Grant of increment to the retiring employees on the date of their retirement 30th June/31st Dec , if the date of their increment follows their date of retirement - Amendment to the rules governing grant of increment & extension of the amended rule to pensioners as a one-time measure: Minutes of the 33rd SCOVA meeting [DoP&PW OM No. 42/11/2023-P&PW(D) dated … [Read more...] about 33rd SCOVA meeting – Grant of increment to the retiring employees on the date of their retirement, if the date of their increment follows their date of retirement

CENTRAL GOVERNMENT HOLIDAY LIST 2024

| 46% DA Order for Central Government Employees wef 1st July 2023 PDF |

| CGHS Updated Rate Card PDF Download |

| Latest List of KV Schools in India |

| Expected DA 2023 |

| 7th Pay Commission Latest News 2024 |

| MACP for the Central Government Employees |

Pension

Female Government servants or female Pensioner to nominate her child/children for family pension in precedence to her husband in the event of marital discord leading to filing of divorce proceedings in a Court of Law or filing of a case under Protection of Women from Domestic Violence Act or Dowry Prohibition Act or Indian Penal Code

Amendment to CCS (Pension) Rules, 2021 – Allowing female Government servants/female Pensioner to nominate her child/children for family pension amid marital discord: DoPPW Order dated 01.01.2024 No.1/1(1)/2023 -P&PW (E)Government of IndiaMinistry of Personnel, Public Grievances and PensionDepartment of Pension and Pensioners’ Welfare Lok Nayak Bhawan, Khan Market,New … [Read more...] about Female Government servants or female Pensioner to nominate her child/children for family pension in precedence to her husband in the event of marital discord leading to filing of divorce proceedings in a Court of Law or filing of a case under Protection of Women from Domestic Violence Act or Dowry Prohibition Act or Indian Penal Code

Clarification on the effect of pension cut on the amount of family pension, in case of death of retired government servant during the currency period

Family Pension Cut GOVERNMENT OF INDIAMINISTRY OF FINANCEDEPARTMENT OF EXPENDITURECENTRAL PENSION ACCOUNTING OFFICETRIKOOT-II, BHIKAJI CAMA PLACE,NEW DELHI- 110066 CPAO/ IT&Tech/ Misc.Corrs./35(Vol-I)(PF)/2022-23/146 Dated: 01.01.2024 OFFICE MEMORANDUM Subject:- Clarification on the effect of pension cut on the amount of family pension, in case of death of … [Read more...] about Clarification on the effect of pension cut on the amount of family pension, in case of death of retired government servant during the currency period

Department of Pension Pensioners Welfare – Year End Review 2023

DoPPW Year End Review 2023 Year End Review of the Department of Pension & Pensioners’ Welfare Ministry of Personnel, Public Grievances and Pensions Chintan Shivir, addressed by Prime Minister Shri Narendra Modi in February 2023, deliberated on “Improving Pensioners Welfare” and drew up the roadmap of activities of the Department of Pension and Pensioners … [Read more...] about Department of Pension Pensioners Welfare – Year End Review 2023

Nomination by Pensioners under the Payment of Pension (Nomination) Rules 1983 for Payment of Life Time Arrears Reg. Non Compliance of Instructions of DOP&PW by PDA Banks

Payment of Life Time Arrears through Payment of Pension (Nomination) Rules 1983 - Non Compliance of Instructions of DOP&PW by PDA Banks: RSCWS writes to DoP&PW RAILWAY SENIOR CITIZENS WELFARE SOCIETY(Estd. 1991, Regd. No. 1881 - Under Registration of Societies Act),IDENTIFIED BY DOP&PW GOVT. OF INDIA - UNDER PENSIONERS’ PORTAL No. RSCWS/HO/CHD/ Memo DOP&PW … [Read more...] about Nomination by Pensioners under the Payment of Pension (Nomination) Rules 1983 for Payment of Life Time Arrears Reg. Non Compliance of Instructions of DOP&PW by PDA Banks

