India Post Payment Bank (IPPB)

Release of Incentive amounts for the L0, L1 and L2 from 18th August, 2018 till 30th April, 2019.

F. No. 1-3/2017-PBI (Pt)

Government of India

Ministry of Communications

Department of Posts

(PBI Division)

Sansad Marg, Dak Bhawan

New Delhi, Dated: 10 May, 2019

To

All CPMsG/PMsG

Subject: Release of Incentive amounts by India Post Payments Bank

Please find enclosed herewith circular IPPB/2019-20/CSMO/01 dated 07.05.2019 regarding release of incentive amounts to End users for work related to IPPB. The incentive qualifiers, basis of incentive calculation and TDS deductions have been elaborated by IPPB vide the above mentioned circular.

It is requested to kindly impart wide publicity to the circular for motivation of the end Users.

Enclosure: As above

Abhishek Jain

ADG (PBJ)

Copy to:

- Sr.PPS to Secretary (Posts)

- PS to DG (Posts)

- PPS /PS to all Members, Postal Services Board

- AS & FA

- CGM (BD & M)/CGM (PLI) /CGM (Parcel)/Sr.DDG (PBI)/Sr. DDG (PAF)

- Director, RAKNPA

- All GM (Finance)

- All DDsG/GMs

- GM (CEPT). Mysore. •with a request lo upload the order on India Post Website.

- All DAPs

- CSMO, IPPB

- Office Copy

India Post

Payment Bank

Circular: IPPB/2019-20/CSM0/01

Dated: 7.5.2019

Subject : Release of Incentive amounts for the L0, L1 and L2 from 18th August, 2018 till 30th April, 2019

“Patience is virtue”

The wait is over, Incentives are here!!

Dear All,

We shall be crediting Incentive amount to our End users in this month (i.e. May 2019). It will give immense boost to our on-field Sales team.

1. Handy Information

a. Incentive Calculation

- Incentives are calculated on the basis of Qualifier given in Table 1.0.

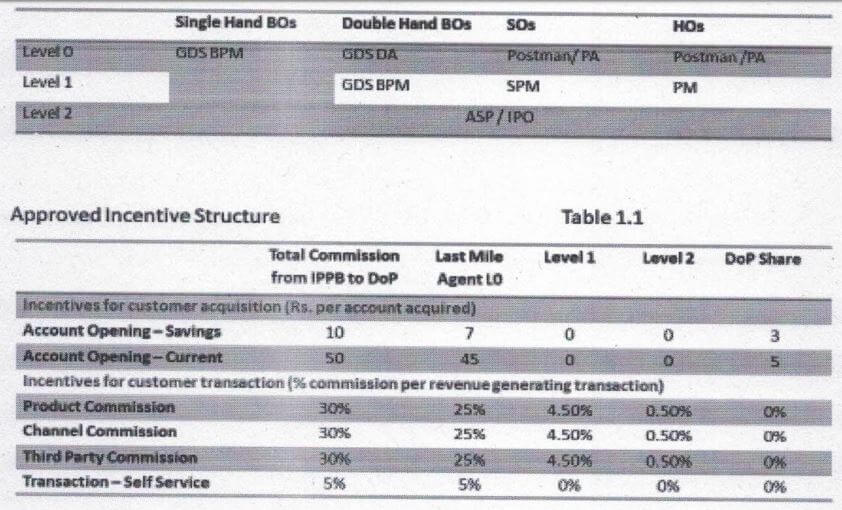

Table 1.0

Incentives: Qualifiers

Savings Account:

A savings account will be recognized and therefore qualifying for Incentive payment provided there is a cumulative credit of Rs.100 within 30 days of account opening.

Therefore a funded account as defined above will qualify for account opening Incentive on fulfillment of either of below mentioned conditions

Linkage of POSA within 30 days of account opening.

OR

Cumulative Revenue Generation of Rs. 30 from transactions within 90 days of account opening.

Current Account:

On Current accounts where the average monthly balance is Rs. 1000 for the period of 3 months beginning with the month in which account is opened.

&

Cumulative revenue generation of Rs. 50 from transactions within 90 days of account opening

- Incentives are calculated for L0,L1 & L2 on the basis of Table 1.1.

Incentives Structure

- Incentives are for time period 18th August 2018 to 31st March 2019 for both acquisitions and transactions.

- Incentives for the month of April,2019 shall be paid later on after 5% TDS deduction. Incentives are for both Acquisitions and Transactions; the incentive amount has been calculated on the basis of incentive structure given in Table 1.1.

- Acquisition incentive as of now is only for Savings accounts only,current account Incentive shall be credited later.

- Transaction Incentive comprises of both Incentive earned on transactions done on Assisted Mode and self-mode.

- In case of counters Incentives are only for Shared counters, no incentives for dedicated counters.

- Incentive will only go to those end users whose IPPB savings account numbers are updated in AMS. Incentives for other end users will be credited in the next monthly cycle after their respective IPPB account detail is updated in the AMS.

- Building on point above we shall urge branches to do the Aadhaar seeding & POSA linkage of IPPB Savings accounts of End users along with the up-dation of same in AMS this will help in Skill India contest.

- Going forward Incentives shall be credited month of month for each preceding month.

- The view of incentive on the CBS and Micro ATM will be the amount accrued for the day and the MTD amount till that day and so on till the end of the calendar month. New cycle will start from the beginning of the next month.

Tax Calculation

- There is a provision of 5% TDS deduction from Incentive amount of end user towards TDS. In case an end user is earning > Rs. 15,000/- in form of Incentives in a•financial year,5% will be retained in the form of TDS and submitted to respective statutory authorities for given financial year & in other cases where the total earnings of the end user are < Rs. 15,000/- in the complete financial year, then the 5% amount retained from the incentives payable of the end user every month wise, the total retained amount will be released into the respective End users IPPB account at the end of financial year.

- In the FY i.e. 2018-19, none of our End Users have earned > 15K in form of Incentives so we will be crediting entire amount to end users without any deduction towards TDS.

Communication

- Each end user will get an SMS upon successful credit of Incentive in their IPPB bank accounts.

- Each Circle will get email communication on details of Incentives.

- Fan-Fare will be created on Social Media handles and communications apps on incentives.

- Detailed end user wise Incentive calculation will be shared with circles for any query resolution and information dissemination further downwards.

- Leaderboards, testimonials and best practices of achievers will be shared.

- End User will be able to check Incentives on Micro ATM and CBS.

- We shall be providing Screen Shots & a small video on How to check Incentives and other functionalities related to Incentives.

Query Resolution

In case of any query or dispute the team need to follow given escalation matrix only

| Escalation Level | Designation | Remarks |

| First Level | Branch Manager | Branches & Circles will have detailed data |

| Second Level | Circle Manager | Branches & Circles will have detailed data |

| Third level | Corporate office | Ankur Bhatt 9816049475 |

Best wishes for a wonderful year ahead.

Regards,

Sd/- 07/05/2019

Gursharan Rai Bansal

CGM & CSMO

Source: cept.gov.in

Leave a Reply