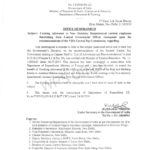

7th Pay Commission Cooking Allowance to NS Departmental Canteen Employees in Department of Posts: Order dated 11.05.2023 PP-05/1/2023 -PAP-DOP/72542/2023 F.No. PP-05/1/ 2023-PAPMinistry of CommunicationsDepartment of Posts[Establishment Division /P.A.P. Section] Dak Bhawan, Sansad Marg,New Delhi- 110001.Dated: 11.05.2023 To 1. All Chief Postmasters General / … [Read more...] about 7th CPC Cooking Allowance to Non- statutory Departmental canteen employees functioning from Central Government Offices

CENTRAL GOVERNMENT HOLIDAY LIST 2024

| 46% DA Order for Central Government Employees wef 1st July 2023 PDF |

| CGHS Updated Rate Card PDF Download |

| Latest List of KV Schools in India |

| Expected DA 2023 |

| 7th Pay Commission Latest News 2024 |

| MACP for the Central Government Employees |

7th CPC

Handling of Disciplinary Proceedings in respect of Central Civilian Employees

No. DOPT- 168006 8417507Government of IndiaMinistry of Personnel, Public Grievances & PensionsDepartment of Personnel and TrainingESTT.(Estt. A-III) (Dated 29 March, 2023 ) OFFICE MEMORANDUM Handling of Disciplinary Proceedings in respect of Central Civilian Employees Department of Personnel and Training has issued various instructions from time to time on … [Read more...] about Handling of Disciplinary Proceedings in respect of Central Civilian Employees

Re-exercise the option for 7th CPC fixation of pay to Central Government employees

7th CPC Re-fixation of Pay of Employees - Parliament Question on opportunity of re-exercise of option of fixation of pay on Promotion/MACP 7th Pay Commission Latest News 2023 GOVERNMENT OF INDIAMINISTRY OF FINANCEDEPARTMENT OF EXPENDITURERAJYA SABHAUNSTARRED QUESTION No. 569TO BE ANSWERED ON TUESDAY, FEBRUARY 7, 2023/ 18 MAGHA, 1944 (SAKA) RE-FIXATION OF PAY OF … [Read more...] about Re-exercise the option for 7th CPC fixation of pay to Central Government employees

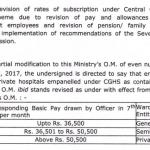

7th CPC Revised rates of subscription under CGHS due to revision of pay and allowances of Central Government employees and revision of pension/ family pension

7th CPC Revision of CGHS Rates F. No. S.11011/11/2016-CGHS(P)/EHSGovernment of IndiaMinistry of Health & Family WelfareDepartment of Health & Family Welfare(EHS Section) Dated, the 28th October, 2022Nirman Bhawan, New Delhi OFFICE MEMORANDUM Subject: Revision of rates of subscription under Central Government Health Scheme due to revision of pay and … [Read more...] about 7th CPC Revised rates of subscription under CGHS due to revision of pay and allowances of Central Government employees and revision of pension/ family pension

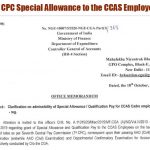

7th CPC Special Allowance and Qualification Pay to the CCAS Cadre Employees

Special Allowance and Qualification Pay No. NGE- 18007/5/2020 -NGE- CGA-Part(1)/365Government of IndiaMinistry of FinanceDepartment of ExpenditureController General of Accounts(HR-4 Section) Mahalekha Niyantrak BhawanGPO Complex, Block-E, INANew Delhi - 110023Email ID:- hr4section [email protected], the 18th October, 2022 OFFICE MEMORANDUM Subject:- Clarification … [Read more...] about 7th CPC Special Allowance and Qualification Pay to the CCAS Cadre Employees

