CBDT Complete Scrutiny

F.No.225/ 81/2022/ITA-II

Government of India

Ministry of Finance

Department of Revenue

Central Board of Direct Taxes (ITA-II division)

North Block, New Delhi, the 03rd June, 2022

To

All Pr. Chief Commissioners of Income-tax/ Chief Commissioners of Income-tax

All Pr. Director Generals of Income-tax/ Director Generals of Income-tax.

Madam/Sir

Subject: Guidelines for compulsory selection of returns for Complete Scrutiny during the Financial Year 2022-23 – procedure for compulsory selection in such cases -regarding.

Kindly refer to CBDT’s Guidelines dated 11.05.2022 on the above-mentioned subject (copy enclosed).

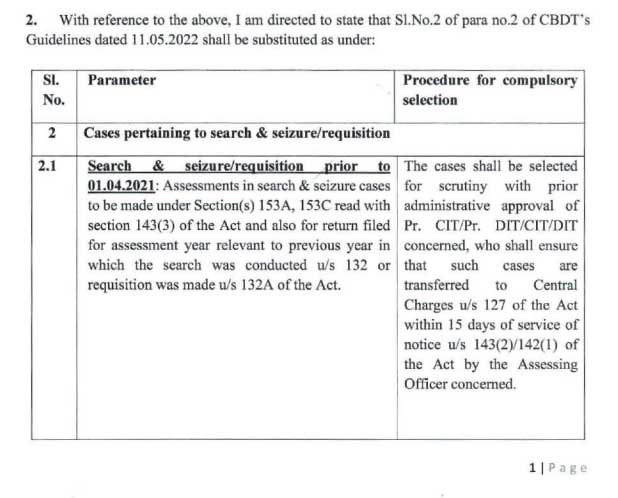

2. With reference to the above, I am directed to state that Sl.No.2 of para no.2 of CBDT’s Guidelines dated 11.05.2022 shall be substituted as under:

2. Cases pertaining to search & seizure/requisition

| Sl. No. | Parameter | Procedure for compulsory selection |

| 2.1 | Search & seizure/ requisition prior to 01.04.2021: Assessments in search & seizure cases to be made under Section(s) 153A, 153C read with section 143(3) of the Act and also for return filed for assessment year relevant to previous year in which the search was conducted u/s 132 or requisition was made u/s 132A of the Act. | The cases shall be selected for scrutiny with prior administrative approval of Pr. CIT/Pr. DIT/CIT/DIT concerned, who shall ensure that such cases are transferred to Central Charges u/s 127 of the Act within 15 days of service of notice u/s 143(2)/ 142(1) of the Act by the Assessing Officer concerned. Where such cases are not centralized and Return of Income is filed in response to notice u/s l 53C, the Assessing Officer concerned shall serve notice u/s 143(2) of the Act. Where such cases are not centralized and no Return of Income is filed in response to notice u/s l53C, the Assessing Officer concerned shall serve notice u/s 142(1) of the Act calling for information. |

| 2.2 | Search & seizure/requisition on or after 01.04.2021: Assessments in cases arising from search & seizure actions/requisitions u/s 132/ 132A conducted on or after 01.04.2021, for returns pertaining to A.Y. 2021-22. | The cases shall be selected for scrutiny with prior administrative approval of Pr. CIT/Pr. DIT/CIT/DIT concerned, who shall ensure that such cases are transferred to Central Charges u/s 127 of the Act within 15 days of service of notice u/s 143(2)/142(1) of the Act by the Assessing Officer concerned. |

3. All other contents of the said Guidelines will remain unchanged.

4. The above may be brought to the notice of all concerned for necessary compliance.

Enclosure: As above

(Ravinder Maini)

Director (ITA-II), CBDT

Leave a Reply