7th CPC Advance increment – Information Document on Counting of specific periods, while on leave, Advance increments etc., by DoPT updated on 12.09.2022

- Counting of specific periods for Increment

- Increment while on Leave

- Increment, if Govt. servant dies while on Leave

- Advance increments granted to Stenographers of Subordinate Offices on qualifying speed test in shorthand at 100/120 w.p.m., in the 7th CPC Scenario

(Updated on 12.09.2022)

Government of India

Ministry of Personnel, Public Grievances & Pensions

Department of Personnel & Training

Establishment (Pay-I) Section

INCREMENT

Department of Personnel and Training has issued instructions from time to time regarding various provisions governing the subject of increment. The essence of these instructions has been summarized in the following paras for guidance and better understanding:

Counting of specific periods for Increment

1. In cases where a person has been selected for regular appointment and before formally taking over charge of the post for which selected the person is required to undergo training, training period undergone by such a Govt. servant whether on remuneration of stipend or otherwise may be treated as duty for the purpose of drawing increments.

[Para 3 of OM No. 16/16/89 -Estt.(Pay-I) dated 22.10.1990]

2. The provisions of FR 26 which provide for counting of broken spells in officiation in the higher post for increment, continue to apply for increment under Rule 10 of CCS (RP) Rules, 2008.

[OM No. 19/2/2013 -Estt.(Pay-I) dated 12.12.2013]

3. Consequent upon the implementation of CCS (RP) Rules 2008, increments in the revised pay structure are to be regulated in terms of Rule 10 of the CCS (RP) Rules 2008. This rule states that “there will be a uniform date of annual increment viz. 1st of July every year. Employees completing 6 months and above in the revised pay structure as on 1st July will be eligible to be granted the increment.”

4. Except as provided under the conditions laid down in this Department’s OM No. 13017/20/85 -Estt.(L) dated 18.02.1986, qualifying service of less than six months on account of EOL (without medical certificate) between 1st July of the previous year till 30th June of the year under consideration shall have the effect of postponing the increment to 1st July of the next year. The same stipulation will also be applicable to those cases where the increment became due on 01.07.2006. In terms of this Department’s OM No. 13017/20/85-Estt.(L) dated 18.02.1986, EOL granted for the following purposes automatically counts as qualifying service for pension and for increments without any further sanctions:

- (i) EOL granted due to inability of a Government servant to join or rejoin duty on account of civil commotion; and

- (ii) EOL granted to a Government servant for prosecuting higher technical and scientific studies.

[OM No. 16/2/2009 -Estt.(Pay-I) dated 02.07.2010]

Increment while on Leave

5. According to Rule 40 of the CCS (Leave) Rules, 1972, a Government servant who proceeds on Earned Leave or Commuted Leave is entitled to leave salary equal to the pay drawn immediately before proceeding on Earned Leave or Commuted Leave. Consequently, if the normal date of increment of a Government servant falls during a period when he remains on Earned Leave/ Commuted Leave/ Half Pay Leave/Leave not due, the benefit of such increment is actually paid to him only from the date he joins duty on expiry of leave though the actual date of next increment remains unaffected.

[Para 1 of OM No. 16/13/88-Estt.(Pay-I) dated 16.02.1989]

Increment, if Govt. servant dies while on Leave

6. In the case of a servant who dies while on any kind of leave for which leave salary is payable, a lump-sum ex-gratia payment, in addition to the normal entitlements under leave, may be allowed to the member of family as specified in Rule-39-C of CCS (Leave) Rules,1972. The ex-gratia payment shall be equivalent to the difference between the amount of leave salary as well as cash equivalent of leave salary admissible as per rules and 39A of CCS (Leave) Rules, 1972 thereof and the amount of leave salary as well as cash equivalent of leave salary which would have been admissible if the benefit of the increment falling due during currency of leave period until date of death was allowed from its due date without waiting for re-joining duty by the Govt. servant. The Head of the Department may issue necessary order sanctioning the amount of ex-gratia in each individual case.

