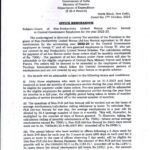

EMPLOYEES’ PROVIDENT FUND ORGANISATIONMINISTRY OF LABOUR & EMPLOYMENT,GOVERNMENT OF INDIAHead Office Bhavishya Nidhi Bhawan, 14, Bhikaji Cama Place, New Delhi-110066Website: www.epfindia.gov.in No: WSU/25(1)/2018-19/PLB/Part./1404 Date: 19.10.2023 To All Addl. Central P.F. Commissioners (Zones)All Regional PF Commissioner-In charge of Regions Sub: … [Read more...] about EPFO Bonus 2022-2023 pdf

CENTRAL GOVERNMENT HOLIDAY LIST 2024

| 46% DA Order for Central Government Employees wef 1st July 2023 PDF |

| CGHS Updated Rate Card PDF Download |

| Latest List of KV Schools in India |

| Expected DA 2023 |

| 7th Pay Commission Latest News 2024 |

| MACP for the Central Government Employees |

BONUS - CENTRAL GOVERNMENT EMPLOYEES NEWS

Payment of Productivity Linked Bonus to all eligible non-gazetted Railway employees 2023

Productivity Linked Bonus to all eligible non-gazetted Railway employees for the financial year 2022-23: Railway Board Order RBE No. 117/2023 Railway Bonus Order 2023 GOVERNMENT OF INDIA (भारत सरकार)MINISTRY OF RAILWAYS (रेल मंत्रालय)RAILWAY BOARD (रेलवे बोर्ड) RBE No. 117/ 2023 No. E(P&A)II/2023/PLB-1 New Delhi, dt. 18.10.2023 The General … [Read more...] about Payment of Productivity Linked Bonus to all eligible non-gazetted Railway employees 2023

Railway Bonus 2023 – Cabinet approves Productivity Linked Bonus (PLB) for railway employees

Railway Bonus 2023 Cabinet approves Productivity Linked Bonus (PLB) of Rs 1968.87 Crores for railway employees. Posted On: 18 OCT 2023 3:24PM by PIB Delhi The Union Cabinet chaired by Prime Minister Shri Narendra Modi has approved Productivity Linked Bonus (PLB) equivalent to 78 days’ wages for the financial year 2022-23 to all eligible non-gazetted Railway employees … [Read more...] about Railway Bonus 2023 – Cabinet approves Productivity Linked Bonus (PLB) for railway employees

Central Government Employees Bonus Order 2023 PDF – Grant of Non-Productivity Linked Bonus (ad-hoc bonus)

Non-PLB 2023 Non-Productivity Linked Bonus (ad-hoc bonus) to Central Government Employees for the year 2022-23: Ministry of Finance, Department of Expenditure Order dated 17.10.2023 No.7 /24/2007/E III (A)Government of IndiaMinistry of FinanceDepartment of Expenditure(E III-A Branch) North Block, New Delhi,Dated the 17th October, 2023 OFFICE … [Read more...] about Central Government Employees Bonus Order 2023 PDF – Grant of Non-Productivity Linked Bonus (ad-hoc bonus)

Request for Timely declaration of DA/DR hike and Bonus for Employees and Pensioners – Ministerial Staff Association

2023 Bonus orders for Employees and Pensioners Request for timely declaration of DA/DR hike and 2023 Bonus orders for Employees and Pensioners by Ministerial Staff Association, Survey of India MINISTERIAL STAFF ASSOCIATIONSurvey of India, CHQ No. CHQ-28/MSA(2022-23) Dated: 09 Oct, 2023 सेवा में भारत के महासर्वेक्षक,महासर्वेक्षक का कार्यालय,भारतीय सर्वेक्षण … [Read more...] about Request for Timely declaration of DA/DR hike and Bonus for Employees and Pensioners – Ministerial Staff Association

Confederation Of Central Government Employees Declaration of DA, PLB and Ad-Hoc Bonus