Pensioners Grievances Impact of Pension Adalats and CPENGRAMS – IRTSA

INDIAN RAILWAYS TECHNICAL SUPERVISORS' ASSOCIATION No:IRTSA/CHQ/ Memo/ 2022-7 Date:17.10.2022 Dr. Jitendra SinghMoS DoPT & DoP&PWmos-pp[at]nic.in Respected Sir, Sub: Recommendation of 110th Report on the Subject ‘Pensioner’s Grievances-Impact of Pension Adalats and Centralized Pensioners Grievance Redress and Monitoring System (CPENGRAMS)' Submitted to … [Read more...] about Pensioners Grievances Impact of Pension Adalats and CPENGRAMS – IRTSA

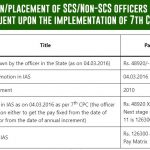

7th Pay Commission Pay fixation/ placement of SCS/Non-SCS officers inducted to IAS – 7th CPC fixation of pay/stepping up of pay DoPT

Stepping up of pay of senior on par with junior Latest DoPT Order 2022 [Updated on: 29.09.2022] I/ 3021790/ 2022 20011/04/2022 -AIS-IIGovernment of IndiaMinistry of Personnel, Public Grievances and PensionsDepartment of Personnel & TrainingAIS-II (Pay) Subject: Pay fixation/placement of SCS/Non-SCS officers inducted to IAS consequent upon the implementation … [Read more...] about 7th Pay Commission Pay fixation/ placement of SCS/Non-SCS officers inducted to IAS – 7th CPC fixation of pay/stepping up of pay DoPT

7th CPC Revised Pay Levels – Revision in minimum qualifying service required for promotion – DoPT

7th CPC Pay Matrix - Minimum qualifying service for promotion - Latest DoPT Order 2022 Latest DoPT Orders 2022 F. No. AB-14017/4/ 2021-Estt.(RR)Government of IndiaMinistry of Personnel, Public Grievances & PensionsDepartment of Personnel & Training North Block, New Delhi.Date: 20 September 2022. OFFICE MEMORANDUM Subject: Revised Pay Levels as per … [Read more...] about 7th CPC Revised Pay Levels – Revision in minimum qualifying service required for promotion – DoPT

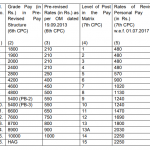

INCENTIVES FOR CENTRAL GOVERNMENT EMPLOYEES PARTICIPATING IN SPORTS EVENTS

7th CPC Special Increment (Personal Pay) to Sportspersons Latest DoPT Orders 2022 (Updated on 15.09.2022) Government of IndiaMinistry of Personnel, Public Grievances & PensionsDepartment of Personnel & TrainingEstablishment (Pay-I) Section INCENTIVES FOR PARTICIPATING IN SPORTS EVENTS Department of Personnel and Training has issued various instructions … [Read more...] about INCENTIVES FOR CENTRAL GOVERNMENT EMPLOYEES PARTICIPATING IN SPORTS EVENTS

Central Govt employees allow to travel by Tejas Express Trains on Official Tour – DoE

Tejas Express trains for official tours No. 19030/1/2017 -E.IVGovernment of IndiaMinistry of FinanceDepartment of Expenditure North Block, New Delhi.Dated the 12th September, 2022 OFFICE MEMORANDUM Subject: Admissibility to travel by Tejas Express Trains on Official Tour. The undersigned is directed to refer to this Department’s OM No. 19030/1/2017 -E.IV dated … [Read more...] about Central Govt employees allow to travel by Tejas Express Trains on Official Tour – DoE

Latest DoPT Orders 2024

CENTRAL GOVT HOLIDAY LIST 2024

Indian Railway Holiday List 2023 PDF | Postal Holidays List 2023 India Post | Bank Holidays List 2023 India | LIC Office Holiday List 2023 PDF Download | EPFO Holiday List 2023 PDF Download | ESIC Holiday List 2023 PDF Download | CGHS Holiday Calendar List 2023 | Post Office Holidays 2023 | Railway Holidays CG Office Holidays 2023 | TN Govt Holidays 2023 | KVS Holiday List 2023-2024 PDF