50% DA Rates - Enhanced rate of DA at the rate of 50% effective from 01.01.2024. CONROLLER GENERAL OF DEFENCE ACCOUNTSUlan Batar Road, Palam, Delhi Cantt- 110010 No. AN/XIV/19015/ Govt. Orders/2019 दिनांक: 10/04/2024 सेवा में, सभी रक्षा लेखा प्रधान नियंत्रक/ रक्षा लेखा नियंत्रकAll PCSDA/CsDA(Through CGDA WAN and email) Sub: Revision of rates of Allowances with … [Read more...] about CGDA – Revision of rates of Allowances with DA rates increased to 50%

CENTRAL GOVERNMENT HOLIDAY LIST 2024

| 46% DA Order for Central Government Employees wef 1st July 2023 PDF |

| CGHS Updated Rate Card PDF Download |

| Latest List of KV Schools in India |

| Expected DA 2023 |

| 7th Pay Commission Latest News 2024 |

| MACP for the Central Government Employees |

DA - Dearness Allowance - Central Government employees

Dearness Allowance hike to Gramin Dak Sevak (GDS) effective from Jan 2024

Department of Posts issued order for Payment of Dearness Allowance to GDS effective from Jan 2024 Table of ContentsThe Dearness Allowance payable to the Gramin Dak Sevaks (GDS) will be enhanced from 46% to 50% of the Basic Time Related Continuity Allowance (TRCA) effective from January 1, 2024. This decision is in accordance with the grant of another installment of Dearness … [Read more...] about Dearness Allowance hike to Gramin Dak Sevak (GDS) effective from Jan 2024

Benefits of 50% DA Hike for Central Government Employees

50% DA Milestone, from January 2024: How it transforms your Allowances With the available Consumer Price Index for Industrial Workers (CPI-IW) indices as published by the Labour Bureau, it is seen that the Dearness Allowance for the central government employees will be at least 50%. As a central government employee, you're well aware of the significance of Dearness … [Read more...] about Benefits of 50% DA Hike for Central Government Employees

Cabinet approves 4% additional instalment of Dearness Allowance and Dearness Relief to Central Government employees and pensioners

DA Hike - 7th Central Pay Commission News Cabinet approves additional instalment of 4% Dearness Allowance and Dearness Relief to Central Government employees and pensioners 49.18 lakh employees and 67.95 lakh pensioners to benefit4% benefit to cost Rs.12,868.72 crore per annum to exchequer The Union Cabinet chaired by Prime Minister Shri Narendra Modi … [Read more...] about Cabinet approves 4% additional instalment of Dearness Allowance and Dearness Relief to Central Government employees and pensioners

Download Central Government Employees DA order wef 1st July 2023 PDF

Dearness Allowance Order July 2023 Central Government employees DA from 42% to 46% of the Basic Pay with effect from 1st July, 2023 No. 1/4/2023-E-II (B)Government of IndiaMinistry of FinanceDepartment of Expenditure North Bert New DelhiDated the 2oth October, 2023. OFFICE MEMORANDUM Subject: Revision of rates of Dearness Allowance to Central Government employees … [Read more...] about Download Central Government Employees DA order wef 1st July 2023 PDF

Cabinet approved Dearness Allowance and Dearness Relief due from 1st July 2023

4℅ July DA 2023 Release an additional instalment of Dearness Allowance (DA) to Central Government employees and Dearness Relief (DR) to pensioners w.e.f. 01.07.2023 representing an increase of 4% over the existing rate of 42% of the Basic Pay/Pension DA Increase 4% to Central Government employees and pensioners from 01.07.2023 Existing DA 42% + Additional DA 4% = … [Read more...] about Cabinet approved Dearness Allowance and Dearness Relief due from 1st July 2023

Request for Timely declaration of DA/DR hike and Bonus for Employees and Pensioners – Ministerial Staff Association

2023 Bonus orders for Employees and Pensioners Request for timely declaration of DA/DR hike and 2023 Bonus orders for Employees and Pensioners by Ministerial Staff Association, Survey of India MINISTERIAL STAFF ASSOCIATIONSurvey of India, CHQ No. CHQ-28/MSA(2022-23) Dated: 09 Oct, 2023 सेवा में भारत के महासर्वेक्षक,महासर्वेक्षक का कार्यालय,भारतीय सर्वेक्षण … [Read more...] about Request for Timely declaration of DA/DR hike and Bonus for Employees and Pensioners – Ministerial Staff Association

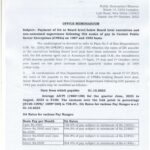

Dearness Allowance from 1st Oct 2023 – IDA Scales of pay in CPSEs on 1987 and 1992 Basis

DA Rates for various Pay Ranges DA from 01 Oct 2023 to Board level/below Board level executives and non-unionized supervisors following IDA scales of pay in Central Public Sector Enterprises (CPSEs) on 1987 and 1992 basis F.No.W-02/ 0003/2014 -DPE(WC)- GL-XXI/2023Government of IndiaMinistry of FinanceDepartment of Public Enterprises Public Enterprises BhawanBlock 14, … [Read more...] about Dearness Allowance from 1st Oct 2023 – IDA Scales of pay in CPSEs on 1987 and 1992 Basis

Dearness Allowance Hike from July 2023 expected – Cabinet meeting today

DA Hike July 2023 Dearness Allowances Approval of a hike starting in July 2023 Cabinet meeting is scheduled for today, October 4, 2023, at 10:30AM. The Centre may provide a 4% DA increase to employees and pensioners ahead of Navratri on October 4, 2023. Before Navratri, the Modi government may enhance the dearness allowance for central employees and pensioners by … [Read more...] about Dearness Allowance Hike from July 2023 expected – Cabinet meeting today

Union Cabinet expected to approve 4% Increase in Dearness Allowance from July 2023

Dearness Allowance July 2023 It is expected that the Union Cabinet would approve increasing the Dearness Allowance (DA) by 4% starting in July 2023. The Cabinet Committee on Economic Affairs generally approves this permission in the second week of September based on the average AICPIN for Industrial Workers over the previous 12 months. 4% Increase in Dearness Allowance … [Read more...] about Union Cabinet expected to approve 4% Increase in Dearness Allowance from July 2023

Latest DoPT Orders 2023

CENTRAL GOVT HOLIDAY LIST 2023

Indian Railway Holiday List 2023 PDF | Postal Holidays List 2023 India Post | Bank Holidays List 2023 India | LIC Office Holiday List 2023 PDF Download | EPFO Holiday List 2023 PDF Download | ESIC Holiday List 2023 PDF Download | CGHS Holiday Calendar List 2023 | Post Office Holidays 2023 | Railway Holidays CG Office Holidays 2023 | TN Govt Holidays 2023 | KVS Holiday List 2023-2024 PDF