FREQUENTLY ASKED QUESTIONS ON ENTITLEMENT RULES 2023 AND GMO 2023 … [Read more...] about FAQ ON ENTITLEMENT RULES 2023 AND GUIDE TO MEDICAL OFFICERS 2023

CENTRAL GOVERNMENT HOLIDAY LIST 2024

| 46% DA Order for Central Government Employees wef 1st July 2023 PDF |

| CGHS Updated Rate Card PDF Download |

| Latest List of KV Schools in India |

| Expected DA 2023 |

| 7th Pay Commission Latest News 2024 |

| MACP for the Central Government Employees |

Defence

ENTITLEMENT RULES FOR CASUALTY PENSION AND DISABILITY COMPENSATION AWARDS TO ARMED FORCES PERSONNEL 2023

Entitlement Rules for Casualty Pension and Disability Compensation Awards to Armed Forces Personnel, 2023 Appendix -I (Refer to Ministry of Defence letterNo. 16(3)/2023/D (Pen/Pol)/Vol-IIdated 21.09.2023 ENTITLEMENT RULES FOR CASUALTY PENSION AND DISABILITY COMPENSATION AWARDS TO ARMED FORCES PERSONNEL, 2023 1. Title. These Rules shall be called the … [Read more...] about ENTITLEMENT RULES FOR CASUALTY PENSION AND DISABILITY COMPENSATION AWARDS TO ARMED FORCES PERSONNEL 2023

NC JCM held on 20-09-2023 agenda points Staff Side raised the important issues

AIDEF - Standing Committee meeting of the National Council - JCM held on 20/09/2023 - Outcome of the issues discussed under the Chairpersonship of Secretary (P) DOPT ALL INDIA DEFENCE EMPLOYEES FEDERATION SPECIAL CIRCULAR No. 150 Date: 20th of September, 2023 Outcome of the issues discussed in the Standing Committee meeting of the National Council - JCM held on … [Read more...] about NC JCM held on 20-09-2023 agenda points Staff Side raised the important issues

UPGRADATION OF CLASS OF TRAVEL IN RESPECT OF CANDIDATES APPEARING FOR SSB INTERVIEW AND / OR MEDICAL EXAMINATION AND CANDIDATES SELECTED FOR PRE COMMISSIONING TRAINING

SSB Interview and / or Medical Examination and precommissioning training - Upgradation of class of travel i.r.o. candidates appearing - MoD Order No. 12630/TA/DA/ Mov C/17/ D(Mov)/2023Govt of IndiaMinistry of DefenceDepartment of Military Affairs Dated, the 27 July 2023 To. The Chief of the Army StaffThe Chief of the Naval StaffThe Chief of the Air StaffHQ … [Read more...] about UPGRADATION OF CLASS OF TRAVEL IN RESPECT OF CANDIDATES APPEARING FOR SSB INTERVIEW AND / OR MEDICAL EXAMINATION AND CANDIDATES SELECTED FOR PRE COMMISSIONING TRAINING

Date of next increment under Rule 10 of CCS (Revised Pay) Rules 2016 – MoD Clarification

Date of next increment under Rule 10 of Central Civil Services (Revised Pay) Rules, 2016 - Opportunity to exercise/re-exercise option for Defence Personnel vide MoD OM dated 18.08.2023 option for Defence Personal No. 1(20)/2017-D (Pay Services)-Part IMinistry of DefenceDepartment of Military AffairsD(Pay/Services) New Delhi. the 18 August, 2023 To The Chief of the … [Read more...] about Date of next increment under Rule 10 of CCS (Revised Pay) Rules 2016 – MoD Clarification

AFFDF – Appeal of Department of Ex-Serviceman Welfare to donate minimum Rs. 200/- to Armed Forces Flag Day Fund

Armed Forces Flag Day Fund (AFFDF) Appeal of Department of Ex-Serviceman Welfare to donate minimum Rs. 200/-: DoP&T OM F.No.-A 28011/124/ 2011-Ad.III /CanteenGovernment of IndiaMinistry of Personnel, P.G. & Pensions(Department of Personnel and Training) North Block, New DelhiDated the 1st September, 2023 OFFICE MEMORANDUM Subject:- Appeal of Department … [Read more...] about AFFDF – Appeal of Department of Ex-Serviceman Welfare to donate minimum Rs. 200/- to Armed Forces Flag Day Fund

7th CPC HBA – Grant of House Building advance to Defence Service Personnel (Army, Navy and Air Force)

7th CPC House Building advance House Building advance to Defence Service Personnel (Army, Navy and Air Force) - MoD Order dated 19.06.2023 F No. 15(1)/2017/D(Pay/Services)Government of IndiaMinistry of DefenceDepartment of Military Affairs New Delhi, Dated 19.06.2023 ToThe Chief of the Army StaffThe Chief of the Air StaffThe Chief of the Naval Staff Subject: … [Read more...] about 7th CPC HBA – Grant of House Building advance to Defence Service Personnel (Army, Navy and Air Force)

Night Duty Allowance to FED re-designated to Station Officer

Night Duty Allowance to Firefighting Staff - Clarification regarding admissibility to FED re-designated to Station Officer: PCDA, Chandigarh Office of the Controller of Defence Accounts GuwahatiUdayan Vihar, Guwahati - 781171 CIRCULAR No : PAY/ORDER /CIRCULAR /VOL-II Date : 12.07.2023 To l. Area Accounts OfficeBivar Regad,Shillong -793001 2. All … [Read more...] about Night Duty Allowance to FED re-designated to Station Officer

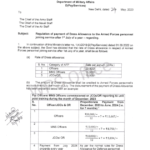

Regulation of payment of Dress Allowance to the Armed Forces personnel joining service after 1st July of a year

Armed Forces Dress Allowance Regulation of payment of Dress Allowance to the Armed Forces personnel joining service after 1st July of a year: MoD Order 24-05-2023 1(4)/2019/D (Pay/Services)Ministry of DefenceDepartment of Military AffairsD(Pay/Services) New Delhi, dated 24th May, 2023 To The Chief of the Army StaffThe Chief of the Naval StaffThe Chief of the Air … [Read more...] about Regulation of payment of Dress Allowance to the Armed Forces personnel joining service after 1st July of a year

Updation of service book (Bio data NPS option form & Part I of service book)

OFFICE OF THE CONTROLLER OF DEFENCE ACCOUNTSUDAYAN VIHAR, NARANGI, GUWAHATI - 781171Phone No. 0361- 2640394,2641142 Fax No. 0361- 2640204 No. AN/II/452/ circular/Vol-VII Date: 28.04.2023 Circular -02Personal Attention please. To The Officer-in-ChargeAll the sub-officesAll sections (Main office) Subject: Updation of service book (Bio data. NPS option form & … [Read more...] about Updation of service book (Bio data NPS option form & Part I of service book)

Latest DoPT Orders 2024

CENTRAL GOVT HOLIDAY LIST 2024

Indian Railway Holiday List 2023 PDF | Postal Holidays List 2023 India Post | Bank Holidays List 2023 India | LIC Office Holiday List 2023 PDF Download | EPFO Holiday List 2023 PDF Download | ESIC Holiday List 2023 PDF Download | CGHS Holiday Calendar List 2023 | Post Office Holidays 2023 | Railway Holidays CG Office Holidays 2023 | TN Govt Holidays 2023 | KVS Holiday List 2023-2024 PDF