Booking of Air/Train tickets on Tour/LTC for D.A.D officials through D.T.S. (Defence Travel System) Platform: CDA, Patna Circular dated 16.11.2023 Controller of Defence Accounts, PatnaRajendra Path, Patna- 19 No. AN/Pay-T/ TA/DA/LTC /35 1 Dated: 16.11.2023 Important Circular To, The OICAll sections Main OfficeAll Sub Office under CDA Patna Sub: Booking of … [Read more...] about LTC – Booking of Air/Train tickets on Tour/LTC for D.A.D officials through DTS (Defence Travel System) Platform

CENTRAL GOVERNMENT HOLIDAY LIST 2024

| 46% DA Order for Central Government Employees wef 1st July 2023 PDF |

| CGHS Updated Rate Card PDF Download |

| Latest List of KV Schools in India |

| Expected DA 2023 |

| 7th Pay Commission Latest News 2024 |

| MACP for the Central Government Employees |

Defence

Night Duty Allowance to FED re-designated to Station Officer

Night Duty Allowance to Firefighting Staff - Clarification regarding admissibility to FED re-designated to Station Officer: PCDA, Chandigarh Office of the Controller of Defence Accounts GuwahatiUdayan Vihar, Guwahati - 781171 CIRCULAR No : PAY/ORDER /CIRCULAR /VOL-II Date : 12.07.2023 To l. Area Accounts OfficeBivar Regad,Shillong -793001 2. All … [Read more...] about Night Duty Allowance to FED re-designated to Station Officer

Updation of service book (Bio data NPS option form & Part I of service book)

OFFICE OF THE CONTROLLER OF DEFENCE ACCOUNTSUDAYAN VIHAR, NARANGI, GUWAHATI - 781171Phone No. 0361- 2640394,2641142 Fax No. 0361- 2640204 No. AN/II/452/ circular/Vol-VII Date: 28.04.2023 Circular -02Personal Attention please. To The Officer-in-ChargeAll the sub-officesAll sections (Main office) Subject: Updation of service book (Bio data. NPS option form & … [Read more...] about Updation of service book (Bio data NPS option form & Part I of service book)

PENSION FOR PARAMILITARY FORCES

Pension for Paramilitary Forces - Grant of Old Pension Scheme to the personnel of para-military forces is policy matter under MHA GOVERNMENT OF INDIAMINISTRY OF FINANCEDEPARTMENT OF FINANCIAL SERVICES LOK SABHAUNSTARRED QUESTION NO. 470TO BE ANSWERED ON 6th FEBRUARY, 2023 (MONDAY)/ 17 MAGHA, 1944 (SAKA) PENSION FOR PARAMILITARY FORCES 470. Shri Asaduddin … [Read more...] about PENSION FOR PARAMILITARY FORCES

OROP Pension Table 2023 – Total 121 tables indicating rates of pension/family pension under OROP scheme

OROP 2023 One Rank One Pension to the Defence Pensioners: OROP-2 Pension Table issued on 20.01.2023 No. 1(1)/2019/D (Pen/Pol)/Vol-IIGovernment of IndiaMinistry of DefenceDepartment of Ex-Servicemen Welfare New Delhi, Dated: 20th January 2023 ToThe Chief of the Defence StaffThe Chief of the Army StaffThe Chief of the Naval StaffThe Chief of the Air … [Read more...] about OROP Pension Table 2023 – Total 121 tables indicating rates of pension/family pension under OROP scheme

Reimbursement of Medical Claim – Non Adhering to CGHS rules

GOVERNMENT OF INDIAMINISTRY OF DEFENCECONTROLLER OF DEFENCE ACCOUNTS, GUWAHATIUDAYAN VIHAR, NARANGI GUWAHATI- 781171 IMPORTANT CIRCULAR No. AN/III/MED/ Orders/Misc/Vol -I Date: 04/01/2023. To, All Sections of Main Office.All Sub-offices (As per standard list). Subject: Reimbursement of Medical Claim : Non Adhering to CGHS rules regarding endorsement of MO/CMO … [Read more...] about Reimbursement of Medical Claim – Non Adhering to CGHS rules

MISUSE OF ID PROOFS OF ARMY PERSONNEL – DEFENCE

ID proofs of army men GOVERNMENT OF INDIAMINISTRY OF DEFENCEDEPARTMENT OF MILITARY AFFAIRS RAJYA SABHAUNSTARRED QUESTION NO. 535TO BE ANSWERED ON 12th December, 2022 MISUSE OF ID PROOFS OF ARMY PERSONNEL 535 SHRI SUSHIL KUMAR GUPTA:Will the Minister of Defence be pleased to state: (a) whether Government is aware that unscrupulous elements were found with copies … [Read more...] about MISUSE OF ID PROOFS OF ARMY PERSONNEL – DEFENCE

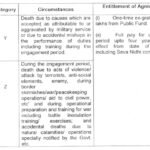

Payment of Ex-gratia in case of death of Agniveers enrolled under the Agnipath Scheme 2022

Death of an Agniveer 1(21)/2022/D (Pay/Services)Government of IndiaMinistry of DefenceDepartment of Military AffairsD(Pay/Services) New Delhi, dated 05 December, 2022 To The Chief of the Army StaffThe Chief of the Naval StaffThe Chief of the Air Staff Subject: Payment of Ex-gratia in case of death of Agniveers enrolled under the Agnipath Scheme, 2022. I am … [Read more...] about Payment of Ex-gratia in case of death of Agniveers enrolled under the Agnipath Scheme 2022

DAD – Submission of Income Tax Savings Documents for the Financial Year 2022-2023

Income Tax Savings Documents GOVERNMENT OF INDIAMINISTRY OF DEFENCECONTROLLER OF DEFENCE ACCOUNTS, GUWAHATIUdayan Vihar, Narangi, Guwahati - 781171 CIRCULAR NO. 105THROUGH OFFICIAL WEBSITE Subject: Submission of Income Tax Savings Documents for the Financial Year 2022-2023: DAD For the purpose of assessment and regularization of Income Tax for the Financial Year … [Read more...] about DAD – Submission of Income Tax Savings Documents for the Financial Year 2022-2023

Government appoints Lt General Anil Chauhan (Retired) as Chief of Defence Staff (CDS)

Lt General Anil Chauhan CDS Ministry of Defence Government appoints Lt General Anil Chauhan (Retired) as Chief of Defence Staff (CDS) Posted On: 28 SEP 2022 The Government has decided to appoint Lt General Anil Chauhan (Retired) PVSM, UYSM, AVSM, SM, VSM as the next Chief of Defence Staff (CDS) who shall also function as Secretary to Government of India, … [Read more...] about Government appoints Lt General Anil Chauhan (Retired) as Chief of Defence Staff (CDS)

Latest DoPT Orders 2023

CENTRAL GOVT HOLIDAY LIST 2023

Indian Railway Holiday List 2023 PDF | Postal Holidays List 2023 India Post | Bank Holidays List 2023 India | LIC Office Holiday List 2023 PDF Download | EPFO Holiday List 2023 PDF Download | ESIC Holiday List 2023 PDF Download | CGHS Holiday Calendar List 2023 | Post Office Holidays 2023 | Railway Holidays CG Office Holidays 2023 | TN Govt Holidays 2023 | KVS Holiday List 2023-2024 PDF