8th central Pay Commission F. No. 2/1/2023-JCAGovernment of IndiaMinistry of Personnel, PG & PensionsDepartment of Personnel & TrainingEstablishment (JCA) Section Floor, ‘B’ Wing,Lok Nayak Bhawan, New DelhiDated: 20-03-2024 OFFICE MEMORANDUM Subject: Formation of 8th central Pay Commission - regarding. The undersigned is directed to forward a copy … [Read more...] about 8th CPC – Formation of 8th central Pay Commission – DoPT forwards IRTSA Memo to MoF

CENTRAL GOVERNMENT HOLIDAY LIST 2024

| 46% DA Order for Central Government Employees wef 1st July 2023 PDF |

| CGHS Updated Rate Card PDF Download |

| Latest List of KV Schools in India |

| Expected DA 2023 |

| 7th Pay Commission Latest News 2024 |

| MACP for the Central Government Employees |

7th Central Pay Commission News

7th Central Pay Commission Fixed Conveyance Allowance

7th CPC Conveyance Allowance Rate of Conveyance Allowance in 7th Pay Commission - Modification: DoE, FinMin OM dated 13.12.2023 No. 19039/3/2017-E.IVGovernment of IndiaMinistry of FinanceDepartment of Expenditure North Block, New DelhiDated 13th December, 2023 CORRIGENDUM Subject:- Rate of conveyance allowance - Modification reg. The undersigned is directed to … [Read more...] about 7th Central Pay Commission Fixed Conveyance Allowance

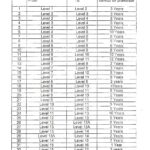

7th CPC Revised Pay Levels – Revision in minimum qualifying service required for promotion

Revised Pay Levels as per 7th CPC - Revision in minimum qualifying service required for promotion: MoD Corrigendum OM dt 31.08.2023 of MoD OM dt 22.08.2023 for Defence Civilian Employees paid from Defence Service Estimates Government of IndiaMinistry of Defence(Department of Defence)D(Civ-I) Corrigendum Subject: Circulation of OM issued by DoP&T on “Revised Pay … [Read more...] about 7th CPC Revised Pay Levels – Revision in minimum qualifying service required for promotion

Revision in minimum qualifying service required for promotion – 7th CPC Revised Pay Levels

Revised Pay Levels as per 7th CPC - Revision in minimum qualifying service required for promotion: MoD OM 22.08.2023 for Defence Civilian Employees paid from Defence Service Estimates Government of IndiaMinistry of Defence(Department of Defence)D(Civ-I) MoD ID No. 11(3)/2016- D(Civ-I) dated 22.08.2023 Subject: Circulation of OM issued by DoP&T on “Revised Pay … [Read more...] about Revision in minimum qualifying service required for promotion – 7th CPC Revised Pay Levels

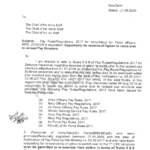

7th CPC HBA – Grant of House Building advance to Defence Service Personnel (Army, Navy and Air Force)

7th CPC House Building advance House Building advance to Defence Service Personnel (Army, Navy and Air Force) - MoD Order dated 19.06.2023 F No. 15(1)/2017/D(Pay/Services)Government of IndiaMinistry of DefenceDepartment of Military Affairs New Delhi, Dated 19.06.2023 ToThe Chief of the Army StaffThe Chief of the Air StaffThe Chief of the Naval Staff Subject: … [Read more...] about 7th CPC HBA – Grant of House Building advance to Defence Service Personnel (Army, Navy and Air Force)

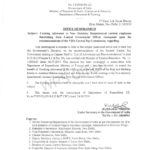

Pay Rules/ Regulations, 2017 for Army/ Navy/ Air Force officers, MNS, JCOS/ OR & equivalent- Opportunity for revision of Option to come over to 7th CPC revised Pay Structure

