UPS FAQ 2025 This FAQ document is intended solely for informational and reference purposes, based on the PFRDA (Operationalisation of UPS under NPS) Regulations, 2025. While every effort has been made to ensure the accuracy of the information provided, this document should not be considered a legal interpretation or a substitute for the official regulations, circulars, or … [Read more...] about Unified Pension Scheme (UPS) FAQ 2025 – PFRDA NPS Guidelines & Clarifications

CENTRAL GOVERNMENT HOLIDAYS IN 2025

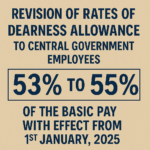

| 2% DA Hike Order for Central Government Employees wef 1st Jan 2025 PDF |

| CGHS Updated Rate Card PDF Download |

| Latest List of KV Schools in India |

| 7th Pay Commission Latest News 2025 |

| MACP for the Central Government Employees |

Revision of timelines for preparation/ completion of Annual Performance Assessment Report (APAR) in respect of Central Civil Services

Completion of APAR in CCS F. No. 21011/10/2025 PP(A-I)Government of IndiaMinistry of Personnel, Public Grievances and Pensions(Department of Personnel & Training) ; dated the 09th April, 2025 OFFICE MEMORANDUM Subject: Revision of timelines for preparation/ completion of Annual Performance Assessment Report (APAR) in respect of Central Civil Services The … [Read more...] about Revision of timelines for preparation/ completion of Annual Performance Assessment Report (APAR) in respect of Central Civil Services

6th CPC DA Order Jan 2025 Download PDF

6th CPC DA Order Jan 2025 The Dearness Allowance (DA) for employees still receiving pay under the pre-revised pay scale/Grade Pay of the 6th Central Pay Commission will be increased from 246% to 252% of Basic Pay, effective from January 1, 2025. No. 1/1(2)/2025-E.II(B)Government of IndiaMinistry of FinanceDepartment of Expenditure North Block, New DelhiDated the 2nd … [Read more...] about 6th CPC DA Order Jan 2025 Download PDF

5th CPC DA Order from Jan 2025 Download PDF

5th CPC DA Order Jan 2025 5th CPC - The Dearness Allowance (DA) for employees who are still receiving their pay based on the pre-revised pay scale under the 5th Central Pay Commission will be increased from 455% to 466% of Basic Pay, effective from January 1, 2025. No. 1/1(3)/2025-E.II(B)Government of IndiaMinistry of FinanceDepartment of Expenditure North Block, New … [Read more...] about 5th CPC DA Order from Jan 2025 Download PDF

DA Order for Central Government Employees wef 1st Jan 2025 Download PDF

DA Order Jan 2025 Revision of rates of Dearness Allowance to Central Government employees effective from 01.01.2025 - 53% to 55% of the Basic Pay with effect from 1st January, 2025. No. 1/1(1)/2025-E.II(B)Government of IndiaMinistry of FinanceDepartment of Expenditure OFFICE MEMORANDUM North Block, New DelhiDated the 2nd April, 2025 Subject: Revision of rates … [Read more...] about DA Order for Central Government Employees wef 1st Jan 2025 Download PDF

EPFO Order 60 Days Productivity Linked Bonus (PLB) for the employees of the EPFO for the year 2023-2024

EPFO Bonus Order Employees Provident Fund OrganisationMINISTRY OF LABOUR & EMPLOYMENT GOVERNMENT OF INDIA Head OfficePlate A Ground Floor, Block II. East Kidwai Nagar New Delhi-110023 No: WSU/Payment & Declaration of PLB/E-886849 /2024-25/ 13 Date: 27/Mar/2025 To, All ACC (HQ)s/ACCs (Zones)All RPFC-I/RPFC-II/ APFC OICsThe Director, PDUNASS Ref: … [Read more...] about EPFO Order 60 Days Productivity Linked Bonus (PLB) for the employees of the EPFO for the year 2023-2024

Ambedkar Jayanti Central Government Offices holiday on 14 April 2025 Monday – DoPT Order

Ambedkar Birthday DoPT Holiday Order 2025 Holiday for Central Govt Offices on 14.4.2025 on account of Birthday of Dr. B.R. Ambedkar. Latest DoPT Orders 2025 F. No.12/4/2020 -JCA2Government of IndiaMinistry of Personnel, Public Grievances & Pensions(Department of Personnel & Training)Establishment (JCA) Section North Block, New DelhiDated the 27th … [Read more...] about Ambedkar Jayanti Central Government Offices holiday on 14 April 2025 Monday – DoPT Order

KVS Lottery Results 2025 Region Wise – Check Selection List & Merit List Online

Applicants can check KVs lottery result for the applied school online by clicking on the direct link given below: KVS Region NameKVS Official … [Read more...] about KVS Lottery Results 2025 Region Wise – Check Selection List & Merit List Online

Union Cabinet Approves 2% DA Hike for Central Employees & Pensioners

Cabinet Cabinet approves release of an additional instalment of Dearness Allowance to Central Government employees and Dearness Relief to Pensioners w.e.f. 01.01.2025 48.66 lakh Central Government employees and 66.55 lakhs pensioners to benefit 2% benefit to cost Rs. 6614.04 crore per annum to exchequer The Union Cabinet chaired by Prime Minister Narendra Modi … [Read more...] about Union Cabinet Approves 2% DA Hike for Central Employees & Pensioners

Whether the 8th Central Pay Commission (8th CPC) has been approved?

APPROVAL OF 8th CENTRAL PAY COMMISSION Yes, the Government of India has approved the formation of the 8th Central Pay Commission (CPC). Minister of State for Finance, Shri Pankaj Chaudhary, confirmed this decision in a written reply to the Rajya Sabha on March 25, 2025. The 8th CPC is expected to benefit approximately 36.57 lakh Central Government civilian employees (as … [Read more...] about Whether the 8th Central Pay Commission (8th CPC) has been approved?

Latest DoPT Orders 2025

CENTRAL GOVT HOLIDAY LIST 2025

Indian Railway Holiday List 2025 PDF | Postal Holidays List 2025 India Post | Bank Holidays List 2025 India | LIC Office Holiday List 2025 PDF Download | EPFO Holiday List 2025 PDF Download | ESIC Holiday List 2025 PDF Download | CGHS Holiday Calendar List 2025 | Post Office Holidays 2025 | Railway Holidays CG Office Holidays 2025 |