7th Pay Commission Report on Death Gratuity

The Commission has received representations pointing to a need for rationalization of current slabs for death gratuity, especially for the slab of 5 to 20 years of qualifying service in which family pensioners are stated to be placed at a disadvantageous position.

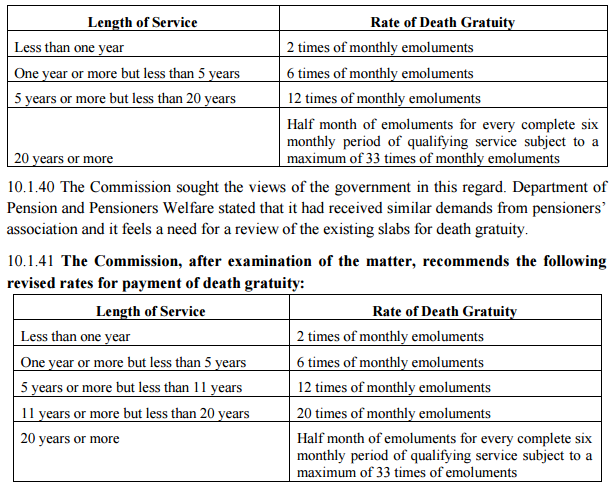

Analysis and Recommendations : As per Rule 50 of Pension Rules, the death gratuity admissible will be as follows, subject to the maximum limit prescribed for the gratuity:

Authority: 7th CPC Report

Leave a Reply