Postal Small Savings Schemes – DoP

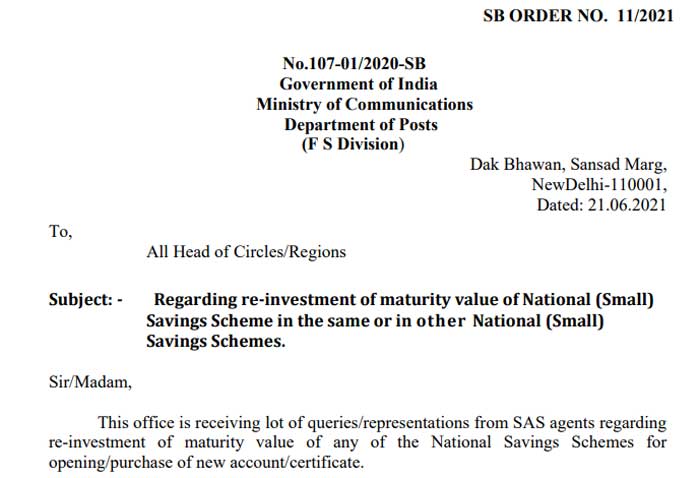

No.107-01/2020-SB

Government of India

Ministry of Communications

Department of Posts

(F S Division)

Dak Bhawan, Sansad Marg,

NewDelhi-110001,

Dated: 21.06.2021

To,

All Head of Circles/Regions

Subject: Regarding re-investment of maturity value of National (Small) Savings Scheme in the same or in other National (Small) Savings Schemes.

Sir/Madam,

This office is receiving lot of queries/ representations from SAS agents regarding re-investment of maturity value of any of the National Savings Schemes for opening/ purchase of new account/ certificate.

To avoid any confusion amongst agents/ field units, the competent authority has decided to reiterate the provisions available for re-investment of maturity value of any National (Small) Savings Schemes for opening of new account/ purchase of certificate either by account holder directly or through SAS agents.

The procedure for reinvestment is given below:-

1. For re-investment of full maturity value or part thereof either by account holder directly or through SAS agent, the account/certificate holder has to either maintain or open a new Post Off ice Savings Account in the post office.

2. Procedure of reinvestment by account holder (Direct Reinvestment)

- i) If an account holder wants to re-invest the maturity value of his/her National (Small) Savings Scheme either in full or part thereof, he/she shall submit account closure form (SB-7A) for the matured account, passbook and withdrawal form(SB-7) or POSE cheque of his/her Post Office Savings Account at concerned post office. Further he/she shall submit the Account Opening Form (AOF) with pay-in-slip for the new account to be opened.

- ii) If he/she has not provided his KYC documents as per provisions available in GSPR-2018 and KYC guidelines issued from time to time, he/she shall also submit updated KYC documents along with above documents.

- iii) In acquittance portion of account closure form (SB-7A) or backside of preprinted KVP/NSC, account holder shall write “Credit maturity value into my Post Office Savings Account No. ………………” and sign.

- iv) In acquittance portion of withdrawal form (SB-7) of Post Office Savings Account or on the backside of POSE cheque, account holder shall write ‘For Reinvestment in scheme in lieu of closed A/c No. ………….. for Rs. ……………… and sign’.

- v) The counter PA of post office shall check documents received and if all documents are in order, follow the procedure as prescribed in the rules for closure of an existing account and transfer maturity value into the account holder’s Post Office Savings Account.

- vi) Supervisor shall verify the closure of account.

- vii) After closure of account, counter PA shall open new account under account holder/minor CIF and during account opening, funding of amount mentioned in withdrawal form(SB-7) or POSE Cheque shall be done from account holder’s Post Office Savings Account.

- viii) Supervisor shall verify the new account opening and funding of account.

- ix) Counter PA shall provide passbook of the new account opened to the account holder.

Note: (i) The re-investment can be made either for the amount equal to or less amount and up to maturity value credited.

(ii) The reinvestment can only be made under same CIF and in the name of account holder/ one of the joint holders/ minor under the guardianship of the account holder i.e. The account holder (s) of the matured account shall be the sole account holder or one of the joint account holders or the guardian of the minor / person of unsound mind as the case may be, of the new account opened under reinvestment.

3. Procedure of reinvestment through SA S agent

In SAS agency rules/existing procedure, re-investment of maturity value through withdrawal form (SB-7) is allowed. However new investment under SAS agency rules is allowed only through Cash (up to Rs.20,000) or By cheque.

- i) The agent will issue authorized agent receipt of the documents mentioned below from the Authorized Agent Receipt Book (Cheque) with suitable remarks and hand it over to the account holder as prescribed in the SAS Agency rules. Particulars of the matured deposit/certificates which are to be reinvested will be written in place of cheque number on the receipt.

- ii) Where account holder desires to re-invest his/her maturity value through SAS agent in any of (TD/MIS/KVP/NSC) schemes, the account holder shall handover the following documents to SAS agent after obtaining one copy of Authorized Agent Receipt

- a) Passbook/ Certificate (KVP/NSC) matured.

- b) Account Closure Form (SB-7A)

- c) Account Opening Form (AOF) of new scheme with pay-in-slip

- d) Withdrawal Form (SB-7) along with passbook or POSE Cheque of PO Savings Account.

Note: If KYC documents have not submitted by the depositor earlier as prescribed in GSPR-2018 and KYC guidelines issued from time to time, he/she shall also submit required KYC documents.

- iii) In acquittance portion of account closure form (SB-7A) or backside of preprinted KVP/NSC, account holder shall write ‘Credit maturity value in to my Post Office Savings Account No. ………………” and sign.

- iv) In acquittance portion of withdrawal form (SB-7) of Post Office Savings Account or on the backside of POSE cheque, account holder shall write ‘For Re- investment in scheme in lieu of closed A/c No. ………….. for Rs. ……………… through the agent………………………… (name of agent and C.A. number) and sign.

- v) The counter PA of post office shall check documents received and if all documents are in order, follow the procedure as prescribed in the rules for closure of an existing account and transfer maturity value into the account holder’s Post Office Savings Account.

- vi) Supervisor shall verify the closure of account.

- vii) After closure of account, counter PA shall open new account under account holder/minor CIF and during account opening, funding of amount mentioned in Withdrawal Form (SB-7) or POSE Cheque shall be done by transfer from account holder’s Post Office Savings Account.

- viii) Select agency code of the concerned agent during account opening.

- ix) Supervisor shall verify the new account opening and funding of account.

- x) Counter PA shall handover the passbook of new account opened, cancelled passbook of closed account and authorized agent receipt duly affix date stamp to the SAS agent.

- xi) SAS agent will handover passbooks of new account, cancelled passbook of closed account to the account holder and take back account holders copy of Authorized Agent Receipt and paste on agent’s copy of Authorized Agent Receipt.

Note: (i) The reinvestment can be made either for the amount equal to or less amount and up to maturity value credited.

(ii) The re-investment can only be made under same CIF and in the name of account holder/one of the joint holders/ minor under the guardianship of the account holder i.e. The account holder (s) of the matured account shall be the sole account holder or one of the joint account holders or the guardian of the minor I person of unsound mind as the case may be, of the new account opened under reinvestment.

4. It is requested to circulate this amendment to all CBS Post Offices for information, guidance and necessary action.

5. This issues with the approval of DDG (FS)

Yours Sincerely

(Devendra Sharma)

Assistant Director (SB-II)

Leave a Reply