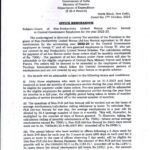

Non-PLB 2023 Non-Productivity Linked Bonus (ad-hoc bonus) to Central Government Employees for the year 2022-23: Ministry of Finance, Department of Expenditure Order dated 17.10.2023 No.7 /24/2007/E III (A)Government of IndiaMinistry of FinanceDepartment of Expenditure(E III-A Branch) North Block, New Delhi,Dated the 17th October, 2023 OFFICE … [Read more...] about Central Government Employees Bonus Order 2023 PDF – Grant of Non-Productivity Linked Bonus (ad-hoc bonus)

| 46% DA Order for Central Government Employees wef 1st July 2023 PDF |

4% DA for Central Government Employees wef 1st July 2023

Railway Employees Bonus 2023

Bonus for central government employees 2023 pdf

CENTRAL GOVERNMENT HOLIDAY LIST 2024

| 42% DA Order for Central Government Employees wef 1st January 2023 PDF |

| 42% DR Order for Central Government Pensioners wef 1st January 2023 PDF |

Adhoc Bonus

Confederation Of Central Government Employees Declaration of DA, PLB and Ad-Hoc Bonus

DA and Bonus Declaration of DA, PLB and Ad-Hoc Bonus: Confederation writes to FM Ref: Confd. Bonus- DA-DR/2023 Dated - 06.10.2023 ToSmt. Nirmala SitharamanHon’ble Finance MinisterGovernment of IndiaMinistry of FinanceNorth Block, New Delhi - 110001 Sub: DECLARATION OF DA/DR, PLB AND ADHOC BONUS - REG. Respected Madam, I would like to bring to your kind … [Read more...] about Confederation Of Central Government Employees Declaration of DA, PLB and Ad-Hoc Bonus

BONUS TO NON-GAZETTED OFFICERS OF AUTONOMOUS INSTITUTIONS/ ORGANIZATIONS

GOVERNMENT OF INDIAMINISTRY OF EDUCATIONDEPARTMENT OF HIGHER EDUCATION LOK SABHASTARRED QUESTION No- 55ANSWERED ON- 06.02.2023 BONUS TO NON-GAZETTED OFFICERS OF AUTONOMOUS INSTITUTIONS/ ORGANIZATIONS *55. SHRI TIRATH SINGH RAWAT: Will the Minister of EDUCATION be pleased to state: (a) whether the Government is not giving bonus to non-gazetted officers of some … [Read more...] about BONUS TO NON-GAZETTED OFFICERS OF AUTONOMOUS INSTITUTIONS/ ORGANIZATIONS

State Public Sector Undertakings : Sanction of Bonus and Ex-gratia to the employees of State Public Sector Undertakings for the year 2015-16 payable during 2016-17 : orders issued

State Public Sector Undertakings : Sanction of Bonus and Ex-gratia to the employees of State Public Sector Undertakings for the year 2015-16 payable during 2016-17 : orders issued TAMILNADU Government Employees Bonus 2016 - GOVERNMENT ORDER - Sanction of Bonus & Ex-gratia to the employees ABSTRACT State Public Sector Undertakings - Sanction of Bonus & Ex-gratia to … [Read more...] about State Public Sector Undertakings : Sanction of Bonus and Ex-gratia to the employees of State Public Sector Undertakings for the year 2015-16 payable during 2016-17 : orders issued

Finmin Orders – Grant of Non-Productivity Linked Bonus (ad-hoc bonus) to Central Government Employees for the year 2012-13

Grant of Non-Productivity Linked Bonus (ad-hoc bonus) to Central Government Employees for the year 2012-13. No.7/24/2007/E III (A) Government of India Ministry of Finance Department of Expenditure E III (A) Branch New Delhi, the 27th September, 2013 OFFICE MEMORANDUM Subject : Grant of Non-Productivity Linked Bonus (ad-hoc bonus) to Central Government Employees … [Read more...] about Finmin Orders – Grant of Non-Productivity Linked Bonus (ad-hoc bonus) to Central Government Employees for the year 2012-13

Grant of Non-Productivity Linked Bonus (Ad-hoc Bonus) to Central Government Employees for the year 2011-12 — Extension of orders to Autonomous Bodies

No.7/22/2008-E-III (A) Government of India Ministry of Finance Department of Expenditure E III (A) Branch New Delhi, the 10th October, 2012. OFFICE MEMORANDUM Subject: - Grant of Non-Productivity Linked Bonus (Ad-hoc Bonus) to Central Government Employees for the year 2011-12 — Extension of orders to Autonomous Bodies. Orders have been issued vide this … [Read more...] about Grant of Non-Productivity Linked Bonus (Ad-hoc Bonus) to Central Government Employees for the year 2011-12 — Extension of orders to Autonomous Bodies

Grant of Non-Productivity Linked Bonus (ad-hoc bonus) to Central Government Employees for the year 2011-12

No 7/24/2007/E III (A) Government of India Ministry of Finance Department of Expenditure E III (A) Branch New Delhi, the 5th October, 2012 OFFICE MEMORANDUM Subject: - Grant of Non-Productivity Linked Bonus (ad-hoc bonus) to Central Government Employees for the year 2011-12. The undersigned is directed to convey the sanction of the President to the grant of … [Read more...] about Grant of Non-Productivity Linked Bonus (ad-hoc bonus) to Central Government Employees for the year 2011-12

Latest DoPT Orders 2023

CENTRAL GOVT HOLIDAY LIST 2023

Indian Railway Holiday List 2023 PDF | Postal Holidays List 2023 India Post | Bank Holidays List 2023 India | LIC Office Holiday List 2023 PDF Download | EPFO Holiday List 2023 PDF Download | ESIC Holiday List 2023 PDF Download | CGHS Holiday Calendar List 2023 | Post Office Holidays 2023 | Railway Holidays CG Office Holidays 2023 | TN Govt Holidays 2023 | KVS Holiday List 2023-2024 PDF