DA July Calculation 2023 Expected DA From July 2023 From July 2023, it is projected that the Dearness Allowance would increase. Dearness Allowance (DA) is an essential benefit given to employees to offset the impacts of wage inflation and preserve their buying power. Government employees, as well as individuals in the public and specific private sectors, frequently … [Read more...] about DA July 2023 for Central Government Employees – Expected DA from July 2023 is 46%

CENTRAL GOVERNMENT HOLIDAY LIST 2024

| 46% DA Order for Central Government Employees wef 1st July 2023 PDF |

| CGHS Updated Rate Card PDF Download |

| Latest List of KV Schools in India |

| Expected DA 2023 |

| 7th Pay Commission Latest News 2024 |

| MACP for the Central Government Employees |

Central Government Employees News

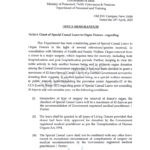

Grant of Special Casual Leave to Organ Donors – DoPT

Organ donation special casual leave No. A-24011/23/2022 -Estt. (Leave)Government of IndiaMinistry of Personnel, Public Grievances & PensionsDepartment of Personnel and Training Old JNU Campus, New DelhiDated the 25 April, 2023 OFFICE MEMORANDUM Subject: Grant of Special Casual Leave to Organ Donors - regarding. This Department has been considering grant of … [Read more...] about Grant of Special Casual Leave to Organ Donors – DoPT

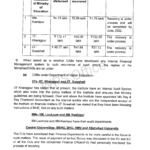

Irregular Payment of ad-hoc Bonus – important Observations/ Recommendations of the Committee

Irregular Payment of ad-hoc Bonus in Central Autonomous Bodies: Observations/ Recommendations of the Public Accounts Committee a Parliamentary Committee PRESS RELEASE (05.04.2023) Chairperson, Public Accounts Committee, Shri Adhir Ranjan Chowdhury, MP presented today i.e. 05th April, 2023, the 62nd Report of the Committee (17th Lok Sabha) on “Irregular … [Read more...] about Irregular Payment of ad-hoc Bonus – important Observations/ Recommendations of the Committee

Central Government employees revised DA Order effective from 1st Jan 2023 PDF

DA Jan 2023 Revision of rates of Dearness Allowance to Central Government employees effective from 01.01.2023 from the existing rate of 38% to 42%: DoE, FinMin Order No. 1/1/2023-E-II (B)Government of IndiaMinistry of FinanceDepartment of Expenditure North Block, New DelhiDated the 3rd April, 2023. OFFICE MEMORANDUM Subject: Revision of rates of Dearness … [Read more...] about Central Government employees revised DA Order effective from 1st Jan 2023 PDF

Handling of Disciplinary Proceedings in respect of Central Civilian Employees

No. DOPT- 168006 8417507Government of IndiaMinistry of Personnel, Public Grievances & PensionsDepartment of Personnel and TrainingESTT.(Estt. A-III) (Dated 29 March, 2023 ) OFFICE MEMORANDUM Handling of Disciplinary Proceedings in respect of Central Civilian Employees Department of Personnel and Training has issued various instructions from time to time on … [Read more...] about Handling of Disciplinary Proceedings in respect of Central Civilian Employees

Central Government’s Daily Accounting Data from 1st March to 31st March 2023

Central Government P-A0001/1/2022-DAMA -CGA/489Government of IndiaMinistry of Finance, Department of ExpenditureController General of Accounts(DAMA Section) Mahalekha Niyantarak Bhawan, GPO Complex,INA, New DelhiDated : 01.03.2022 OFFICE MEMORANDUM Sub: Providing flash figures on daily basis from 1st March to 31st March, 2023 - regarding. The undersigned is … [Read more...] about Central Government’s Daily Accounting Data from 1st March to 31st March 2023

Additional installment of 4% Dearness Allowance for Central Government employees – Fake Message – PIB Fact Check

DA payable to Central Government employees - PIB Fact Check Tweet Grant of Dearness Allowance to Central Government employees - Revised Rates effective from 1.7.2022 An order circulating on #WhatsApp claims that the additional installment of DA will be effective from 01.07.2022 PIBFactCheck This order is #FakeDepartment of Expenditure,@FinMinIndiahas not issued any … [Read more...] about Additional installment of 4% Dearness Allowance for Central Government employees – Fake Message – PIB Fact Check

Vacancies in Central Government Jobs including Group A, B and C, as on 01.03.2021

10 Lakh Vacancies in Central Government, plan to fill vacancies in mission mode GOVERNMENT OF INDIAMINISTRY OF PERSONNEL, PUBLIC GRIEVANCES AND PENSIONS(DEPARTMENT OF PERSONNEL & TRAINING) RAJYA SABHAUNSTARRED QUESTION NO. 602(TO BE ANSWERED ON 21.07.2022) DETAILS OF VACANCIES IN CENTRAL GOVERNMENT 602 SHRI RAGHAV CHADHA:Will the PRIME MINISTER be pleased to … [Read more...] about Vacancies in Central Government Jobs including Group A, B and C, as on 01.03.2021

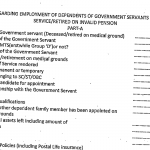

Master Circular on Scheme of compassionate appointment under Central Government – DoPT

Scheme for Compassionate Appointment Latest DoPT Orders 2022 F.No. 14014/1/2022-Estt. (D)Government of IndiaMinistry of Personnel, Public Grievances and Pensions(Department of Personnel & Training) North Block, New DelhiDated the 02nd August, 2022 OFFICE MEMORANDUM Subject:- Master Circular on Scheme of compassionate appointment – regarding. The … [Read more...] about Master Circular on Scheme of compassionate appointment under Central Government – DoPT

Exclusion of Central Government Employees from NPS and to cover them under OPS

Central government employees under OPS GOVERNMENT OF INDIAMINISTRY OF LAW AND JUSTICEDEPARTMENT OF LEGAL AFFAIRS RAJYA SABHAUNSTARRED QUESTION NO.1392TO BE ANSWERED ON THURSDAY, THE 28th JULY, 2022 Exclusion of Central Government Employees from NPS 1392. Shri Javed Ali Khan: Will the Minister of Law and Justice be pleased to state: (a) whether Department of … [Read more...] about Exclusion of Central Government Employees from NPS and to cover them under OPS

Latest DoPT Orders 2024

CENTRAL GOVT HOLIDAY LIST 2024

Indian Railway Holiday List 2023 PDF | Postal Holidays List 2023 India Post | Bank Holidays List 2023 India | LIC Office Holiday List 2023 PDF Download | EPFO Holiday List 2023 PDF Download | ESIC Holiday List 2023 PDF Download | CGHS Holiday Calendar List 2023 | Post Office Holidays 2023 | Railway Holidays CG Office Holidays 2023 | TN Govt Holidays 2023 | KVS Holiday List 2023-2024 PDF