6th CPC DA Order July 2022 DA to the Central Government Employees and Central Autonomous Bodies continuing to draw their pay in the pre-revised pay scale/Grade Pay as per 6th CPC from the existing rate of 203% to 212% wef 01.07.2022 No. 1/3(1)/2008-E.11(B)Government of IndiaMinistry of FinanceDepartment of Expenditure North Block, New DelhiDated the 12th October, … [Read more...] about 6th CPC Dearness Allowance to Central Government Employees from July 2022 – DoE Order

CENTRAL GOVERNMENT HOLIDAY LIST 2024

| 46% DA Order for Central Government Employees wef 1st July 2023 PDF |

| CGHS Updated Rate Card PDF Download |

| Latest List of KV Schools in India |

| Expected DA 2023 |

| 7th Pay Commission Latest News 2024 |

| MACP for the Central Government Employees |

6th Central Pay Commission - Sixth Central Pay Commission, 6th Central Pay Commission, 6th pay commission pay matrix, 6th CPC, 6CPC

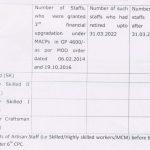

Grant of 3rd MACP on completion of 30 years of service to Artisan Staff

3rd MACP - Number of Staffs, who were granted financial upgradation under 3rd MACPs in GP 4600/- as per MOD order dated 06.02.2014 and 19.10.2016 MACP for the Central Government Employees PRINCIPAL CONTROLLER OF DEFENCE ACCOUNTS(WESTERN COMMAND) CHANDIGARH Circular No.Pay/II/ Tech/243 ACP Dated 20/09/2022. To,1. All Sub offices under jurisdiction of this … [Read more...] about Grant of 3rd MACP on completion of 30 years of service to Artisan Staff

6th CPC DA 196% w.e.f. 1st June 2021 and 203% w.e.f. 1st Jan 2022 – Railway Board

Indian railways latest news today GOVERNMENT OF INDIAMINISTRY OF RAILWAYS(RAILWAY BOARD) S.No. PC-VI/407 RBE No. 56/2022 No. PC-VI/2008/1/7/2/1 New Delhi, dated 11.05.2022 The GMs/CAOs(R),All Zonal Railways & Production Units,(as per mailing list). Sub: Rate of Dearness Allowance applicable w.e.f. 01.07.2021 and 01.01.2022 to those Railway … [Read more...] about 6th CPC DA 196% w.e.f. 1st June 2021 and 203% w.e.f. 1st Jan 2022 – Railway Board

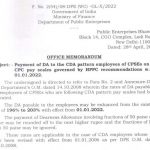

203% Payment of DA to the CDA pattern employees of CPSEs on 6th CPC from 01.01.2022

Payment of DA to the CDA pattern employees of CPSEs on 6th CPC pay scales governed by HPPC recommendations w.e.f. 01.01.2022 F. No. 2(54)/O08-DPE (WC) -GL-X/2022Government of IndiaMinistry of FinanceDepartment of Public Enterprises Public Enterprises Bhawan,Block 14, CGO Complex, Lodi Road,New Delhi-110003,Dated: 28 April, 2021 OFFICE MEMORANDUM Subject: Payment … [Read more...] about 203% Payment of DA to the CDA pattern employees of CPSEs on 6th CPC from 01.01.2022

Cadre Restructuring Proposal of Group B Group C Posts/Cadres of Survey of India

Cadre Restructuring Proposal of Group B & C Posts/Cadres - Demand of Level 8/9 on promotion after merger of Assistant & Office Supdt. posts as per 6th CPC recommendations The Ministerial Staff Association, Survey of India has requested the Secretary to the Govt. of India, Ministry of Science & Technology, Department of Science & Technology, New Delhi to … [Read more...] about Cadre Restructuring Proposal of Group B Group C Posts/Cadres of Survey of India

