Strengthening of Administration- Periodic review of Central Government Employees under FR 56 (J) and Rule 48 of CCS (Pension) Rules, 1972: CGA, FinMin OM dated 14.09.2023 E-11282No. K-16003/1/2022- Group B-CGA/1165Government of IndiaMinistry of FinanceDepartment of ExpenditureController General of Accounts Mahalekha Niyantrak Bhawan,E-Block, GPO Complex,I.N.A, New Delhi- … [Read more...] about Strengthening of Administration Periodic review of Central Government Employees under FR 56 (J) and Rule 48 of CCS (Pension) Rules 1972

CENTRAL GOVERNMENT HOLIDAY LIST 2024

| 46% DA Order for Central Government Employees wef 1st July 2023 PDF |

| CGHS Updated Rate Card PDF Download |

| Latest List of KV Schools in India |

| Expected DA 2023 |

| 7th Pay Commission Latest News 2024 |

| MACP for the Central Government Employees |

CCS RULES - Central Government Employees News

Date of next increment under Rule 10 of Central Civil Services (Revised Pay) Rules 2016 – Reminder

Fixation of DNI BPMS - Pay Fixation भारतीय प्रतिरक्षा मजदूर संघBharatiya Pratiraksha Mazdoor Sangh REF: BPMS/ MoF/ Pay Fixation/ 60(7/3/L) Dated: 01.03.2023 REMINDER 3 To, The SecretaryDepartment of ExpenditureGovt of India, Ministry of FinanceNorth Block, New Delhi- 110 001 Subject: Date of next increment under Rule 10 of Central Civil Services (Revised … [Read more...] about Date of next increment under Rule 10 of Central Civil Services (Revised Pay) Rules 2016 – Reminder

Central Civil Services Amendment Rules 2023

Civil Posts in Defence Services Central Civil Services (Classification, Control and Appeal) Amendment Rules, 2023 regarding Appointing Authorities of Ordnance Factory Board - Notification by DoPT MINISTRY OF PERSONNEL, PUBLIC GRIEVANCES AND PENSIONS(Department of Personnel and Training) NOTIFICATION New Delhi, the 10th January, 2023 G.S.R. 18(E).- In exercise … [Read more...] about Central Civil Services Amendment Rules 2023

Strengthening of Administration by periodical review under FR 56(j) Statutory Body DoPT

CCS Pension Rules 2021 Periodic Review of Central Government Employees for strengthening of administration under FR 96(j)/(l) and Rule 42 of CCS Pension Rules 2021 - DoPT F.No. 26012/8/2022 -Estt.A-IVGovernment of IndiaMinistry of Personnel, Public Grievances and PensionsDepartment of Personnel and Training(Estt.A-lV Desk) North Block, New DelhiDated: 20th December, … [Read more...] about Strengthening of Administration by periodical review under FR 56(j) Statutory Body DoPT

Inclusion of central government employees selected against the vacancies issued under CCS Pension Rules 1972

Coverage of old pension scheme An administrative decision to issue executive instructions providing for coverage of old pension scheme who were covered under subjected parameter सरकारी कर्मचारी राष्ट्रीय परिसंघGovt. Employees National Confederation(AFFILIATED TO B.M.S.)CENTRAL OFFICE : RAM NARESH BHAVAN, TILAK GALI,PAHAR GANJ, NEW DELHI - 110055 No. GENC/MoS PP/ … [Read more...] about Inclusion of central government employees selected against the vacancies issued under CCS Pension Rules 1972

Grant of family pension under Central Civil Services Pension Rules 2021 on remarriage of a childless widow

Rule 50 of the Central Civil Service (Pension) Rules, 2021 deals with payment of family pension on death of a Government servant/pensioner. F. No. 1/1(1))/2022 -P& PW (E)Government of IndiaMinistry of Personnel, PG & PensionsDepartment of Pension & Pensioners’ Welfare 3rd Floor, Lok Nayak BhawanKhan Market, New Delhin-110 003Dated: 26.10.2022 Office … [Read more...] about Grant of family pension under Central Civil Services Pension Rules 2021 on remarriage of a childless widow

Amount and conditions for grant of pension under CCS Pension Rules 2021

Central Civil Services Pension Rules 2021 - Rate of 50% of Emoluments or average emoluments, whichever is more beneficial to him, subject to a minimum of Rs.9000 per month and maximum of Rs.1,25000 per month. F. No. 38/01(05)/2022 -P&PW(A)Government of IndiaMinistry of Personnel, PG & PensionsDepartment of Pension & Pensioners' Welfare 3th Floor, Lok … [Read more...] about Amount and conditions for grant of pension under CCS Pension Rules 2021

CENTRAL CIVIL SERVICES CCS (LEAVE) RULES 1972 – UPDATED AS ON 19.09.2022 – DoPT

CCS LEAVE RULES 1972 Latest DoPT Orders 2022 TABLE OF CONTENT SHORT TITLE AND COMMENCEMENT.EXTENT OF APPLICATION.DEFINITIONS.GOVERNMENT SERVANTS ON TEMPORARY TRANSFER OR ON FOREIGN SERVICE.TRANSFER FROM SERVICES OR POSTS GOVERNED BY OTHER LEAVE RULES.TRANSFER TO INDUSTRIAL ESTABLISHMENT.RIGHT TO LEAVE.REGULATION OF CLAIM TO LEAVE.EFFECT OF DISMISSAL, REMOVAL OR … [Read more...] about CENTRAL CIVIL SERVICES CCS (LEAVE) RULES 1972 – UPDATED AS ON 19.09.2022 – DoPT

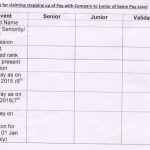

Claiming stepping up of Pay with Compare to Junior of Same Pay Level – PCDA

Fixation of pay on promotion from DNI in the lower rank Message on Website Subject: Stepping up of Pay of Seniors in comparison to Pay of Juniors Consequent to issue of Gol, MoF OM No 4-21/2017-IC/E.IIIA dated 28/11/2019, cases are coming to light wherein Junior Officer is drawing more pay than the Senior after earning Increment (after 6 months), in cases where … [Read more...] about Claiming stepping up of Pay with Compare to Junior of Same Pay Level – PCDA

NPS – Benefits to family of missing Central Government employees covered under National Pension System

Missing Central Government Employees Extension of benefits under the CCS (Pension) Rules or the CCS (EOP) Rules to the families of missing Central Government employees covered by the National Pension System (NPS) No. 57/03/2020-P&PW (B)Government of IndiaMinistry of Personnel, Public Grievances and PensionDepartment of Pension and Pensioners’ Welfare Lok Nayak … [Read more...] about NPS – Benefits to family of missing Central Government employees covered under National Pension System

Latest DoPT Orders 2024

CENTRAL GOVT HOLIDAY LIST 2024

Indian Railway Holiday List 2023 PDF | Postal Holidays List 2023 India Post | Bank Holidays List 2023 India | LIC Office Holiday List 2023 PDF Download | EPFO Holiday List 2023 PDF Download | ESIC Holiday List 2023 PDF Download | CGHS Holiday Calendar List 2023 | Post Office Holidays 2023 | Railway Holidays CG Office Holidays 2023 | TN Govt Holidays 2023 | KVS Holiday List 2023-2024 PDF