[Para 2 of OM No. 16/13/88 -Estt.(Pay-I) dated 16.02.1989]

Advance increments granted to Stenographers of Subordinate Offices on qualifying speed test in shorthand at 100/120 w.p.m., in the 7th CPC Scenario

7. The advance increment(s) to Stenographers of Subordinate Offices on qualifying speed test in shorthand at 100/120 w.p.m. shall be regulated as under with effect from 01.01.2016:

(i) The Stenographer who is recruited on the basis of speed test in the shorthand at 80 w.p.m. may be granted one advance increment on qualifying speed test in shorthand at 100 w.p.m. and one more advance increment on qualifying speed test in shorthand at 120 w.p.m. while in service. However, if a stenographer who is recruited on the basis of speed test in the short hand at 80 w.p.m. directly qualifies the speed test in shorthand at 120 w.p.m. while in service, he/she may be granted two advance increments.

(ii) The Stenographer, who is recruited on the basis of speed test in the shorthand at 100 w.p.m., may be granted one advance increment on qualifying speed test in shorthand at 120 w.p.m. while in service.

(iii) These speed tests shall be conducted by properly constituted Authorities including Departmental Authorities.

(iv) These advance increments shall be granted from the date of passing the test.

(v) These advance increments shall not be absorbed in future increments and the date of next increment after the grant of these advance increments shall remain the same. No option for fixation of pay from the Date of Next Increment shall be available/allowed for fixation of pay on account of these advance increments.

(vi) The amount of these advance increments shall be treated as a separate element in addition to the basic pay and it should be counted as pay for all purposes. Further, once these advance increments are taken into account for the purpose of fixation of pay on promotion or being placed in a higher scale on grant of MACP or due to revision of Pay Scale or Pay Structure etc., these advance increments no longer continue as a separate element.

(vii) In respect of the Stenographers, who become eligible for grant of these advance increments consequent upon the implementation of CCS (RP) Rules, 2016, they may be granted one/two advance increments (as the case may be) in the vertical Level, in which the Government Servant is placed on the date of passing the test, as illustrated below:

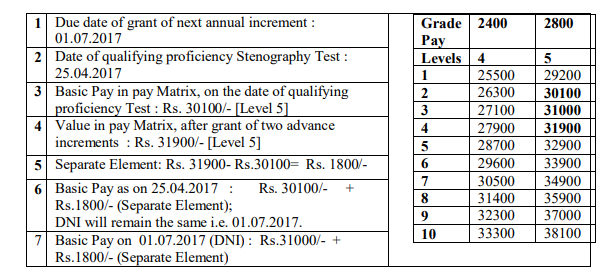

(a) For granting two advance increments:

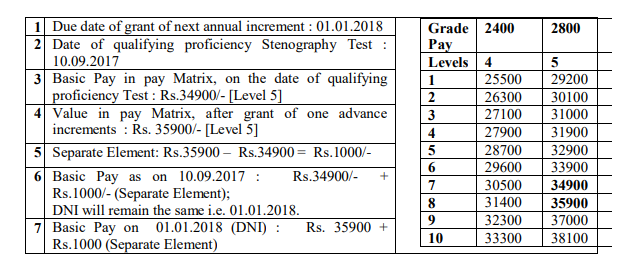

(b) For granting one advance increment:

(viii) Benefit of these advance increments will not be treated as an anomaly for the purpose of stepping of pay of seniors.

[Para 3 of OM No. 1/7/2017-Estt.(Pay-I) dated 24.07.2020]

Note: List of the OMs mentioned in this document is annexed. In case any reference to the relevant OM is required, the same may be accessed from the Archive Section of DOPT’s website.

ANNEXURE

List of OMs mentioned in this Document

1. DoPT OM No. 16/16/89 -Estt.(Pay-I) dated 22.10.1990

2. DoPT OM No. 19/2/2013 -Estt.(Pay-I) dated 12.12.2013

3. DoPT OM No. 16/2/2009 -Estt.(Pay-I) dated 02.07.2010

4. DoPT OM No. 16/13/88 -Estt.(Pay-I) dated 16.02.1989

5. DoPT OM No. 1/7/2017 -Estt.(Pay-I) dated 24.07.2020

6. DoPT OM No. 13017/20/85 -Estt.(L) dated 18.02.1986

Adhikarimayum Rameshwar Sharma says

Very much helpful