Leave Encashment and Gratuity for pensioners | Calculation of Gratuity and Cash payment in lieu of Leave | Notional Percentage of DA for calculation

DA will continue at 17 percent of basic pay during the time, but it has been increased to 28 percent of basic pay, which includes additional instalments due on 01.01.2020 (4 percent), 01.07.2020 (3 percent), and 01.01.2021 (4 percent) payable as of 01.07.2021.

No. 1(5)/E.V/2020

Government of India

Ministry of Finance

(Department of Expenditure)

North Block, New Delhi

Date the 7th September 2021

OFFICE MEMORANDUM

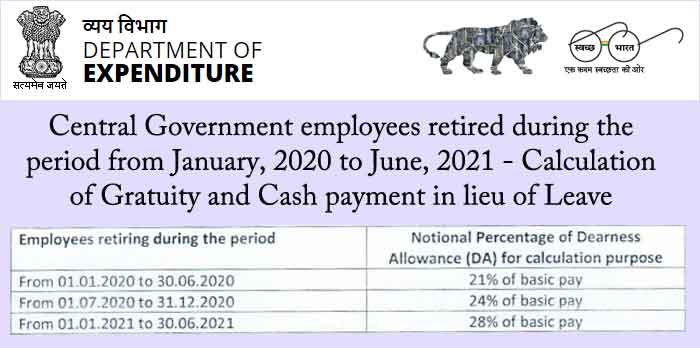

Sub: Central Government employees retired during the period from January, 2020 to June, 2021 – Calculation of Gratuity and Cash payment in lieu of Leave – regarding.

The undersigned is directed to refer to this Ministry’s O.M. No.1/1/2020-E.11(B) dated 23.04.2020, read with O.M. No.1/1/2020-E.II(B) dated 20.07.2021, in regard to payment of Dearness Allowance (DA) during the period from 01.01.2020 up to 30.06.2021 and to say that in terms thereof while the rate of DA during the said period shall remain at 17% of basic pay, the same has been enhanced to 28% of basic pay subsuming additional instalments arising on 01.01.2020(4%), 01.07.2020 (3%) & 01.01.2021(4%) payable w.e.f. 01.07.2021.

2. As per the existing provisions contained in Central Civil Services (Pension) Rules 1972, DA on the date of retirement or death is reckoned as emoluments for the purpose of calculation of gratuity. Also, as per the existing provisions contained in CCS (Leave) Rules 1972, pay admissible on the date of retirement plus DA on that are reckoned for the purpose of calculation of cash payment in lieu of leave.

3. In view of the provisions of the aforesaid orders of this Ministry dated 23.04.2020 and 20.07.2021, calculation of gratuity and cash payment in lieu of leave in respect of Central Government employees who retired on or after 01.01.2020 and up to 30.06.2021 are required to be made based on the rate of DA at 17% of basic pay.

4. Keeping in view that gratuity and cash payment in lieu of leave are one-time retirement benefits admissible to employees on retirement and employees who retired during the period from 01.01.2020 to 30.06.2021 have been allowed lesser amount than what would have been calculable but for the aforesaid orders of this Ministry dated 23.04.2020 and 20.07.2021, the matter has been considered sympathetically with a view to allowing the same to such employees.

5. Accordingly, the President is pleased to decide that in respect of Central Government employees who retired on or after 01.01.2020 and up to 30.06.2021, the amount of DA to be taken into account for the calculation of gratuity and cash payment in lieu of leave will be deemed to be as under:

| Employees retiring during the period | Notional Percentage of Dearness Allowance (DA) for calculation purpose |

| From 01.01.2020 to 30.06.2020 | 21% of basic pay |

| From 01.07.2020 to 31.12.2020 | 24% of basic pay |

| From 01.01.2021 to 30.06.2021 | 28% of basic pay |

6. All other conditions as stipulated in CCS (Pension) Rules 1972 and the orders of Department of Pension & PW vide O.M. No.7/5/2012-P&PW(F)/B dated 26.08.2016 in respect of employees borne on National Pension System (NPS) and CCS (Leave) Rules 1972, shall continue to be applicable while calculating gratuity and cash payment in lieu of leave respectively.

7. In their application to the persons belonging to India Audit and Accounts Department, these orders are issued under Article 148(5) of the Constitution and after consultation with the Comptroller and Auditor General of India.

8. Hindi version will follow.

(Annie G. Mathew)

Addl. Secretary to the Govt. of India

Leave a Reply