6th CPC DA order from January 2022 to Central Govt employees 196% to 203% of the Basic Pay wef 1.1.2022 – DoE

6th CPC DA order from January 2022 The Rate of 6th CPC DA from 196% to 203% of the Basic Pay admissible to the employees of Central Government and Central Autonomous Bodies with effect from 1.1.2022. No. 1/3(1)/2008 -E.II(B)Government of IndiaMinistry of FinanceDepartment of Expenditure North Block, New DelhiDated the 7th April, 2022. OFFICE … [Read more...] about 6th CPC DA order from January 2022 to Central Govt employees 196% to 203% of the Basic Pay wef 1.1.2022 – DoE

6th CPC to Private Sector employees similar to Central/State Government employees

Implementation of 6th CPC recommendations to Private Sector employees GOVERNMENT OF INDIAMINISTRY OF LABOUR AND EMPLOYMENT RAJYA SABHA UNSTARRED QUESTION NO. 1856TO BE ANSWERED ON 17.03.2022 1856. SHRI BHUBANESWAR KALITA: Will the Minister of Labour and Employment be pleased to state: (a)whether Government is considering implementation of 6th Central Pay … [Read more...] about 6th CPC to Private Sector employees similar to Central/State Government employees

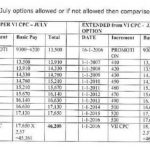

Extension of Annual increment to the Central Government Employees on January and July from 01-01-2006 as a special case for settling an outstanding 6th CPC anomaly

Extension of DNI MACP for the Central Government Employees Shiva Gopal MishraSecretary National Council (Staff Side)Joint Consultative Machineryfor Central Government Employees13-C, Ferozshah Road, New Delhi-110001 No.NC-JCM-2022/DOPT (Inc) North Block, New Delhi,January 25 , 2022 The Secretary (P)Government Of IndiaDepartment of Personnel and … [Read more...] about Extension of Annual increment to the Central Government Employees on January and July from 01-01-2006 as a special case for settling an outstanding 6th CPC anomaly

6th CPC DA payable to the employees of CPSEs following CDA pattern pay scales governed by HPPC recommendations

CPSE 6th CPC DA from July 2021 - DA will be granted to CDA pattern employees of CPSEs on the 6th CPC pay scales beginning on July 1, 2021. F. No. 2(54) /O8-DPE (WC) -GL-XVIII/2021Government of IndiaMinistry of FinanceDepartment of Public Enterprises Public Enterprises Bhawan,Block 14, CGO Complex, Lodi Road,New Delhi-110003, the 3rd December, 2021 OFFICE … [Read more...] about 6th CPC DA payable to the employees of CPSEs following CDA pattern pay scales governed by HPPC recommendations

6th CPC DA to Central Government employees and Central Autonomous Bodies continuing to draw their pay in the pre-revised pay scale/Grade Pay

6th CPC DA July 2021 With effect from July 1, 2021, the pay of Central Government and Central Autonomous Bodies who are still on the pre-revised pay scale/Grade Pay as per the 6th Central Pay Commission would be increased from 189 percent to 196 percent of the Basic Pay. No. 1/3(1)/2008-E.II(B)Government of IndiaMinistry of FinanceDepartment of Expenditure North … [Read more...] about 6th CPC DA to Central Government employees and Central Autonomous Bodies continuing to draw their pay in the pre-revised pay scale/Grade Pay

Latest DoPT Orders 2023

CENTRAL GOVT HOLIDAY LIST 2023

Indian Railway Holiday List 2023 PDF | Postal Holidays List 2023 India Post | Bank Holidays List 2023 India | LIC Office Holiday List 2023 PDF Download | EPFO Holiday List 2023 PDF Download | ESIC Holiday List 2023 PDF Download | CGHS Holiday Calendar List 2023 | Post Office Holidays 2023 | Railway Holidays CG Office Holidays 2023 | TN Govt Holidays 2023 | KVS Holiday List 2023-2024 PDF