General Financial Rules 2017 No. 01(14)/2016-E.JI(A) (Vol III)Government of IndiaMinistry of FinanceDepartment of Expenditure North Block, New DelhiDated 01st April, 2024 OFFICE MEMORANDUM Subject: Revised guidelines on financial Limits to be observed in determining cases relating to New Service (NS) / New Instrument of Service (NIS) - Amendment to Annexure-I of … [Read more...] about Revised guidelines on financial Limits to be observed in determining cases relating to New Service (NS) / New Instrument of Service (NIS) – Amendment to Annexure-I of Appendix-3 of General Financial Rules 2017

CENTRAL GOVERNMENT HOLIDAY LIST 2024

| 46% DA Order for Central Government Employees wef 1st July 2023 PDF |

| CGHS Updated Rate Card PDF Download |

| Latest List of KV Schools in India |

| Expected DA 2023 |

| 7th Pay Commission Latest News 2024 |

| MACP for the Central Government Employees |

Latest News on CENTRAL GOVERNMENT EMPLOYEES

Request for Timely declaration of DA/DR hike and Bonus for Employees and Pensioners – Ministerial Staff Association

2023 Bonus orders for Employees and Pensioners Request for timely declaration of DA/DR hike and 2023 Bonus orders for Employees and Pensioners by Ministerial Staff Association, Survey of India MINISTERIAL STAFF ASSOCIATIONSurvey of India, CHQ No. CHQ-28/MSA(2022-23) Dated: 09 Oct, 2023 सेवा में भारत के महासर्वेक्षक,महासर्वेक्षक का कार्यालय,भारतीय सर्वेक्षण … [Read more...] about Request for Timely declaration of DA/DR hike and Bonus for Employees and Pensioners – Ministerial Staff Association

Monthly reconciliation of expenditure by DDOs

Monthly reconciliation of expenditure by DDOs: CGA, FinMin O.M. dated 11.09.2023 No TA-2-03001 (03) 1/2023- PA-CGA (e-12976)/Government of IndiaMinistry of FinanceDepartment of ExpenditureOffice of Controller General of Accounts °Mahalekha Niyantrak Bhawan E-Block, INA, New Delhi,Dated, the 11th Sept., 2023. OFFICE MEMORANDUM Subject: Monthly reconciliation of … [Read more...] about Monthly reconciliation of expenditure by DDOs

Relaxation in air travel (both ways) for the officers working in Station Development Directorate of Railway Board

Relaxation in air travel (both ways) for the officers working in Station Development Directorate of Railway Board: Office Order No.22 of 2023 F(E)I72023 /AL-28/24 (AIRTRAVEL)1/3065609 /2023GOVERNMENT OF INDIA (भारत सरकार)MINISTRY OF RAILWAYS (रेल मंत्रालय)(RAILWAY BOARD) (रेलवे बोर्ड) Office Order No.22 of 2023 Sub: Relaxation in air travel (both ways) for the … [Read more...] about Relaxation in air travel (both ways) for the officers working in Station Development Directorate of Railway Board

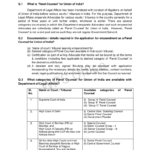

FAQ EMPANELMENT OF ADVOCATES FOR UNION OF INDIA

FREQUENTLY ASKED QUESTIONS ON EMPANELMENT OF ADVOCATES FOR UNION OF INDIA FAQ Q.1 What is ‘Panel Counsel’ for Union of India? Department of Legal Affairs has been mandated with conduct of litigations on behalf of Union of India before various courts / tribunals in India. For this purpose, Department of Legal Affairs empanels Advocates for various courts / tribunals … [Read more...] about FAQ EMPANELMENT OF ADVOCATES FOR UNION OF INDIA

Admissibility of 7th CPC daily allowance in case of free boarding and lodging

7th CPC daily allowance 1/99712/2023 F. No. FCI HQ-WRCO13(14)1/2022-WRCFood Corporation of IndiaHeadquartersNew Delhi(Circular No- WR-13-2023-02) Dated: Approved Date Sub: Admissibility of daily allowance in case of free boarding and lodging. A reference is invited to the Department of Expenditure, E.IV, Office Memorandum No. 19030/1/2017-E-IV dated 01.02.2018 … [Read more...] about Admissibility of 7th CPC daily allowance in case of free boarding and lodging

Expected DA from Jan 2023 – AICPIN for August 2022 for Central Government Employees

AICPIN for August 2022 Labour Bureau Press Release The All-India CPI-IW for August, 2022 increased by 0.3 points and stood at 130.2 (one hundred thirty point two) GOVERNMENT OF INDIAMINISTRY OF LABOUR & EMPLOYMENTLABOUR BUREAU ‘ CLEREMONT” SHIMLA- 171004DATED: 30 Sep 2022 F.No. 5/1/202l-CPI Press Release Consumer Price Index for Industrial Workers … [Read more...] about Expected DA from Jan 2023 – AICPIN for August 2022 for Central Government Employees

Scheme for compassionate appointment – Other Policy Decisions – DoT

DoT compassionate appointments No. A-12012/01/2021-Admn. IIIGovernment of IndiaMinistry of CommunicationsDepartment of Telecommunications Sanchar Bhawan, 20, Ashoka RoadNew Delhi -110001Dated: 01.07.2022 OFFICE MEMORANDUM Subject: Scheme for compassionate appointment - Other Policy Decisions. The undersigned is directed to refer to the subject cited above and … [Read more...] about Scheme for compassionate appointment – Other Policy Decisions – DoT

Reservation in promotion to Persons with Benchmark Disabilities (PwBDs) – DoPT

Reservation in promotion to PwBDS No. 36012/1/2020 -Estt.(Res.-II)Government of IndiaMinistry of Personnel, Public Grievances and PensionsDepartment of Personnel and Training North Block, New Delhi.Dated, the 17th May, 2022. OFFICE MEMORANDUM Subject: - Reservation in promotion to Persons with Benchmark Disabilities (PwBDs). The undersigned is directed to say … [Read more...] about Reservation in promotion to Persons with Benchmark Disabilities (PwBDs) – DoPT

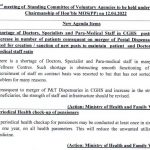

New Agenda Items on 32nd Meeting of SCOVA: Enhancement of Pension, DA/DR arrears freeze, Non-acceptance of Nominations of pensioners LTA

Pensioners New Agenda Items F. No. 42/05/2022- P&PW(D)भारत सरकार/ Government of IndiaMinistry of Personnel, Public Grievances & PensionsDepartment of Pension & Pensioners’ Welfare 3rd Floor, Lok Nayak Bhawan Khan Market,New Delhi: 110003Dated - 06th April, 2022 All Pensioners’ Association included in SCOVA vide thisDepartment’s Resolution dated … [Read more...] about New Agenda Items on 32nd Meeting of SCOVA: Enhancement of Pension, DA/DR arrears freeze, Non-acceptance of Nominations of pensioners LTA

Latest DoPT Orders 2024

CENTRAL GOVT HOLIDAY LIST 2024

Indian Railway Holiday List 2023 PDF | Postal Holidays List 2023 India Post | Bank Holidays List 2023 India | LIC Office Holiday List 2023 PDF Download | EPFO Holiday List 2023 PDF Download | ESIC Holiday List 2023 PDF Download | CGHS Holiday Calendar List 2023 | Post Office Holidays 2023 | Railway Holidays CG Office Holidays 2023 | TN Govt Holidays 2023 | KVS Holiday List 2023-2024 PDF