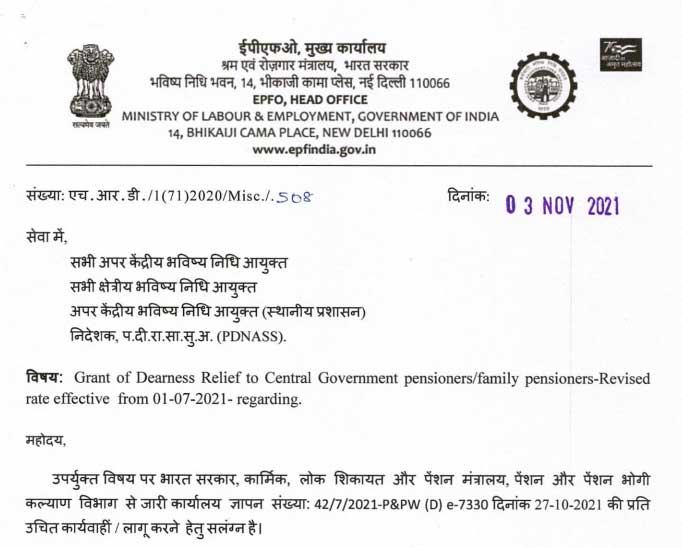

Dearness Relief to Central Government pensioners

File No. No. 42/7/2021 -P&PW(D) e-7330

Government of India

Ministry of Personnel Public

Grievances and Pensions

8th Floor, B-Wing,

Janpath Bhawan, Janpath,

New Delhi- 110001

Dated: 27.10.2021

OFFICE MEMORANDUM

Sub: Grant of Dearness Relief to Central Government Pensioners/ family pensioners – Revised rate effective from 01.07.2021 – reg

The undersigned is directed to refer to this Department’s OM of even no. dated 22.07.2021 on the subject mentioned above and to state that the President is pleased to decide that the Dearness Relief admissible to Central Government Pensioners/ Family pensioners shall be enhanced from existing date of 28% to 31% of the Basic Pension/ Family pension (including additional pension/family pension) w.e.f 01.07.2021.

- These rates 1of DR wi II be applicable to the following categories:-

- Civilian Central Go merriment Pens ionei s/Farn i ly Pensioners including Central Govt. absorbee pensioners in PSU/Autonomous Bod ies in i espect of whom orders ) n e been issued vide this Department’s OM to. 4/34/2002-P&PW(D)Vol.II dated 23.06.2017 for restoration of full pension after expi i y of concur citation period of 1.5 years.

- The Armed Forces Pensioners/Family Pensioners, Civilian Pensioners/Family Pensioners paid out of the Defence Service Estimates.

- All India Service Pensioners/Family Pensioners

- Railway Pensioners/family pensions.

- Pensioners who are in receipt of provisional pension.

- The Burma Civilian pensioners/family pensioners and pensioners/families of displaced Government Pensioners from Burma/ Pakistan, in respect of whom orders have been issued vide th is Department’s OM No. 23/3/2008-P&PW(B) dated 11.09.2017.

- The payment on account of Dearness Relief involving a fraction of a rupee shall be rounded to the next higher rupee.

- Other provisions governing grant of DR in respect of employed family pensioners and re-employed Central Government Pensioners will be regulated in accordance with the provisions contained in th is Department’s OM No. 45/73/97- P&PW (G) dated 2.7.1999 as amended from time to time. The provisions relating to regulation of DR where

a pensioner is in receipt of more than one pension with remain unchanged.

- In the case of retired Judges of the Supreme Court and High Courts, necessary orders will be issued by the Department of Justice separately.

- It will be the responsibility of the pension disbursing authorities, including the nationalized banks, etc. to calculate the quantum of DR payable in each individual case.

- The offices of Accountant General and authorised Pension Disbursing Banks are requested to arrange payment of rel ief to pens ionei s etc. on the basis of these insti uctions without waiting for any further instructions from the Comptroller and Auditor General of India and the Reserve Bank of India in view of letter to 528-TA, 11/34-80-II dated 23/04/1981 of the Comptroller and Auditor General of India addressed to all Accountant Generals and Reserve Bank of India Circrular No. GANB to. 2958/GA-64 (ii) (CGL)/81 dated the 21st May, 1981 addressed to State Bank of India and its subsidiaries and all Nationalized Banks.

- In their application to the persons belonging to Indian Audit and Accounts Department, these orders are issued under Article 148(5) of the Constitution and after consultation with the Comptroller & Auditor General of India.

- This issues in accordance with the Ministry of Finance, Department of Expenditure’s OM No. 1/4/2020-E.II(B) dated 25.10.2021 .

Hindi version will follow.

(Naresh Bhardwaj)

Deputy Secretary to the Government of India

Leave a Reply