Submission of Memorandum to the 7th Central Pay Commission – Request for oral evidence – AICAEA All India Civil Accounts Employees Association (RECOGNISED BY GOVT. OF INDIA) CENTRAL HEADQUARTER No.AICAEA/HQ/ A-41/7CPC/2015/246 Dated 30th March 2015 To The Member Secretary, 7th Central Pay Commission, Chatrapati Shivaji Bhawan, 1st Floor, B-14/A, Qutab … [Read more...] about Submission of Memorandum to the 7th Central Pay Commission – Request for oral evidence – AICAEA

CENTRAL GOVERNMENT HOLIDAYS IN 2025

| 2% DA Hike Order for Central Government Employees wef 1st Jan 2025 PDF |

| CGHS Updated Rate Card PDF Download |

| Latest List of KV Schools in India |

| 7th Pay Commission Latest News 2025 |

| MACP for the Central Government Employees |

7th CPC Common Memorandum

Meeting with 7th Pay Commission on 25.02.2015 – Memorandum including Minimum Wages, Retirement Benefits, Allowances

Meeting with 7th Pay Commission on 25.02.2015 – Memorandum including Minimum Wages, Retirement Benefits, Allowances AIRF All India Railwaymen’s Federation 4, State Entry Road, New Delhi – 110055 No.AIRF/60 Dated- February 24, 2015 The General Secretaries, All Affiliated Unions, Dear Comrades, Sub: Meeting with Seventh Pay Commission on 25.02.2015 Seventh Central … [Read more...] about Meeting with 7th Pay Commission on 25.02.2015 – Memorandum including Minimum Wages, Retirement Benefits, Allowances

Requirement of Budget for the 7th Seventh Pay Commission

Requirement of Budget for the 7th Seventh Pay Commission Ajay Tiwari/ SNB writes an article about the Demand of Budget for the 7th pay commission for Central Government employees. We reproduced the article and given under to our readers for easy understanding… Employee Associations want a separate provision to be placed for them by the Seventh Pay commission during the … [Read more...] about Requirement of Budget for the 7th Seventh Pay Commission

BCPC Final Memorandum to 7th CPC

BCPC Final Memorandum to 7th CPC MEMORANDUM ON PENSION AND OTHER RETIREMENT BENEFITS CHAPTER – I Introduction The Government of India, Ministry of Finance, Department of Expenditure, Resolution No.1/1/2013-EIII(A) dated 28th February, 2014 in its Para 2(f) has included the following terms of reference of the 7th Central Pay Commission: “(f) To examine the principles … [Read more...] about BCPC Final Memorandum to 7th CPC

Memorandum to 7th Pay Commission – AINTSSA submitted on 30.7.2014

Memorandum to 7th Pay Commission – AINTSSA submitted on 30.7.2014 MEMORANDUM TO SEVENTH CENTRAL PAY COMMISSION GOVERNMENT OF INDIA B.B. Mohanty Member, Naval Heaquarters JCM Council, Confederation of Defence Recognized Association President All India Naval Technical Supervisory Staff Associations. Address: F-10/105, Kings Ville, Green City, Ambarnath (East), … [Read more...] about Memorandum to 7th Pay Commission – AINTSSA submitted on 30.7.2014

Change in 7th Pay Commission visit to Bengaluru

Change in Commission’s visit to Bengaluru There is a slight change in 7th CPC’s visit to Bengaluru. The Commission now proposes to visit Bengaluru between 24th and 26th August, 2014 instead of the earlier announced date of 25th-27th August, 2014. The commission has, in its first phase of interaction, been seeking the views of various stakeholders on its terms of … [Read more...] about Change in 7th Pay Commission visit to Bengaluru

INDWF PROPOSED PAY STRUCTURE FOR DEFENCE CIVILIAN EMPLOYEES TO 7TH PAY COMMISSION

INDWF PROPOSED PAY STRUCTURE FOR DEFENCE CIVILIAN EMPLOYEES TO 7TH PAY COMMISSION INDWF submitted a separate memorandum to 7th Pay Commission on the service matters of Defence Civilians Employees on 30th July 2014. INTUC INDIAN NAITONAL DEFENCE WORKERS FEDERATION INDWF/7th CPC/Memorandum/002/2014 28.07.2014 To Member Secretary, VII Central Pay Commission, New … [Read more...] about INDWF PROPOSED PAY STRUCTURE FOR DEFENCE CIVILIAN EMPLOYEES TO 7TH PAY COMMISSION

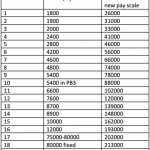

Confederation Proposed New Pay Structure and Rate of Increment in its memorandum to 7th Pay Commission

Confederation Proposed New Pay Structure and Rate of Increment in its memorandum to 7th Pay Commission Proposed Pay Structure and Rate of Increment In the preceding chapters we have dealt with the various principles of pay determination as was enunciated by the successive Pay Commissions. The 6th CPC introduced the new concept of Pay Band and Grade Pay. We are not able to … [Read more...] about Confederation Proposed New Pay Structure and Rate of Increment in its memorandum to 7th Pay Commission

Latest DoPT Orders 2025

CENTRAL GOVT HOLIDAY LIST 2025

Indian Railway Holiday List 2025 PDF | Postal Holidays List 2025 India Post | Bank Holidays List 2025 India | LIC Office Holiday List 2025 PDF Download | EPFO Holiday List 2025 PDF Download | ESIC Holiday List 2025 PDF Download | CGHS Holiday Calendar List 2025 | Post Office Holidays 2025 | Railway Holidays CG Office Holidays 2025 |