DA and Bonus Declaration of DA, PLB and Ad-Hoc Bonus: Confederation writes to FM Ref: Confd. Bonus- DA-DR/2023 Dated - 06.10.2023 ToSmt. Nirmala SitharamanHon’ble Finance MinisterGovernment of IndiaMinistry of FinanceNorth Block, New Delhi - 110001 Sub: DECLARATION OF DA/DR, PLB AND ADHOC BONUS - REG. Respected Madam, I would like to bring to your kind … [Read more...] about Confederation Of Central Government Employees Declaration of DA, PLB and Ad-Hoc Bonus

Festival Bonus 2023 – Early payment of BONUS before Pooja Festival – PLB for the 2022 – 2023

Early payment of “BONUS” before Pooja Festival - PLB for the 2022 - 2023: All Indian Postal Employees Union Group “C” ALL INDIA POSTAL EMPLOYEES UNION GROUP ‘C’CHQ: Dada Ghosh Bhawan, 2151/1, New Patel Road, New Delhi - 110008 Ref: P/4-2/Bonus Dated: 04.10.2023 ToThe SecretaryDepartment of PostsDak Bhawan, New Delhi - 110001 Sub: Early payment of "BONUS” … [Read more...] about Festival Bonus 2023 – Early payment of BONUS before Pooja Festival – PLB for the 2022 – 2023

Clarification on PLB for the Civilians of the Army Ordnance Corps (AOC) for the year 2020-2022

PLB for civilian employees of AOC Office of the Controller of Defence Accounts GuwahatiUdayan Vihar, Guwahati - 781171 CIRCULAR No. 57 CIRCULAR PAY/ ORDER/ CIRCULAR/ VOL.II Date: : 15.05.2023 (THROUGH WEBSITE ONLY) To1. Area Accounts OfficeShillong -79B001 2. All LAlOs/ ALAOs Subject: Clarification on Productivity Linked Bonus for the Civilians of the … [Read more...] about Clarification on PLB for the Civilians of the Army Ordnance Corps (AOC) for the year 2020-2022

Government of India Announces Bonus Payment for LIC Employees for 2018-2021 Period

LIC Employees Bonus The Ministry of Finance, Department of Financial Services in New Delhi has issued a notification on March 2, 2023, regarding the payment in lieu of bonus to the Class III and Class IV employees of the Life Insurance Corporation of India. The notification states that the payment in lieu of bonus for the periods of April 1, 2018, to March 31, 2019, April … [Read more...] about Government of India Announces Bonus Payment for LIC Employees for 2018-2021 Period

BONUS TO NON-GAZETTED OFFICERS OF AUTONOMOUS INSTITUTIONS/ ORGANIZATIONS

GOVERNMENT OF INDIAMINISTRY OF EDUCATIONDEPARTMENT OF HIGHER EDUCATION LOK SABHASTARRED QUESTION No- 55ANSWERED ON- 06.02.2023 BONUS TO NON-GAZETTED OFFICERS OF AUTONOMOUS INSTITUTIONS/ ORGANIZATIONS *55. SHRI TIRATH SINGH RAWAT: Will the Minister of EDUCATION be pleased to state: (a) whether the Government is not giving bonus to non-gazetted officers of some … [Read more...] about BONUS TO NON-GAZETTED OFFICERS OF AUTONOMOUS INSTITUTIONS/ ORGANIZATIONS

Latest DoPT Orders 2023

CENTRAL GOVT HOLIDAY LIST 2023

Indian Railway Holiday List 2023 PDF | Postal Holidays List 2023 India Post | Bank Holidays List 2023 India | LIC Office Holiday List 2023 PDF Download | EPFO Holiday List 2023 PDF Download | ESIC Holiday List 2023 PDF Download | CGHS Holiday Calendar List 2023 | Post Office Holidays 2023 | Railway Holidays CG Office Holidays 2023 | TN Govt Holidays 2023 | KVS Holiday List 2023-2024 PDF