174 officials as retired but their PPO has not been issued and 97 officials as family pension cases

Retired but PPO not issued - Disposal of the pending cases shown on HOO Dashboard of concerned office on Bhavishya Portal: CPWD OM एफ नंबर 12/5/2022 ईसी 7/336(हि.)भारत सरकारआवसन एवं शहरी कार्य मंत्रालय,केन्द्रीय लोक निर्माण विभाग निर्माण भवन, नई दिल्ली -110011दिनांक: 14-09-2022 OFFICE MEMORANDUM Subject: Disposal of the pending cases pertaining to “Retired but PPO … [Read more...] about 174 officials as retired but their PPO has not been issued and 97 officials as family pension cases

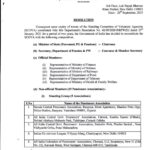

DoPPW – GoI has decided to reconstitute the SCOVA with the following composition

Reconstitution of SCOVA Reconstitution of Standing Committee of Voluntary Agencies (SCOVA) - Composition of Committee : DoPPW Resolution dated 26.09.2023 F. No 42/08/2023- P&PW(D)Government of IndiaMinistry of Personnel, P.G and PensionsDepartment of Pension & Pensioners’ Welfare 3rd Floor, Lok Nayak BhawanKhan Market, New Delhi - 110003Date: 26th September, … [Read more...] about DoPPW – GoI has decided to reconstitute the SCOVA with the following composition

NVS – CCS Pension Scheme 1972 to the retired employees of Navodaya Vidyalaya Samiti

NVS Pension Scheme Grant of pension to the employees who joined prior to 01.01.2004 - Disposal of Representations of retired employees of Navodaya Vidyalaya Samiti vide OM dated 22.09.2023 Navodaya Vidyalaya SamitiMinistry of Education(Dept. of School Education & Literacy)Government of IndiaF.No.B-15, Institutional Area, Sector-62Noida - 201307 (Uttar Pradesh) F. … [Read more...] about NVS – CCS Pension Scheme 1972 to the retired employees of Navodaya Vidyalaya Samiti

Revision of Pension due to detection of wrong fixation of pay and Recovery of Government dues and provisions of Waiving off – DoPPW

Revision of Pension due to detection of wrong fixation of pay and Recovery of Government dues and provisions of Waiving off: Interpretation/ clarifications/ advice given by Department of Pension & PW to MSDE Compilation of rule based interpretation/ clarifications/ advice given by Department of Pension & PW to Ministries/ Departments during 01.01.2023 to … [Read more...] about Revision of Pension due to detection of wrong fixation of pay and Recovery of Government dues and provisions of Waiving off – DoPPW

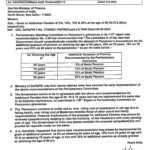

Grant of Additional Pension of 5%, 10%, 15% & 20% at the age of 65,70,75 & 80 yrs

Demand of Pensioners Associations Grant of Additional Pension of 5%, 10%, 15% & 20% at the age of 65,70,75 & 80 yrs respectively: RCSWS writes to MoF for early implementation of recommendations. RAILWAY SENIOR CITIZENS WELFARE SOCIETY(Estd. 1991, Regd. No. 1881 - Under Registration of Societies Act)Head Office: 32, Phase- 6, Mohali-160055 (Mob: 9316131598, … [Read more...] about Grant of Additional Pension of 5%, 10%, 15% & 20% at the age of 65,70,75 & 80 yrs

Latest DoPT Orders 2023

CENTRAL GOVT HOLIDAY LIST 2023

Indian Railway Holiday List 2023 PDF | Postal Holidays List 2023 India Post | Bank Holidays List 2023 India | LIC Office Holiday List 2023 PDF Download | EPFO Holiday List 2023 PDF Download | ESIC Holiday List 2023 PDF Download | CGHS Holiday Calendar List 2023 | Post Office Holidays 2023 | Railway Holidays CG Office Holidays 2023 | TN Govt Holidays 2023 | KVS Holiday List 2023-2024 PDF