Female employees in Railways - Step to redress gender specific issues: Railway Board Order RBE No. 57/2025 dated 24.06.2025 RBE No. 57/2025 भारत सरकार / GOVERNMENT OF INDIAरेल मंत्रालय / MINISTRY OF RAILWAYS(रेलवे बोर्ड / RAILWAY BOARD) No. E(NG)I-2018/TR/13(E-File No.3263981) New Delhi, dated 24.06.2025 The General Manager (P)All Zonal Railways & PUS Sub: … [Read more...] about Steps Taken by Indian Railways to Support Women Employees and Resolve Gender Issues

CENTRAL GOVERNMENT HOLIDAYS IN 2025

| 2% DA Hike Order for Central Government Employees wef 1st Jan 2025 PDF |

| CGHS Updated Rate Card PDF Download |

| Latest List of KV Schools in India |

| 7th Pay Commission Latest News 2025 |

| MACP for the Central Government Employees |

Railways - Indian Railways News

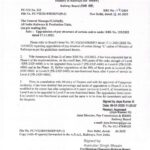

Upgradation of pay structure of certain Group ‘C’ cadres of Ministry of Railways

Upgradation of pay structure of certain cadres – NFU in Level-9 after 4 years service for Supervisory Cadre in Level-8 in Railways: Railway Board Order RBE No. 04/2025 to remove ceiling of 50% of posts. GOVERNMENT OF INDIA (भारत सरकार)Ministry of Railways (रेल मंत्रालय)Railway Board (रेलवे बोर्ड) PC-VII No. 222 RBE No:04/2025 File No. PC-VII/2019/RSRP/3(Pt.1) New … [Read more...] about Upgradation of pay structure of certain Group ‘C’ cadres of Ministry of Railways

Reservation in promotion to the Persons with Benchmark Disability (PwBD) – carry forward of vacancy

Reservation in promotion to the Persons with Benchmark Disability (PwBD) - Clarification on carry forward of vacancy regarding: Railway Board RBE No. 116/2024 dated 31.12.2024 RBE No. 116/2024 भारत सरकार/ GOVERNMENT OF INDIAरेल मंत्रालय / MINISTRY OF RAILWAYS (रेलवे बोर्ड/ RAILWAY BOARD) No. E(NG)I/2023/ PM4/22(E-3451127) New Delhi, 31.12.2024 The … [Read more...] about Reservation in promotion to the Persons with Benchmark Disability (PwBD) – carry forward of vacancy

Indian Railways – Revision of rate of two additional increments (non-absorbable) granted to Nursing Staff

Railway Nursing Staff GOVERNMENT OF INDIA (भारत सरकार)Ministry of Railways (रेल मंत्रालय)Railway Board (रेलवे बोर्ड) File No. PC-VII/2018/ 1/7/5/6(Part) New Delhi, dated: .10.2024 The General Manager/ CAOs(R),All Indian Railways & Production Units,(As per mailing list) Sub: Revision of rate of 'two' additional increments (non-absorbable) granted to … [Read more...] about Indian Railways – Revision of rate of two additional increments (non-absorbable) granted to Nursing Staff

Validity period of Privilege Passes/ Post Retirement Complimentary Passes/ Widow Passes and PTOs w.e.f. 1st Nov 2024

Railway Privilege Passes Validity period of Privilege Passes/Post Retirement Complimentary Passes/Widow Passes and PTOs w.e.f. 01.11.2024: Railway Board Order dated 25.10.2024 भारत सरकार GOVERNMENT OF INDIAरेल मंत्रालय MINISTRY OF RAILWAYS(रेलवे बोर्ड) (RAILWAY BOARD) No. 2024/E(W)/01/08/6 New Delhi, dated 25.10.2024 The General Managers/ DGs/CAOs (P)All Indian … [Read more...] about Validity period of Privilege Passes/ Post Retirement Complimentary Passes/ Widow Passes and PTOs w.e.f. 1st Nov 2024

Railway employees dearness allowance from July 2024

Railway Employees July DA order 2024 Grant of Dearness Allowance to Railway employees - Revised Rates effective from 01.07.2024: RBE No. 99/2024 dated 22.10.2024. GOVERNMENT OF INDIA (भारत सरकार)Ministry of Railways (रेल मंत्रालय)Railway Board (रेलवे बोर्ड) PC-VII No.- 219 RBE No: 99/2024 File No. PC-VIH/2016/ 1/7/2/1 New Delhi, dated: 22.10.2024 The … [Read more...] about Railway employees dearness allowance from July 2024

Railway Bonus Order – Payment of Productivity Linked Bonus to all eligible non-gazetted Railway employees for the financial year 2023-24

Indian Railway Bonus Order 2024 PDF GOVERNMENT OF INDIA (भारत सरकार)MINISTRY OF RAILWAYS (रेल मंत्रालय)RAILWAY BOARD (रेलवे बोर्ड) RBE No.91/2024 No. E(P&A)II/2024/PLB-1 New Delhi, dt. 04.10.2024 The General Managers/CAOs,All Indian Railways &Production Units etc. Sub: Payment of Productivity Linked Bonus to all eligible non-gazetted Railway employees … [Read more...] about Railway Bonus Order – Payment of Productivity Linked Bonus to all eligible non-gazetted Railway employees for the financial year 2023-24

Railway Bonus 2024 – Productivity Linked Bonus (PLB) for 78 days to railway employees cabinet approved

Railway Bonus 2024 CABINET Cabinet approves and announces Productivity Linked Bonus (PLB) for 78 days to railway employees Posted On: 03 OCT 2024 In recognition of the excellent performance by the Railway staff, the Union Cabinet chaired by the Prime Minister Shri Narendra Modi has approved payment of PLB of 78 days for Rs. 2028.57 crore to 11,72,240 railway … [Read more...] about Railway Bonus 2024 – Productivity Linked Bonus (PLB) for 78 days to railway employees cabinet approved

Leave rules – Extending the eligibility of half a day LAP to all employees – IRTSA

Half a day LAP INDIAN RAILWAYS TECHNICAL SUPERVISORS’ ASSOCIATION No:IRTSA/Memo-24 Date:17.04.2024 Director General (HR)Railway Board Respected Sir, Sub: Leave rules. – Extending the eligibility of half a day LAP to all employees.Ref: Para-539(2) of Indian Railway Establishment Code Volume-I IRTSA wishes to emphasize the necessity of extension of half day … [Read more...] about Leave rules – Extending the eligibility of half a day LAP to all employees – IRTSA

8th CPC – Formation of 8th central Pay Commission – DoPT forwards IRTSA Memo to MoF

8th central Pay Commission F. No. 2/1/2023-JCAGovernment of IndiaMinistry of Personnel, PG & PensionsDepartment of Personnel & TrainingEstablishment (JCA) Section Floor, ‘B’ Wing,Lok Nayak Bhawan, New DelhiDated: 20-03-2024 OFFICE MEMORANDUM Subject: Formation of 8th central Pay Commission - regarding. The undersigned is directed to forward a copy … [Read more...] about 8th CPC – Formation of 8th central Pay Commission – DoPT forwards IRTSA Memo to MoF

Latest DoPT Orders 2025

CENTRAL GOVT HOLIDAY LIST 2025

Indian Railway Holiday List 2025 PDF | Postal Holidays List 2025 India Post | Bank Holidays List 2025 India | LIC Office Holiday List 2025 PDF Download | EPFO Holiday List 2025 PDF Download | ESIC Holiday List 2025 PDF Download | CGHS Holiday Calendar List 2025 | Post Office Holidays 2025 | Railway Holidays CG Office Holidays 2025 |