7th CPC revised Pay Structure No.1 (4)/2021/D (Pay/Services)Government of IndiaMinistry of DefenceNew Delhi Dated:- 23.05.2023 To, The Chief of the Army StaffThe Chief of the Naval StaffThe Chief of the Air Staff Subject:- Pay Rules/ Regulations, 2017 for Army/ Navy/ Air Force officers, MNS, JCOS/OR & equivalent- Opportunity for revision of Option to come … [Read more...] about Pay Rules/ Regulations, 2017 for Army/ Navy/ Air Force officers, MNS, JCOS/ OR & equivalent- Opportunity for revision of Option to come over to 7th CPC revised Pay Structure

7th CPC Cooking Allowance to Non- statutory Departmental canteen employees functioning from Central Government Offices

7th Pay Commission Cooking Allowance to NS Departmental Canteen Employees in Department of Posts: Order dated 11.05.2023 PP-05/1/2023 -PAP-DOP/72542/2023 F.No. PP-05/1/ 2023-PAPMinistry of CommunicationsDepartment of Posts[Establishment Division /P.A.P. Section] Dak Bhawan, Sansad Marg,New Delhi- 110001.Dated: 11.05.2023 To 1. All Chief Postmasters General / … [Read more...] about 7th CPC Cooking Allowance to Non- statutory Departmental canteen employees functioning from Central Government Offices

Central Government Grant is being provided to the States for implementing the recommendations of 7th UGC Pay Commission

7th UGC pay scales of teachers GOVERNMENT OF INDIAMINISTRY OF EDUCATIONDEPARTMENT OF HIGHER EDUCATIONRAJYA SABHAUNSTARRED QUESTION NO-1646ANSWERED ON- 15/03/2023 IMPLEMENTATION OF RECOMMENDATION OF 7TH UGC PAY COMMISSION 1646 SMT. JEBI MATHER HISHAM:Will the Minister of EDUCATION be pleased to state: (a) names of the States which are yet to implement the … [Read more...] about Central Government Grant is being provided to the States for implementing the recommendations of 7th UGC Pay Commission

7th CPC revision of the rates of Cycle Maintenance Allowance – Railway Board

7th CPC Cycle Allowance GOVERNMENT OF INDIA(भारत सरकार)MINISTRY OF RAILWAYS (रेल मंत्रालय)RAILWAY BOARD (रेलवे बोर्ड) PC-VII No. 205RBE No, 44/2023 No. F(E)I/2023/AL-7/1 New Delhi, dated 16.03.2023 The General Manager,All Indian Railways/PUs,(As per standard mailing list). Sub: Re-circulation of instructions reg. revision of the rates of Cycle (Maintenance) … [Read more...] about 7th CPC revision of the rates of Cycle Maintenance Allowance – Railway Board

Re-exercise the option for 7th CPC fixation of pay to Central Government employees

7th CPC Re-fixation of Pay of Employees - Parliament Question on opportunity of re-exercise of option of fixation of pay on Promotion/MACP 7th Pay Commission Latest News 2023 GOVERNMENT OF INDIAMINISTRY OF FINANCEDEPARTMENT OF EXPENDITURERAJYA SABHAUNSTARRED QUESTION No. 569TO BE ANSWERED ON TUESDAY, FEBRUARY 7, 2023/ 18 MAGHA, 1944 (SAKA) RE-FIXATION OF PAY OF … [Read more...] about Re-exercise the option for 7th CPC fixation of pay to Central Government employees

Latest DoPT Orders 2023

CENTRAL GOVT HOLIDAY LIST 2023

Indian Railway Holiday List 2023 PDF | Postal Holidays List 2023 India Post | Bank Holidays List 2023 India | LIC Office Holiday List 2023 PDF Download | EPFO Holiday List 2023 PDF Download | ESIC Holiday List 2023 PDF Download | CGHS Holiday Calendar List 2023 | Post Office Holidays 2023 | Railway Holidays CG Office Holidays 2023 | TN Govt Holidays 2023 | KVS Holiday List 2023-2024 PDF