence

7th CPC Special Allowance for Accounts cadre

Department has considered the proposal to revise the rates of Special Allowance and Qualification Pay for Account Cadres 7th CPC Special Allowance for Accounts cadre No.11-1/2016/7th CPC/Part.II (B) GOVERNMENT OF INDIA MINISTRY OF FINANCE DEPARTMENT OF EXPENDITURE (7th CPC matters) North Block, New Delhi Dated: 14th Nov, 2019 OFFICE MEMORANDUM Subject: … [Read more...] about 7th CPC Special Allowance for Accounts cadre

7th CPC Risk and Hardship Allowance for Track Maintainers working in Constructions Organization

7th CPC Risk and Hardship Allowance for Track Maintainers working in Constructions Organization NFIR No.IV/NFIR/7 CPC(Imp)/2016/Allowance/Part II Dated: 20/11/2019 The Member Engineering, Railway Board, New Delhi The Member Staff Railway Board, New Delhi Dear Sir, Sub: Recommendations of 7th CPC - Payment of Risk & Hardship Allowance for Track … [Read more...] about 7th CPC Risk and Hardship Allowance for Track Maintainers working in Constructions Organization

Government Employees of Union Territories of Jammu & Kashmir and Ladakh to get all 7th CPC Allowances from 31st October 2019

Government Employees of Union Territories of Jammu & Kashmir and Ladakh to get all 7th CPC Allowances from 31st October 2019 Central government news today - 7th CPC Allowances Ministry of Home Affairs Government Employees of UT of Jammu & Kashmir and UT of Ladakh to get all 7th CPC Allowances from 31st October 2019 22 OCT 2019 After the Parliament passed … [Read more...] about Government Employees of Union Territories of Jammu & Kashmir and Ladakh to get all 7th CPC Allowances from 31st October 2019

Grant of additional increment to Railway staff – NFIR

Grant of additional increment to the railway employees NFIRNational Federation of Indian Railwaymen3, CHELMSFORD ROAD, NEW DELHI – 110 055Affiliated to :Indian National Trade Union Congress (INTUC) &International Transport Workers’ Federation (ITF) No.I/11/Pt II Dated: 02/10/2019 The Secretary (E),Railway Board,New Delhi Dear Sir, Sub: Grant of additional … [Read more...] about Grant of additional increment to Railway staff – NFIR

Gazette Notification – Amendment in Rule-5 of Civilian Defence Service (Revised Pay) Rules, 2016

Gazette Notification Amendment in Rule-5 of Civilian Defence Service (Revised Pay) Rules, 2016 GOVERNMENT OF INDIA MINISTRY OF DEFENCE OFFICE OF THE PRINCIPAL CONTROLLER OF ACCOUNTS PAY TECH SECTION 10-A, S.K. BOSE ROAD, KOLKATA 700001 Part.I Office Order No. AT/06 Date: 11/06/2019 ToAll CsFA Subject: Amendment in Rule-5 of Civilian Defence Service (RP) Rules, … [Read more...] about Gazette Notification – Amendment in Rule-5 of Civilian Defence Service (Revised Pay) Rules, 2016

Latest DoPT Orders 2024

CENTRAL GOVT HOLIDAY LIST 2024

Indian Railway Holiday List 2023 PDF | Postal Holidays List 2023 India Post | Bank Holidays List 2023 India | LIC Office Holiday List 2023 PDF Download | EPFO Holiday List 2023 PDF Download | ESIC Holiday List 2023 PDF Download | CGHS Holiday Calendar List 2023 | Post Office Holidays 2023 | Railway Holidays CG Office Holidays 2023 | TN Govt Holidays 2023 | KVS Holiday List 2023-2024 PDF