Revised and consolidated Guidelines for writing Annual Performance Appraisal Reports (APARs) of top management incumbents of Central Public Sector Enterprises (CPSEs) No. 5(1)/2018-MGMTGovernment of IndiaMinistry of FinanceDepartment of Public Enterprises Public Enterprises BhawanBlock No. 14, CGO ComplexLodhi Road, New Delhi-110003 Dated: 9th October, 2023 OFFICE … [Read more...] about Revised and consolidated Guidelines for writing APARs of top management incumbents of CPSEs

CENTRAL GOVERNMENT HOLIDAY LIST 2024

| 46% DA Order for Central Government Employees wef 1st July 2023 PDF |

| CGHS Updated Rate Card PDF Download |

| Latest List of KV Schools in India |

| Expected DA 2023 |

| 7th Pay Commission Latest News 2024 |

| MACP for the Central Government Employees |

CPSE - Central Government Employees News

Finalization of Terms & Conditions and Pay Fixation of Board Level Executives – Clarification on Competent Authority

CPSEs Pay Fixation Finalization of Terms & Conditions and Pay Fixation of Board Level Executives of CPSEs- Clarification on Competent Authority: DPE, FinMin OM No.W-02/0009/ 2023- DPE (WC)-GL- XVII/2023Government of IndiaMinistry of FinanceDepartment of Public Enterprises Public Enterprises Bhawan,Block No.14, CGO Complex,Lodhi Road, New Delhi -110003.Dated, the … [Read more...] about Finalization of Terms & Conditions and Pay Fixation of Board Level Executives – Clarification on Competent Authority

Payment of DA to Board level/ below Board level executives and non-unionized supervisors following IDA scales of pay in CPSEs on 1987 and 1992 basis

F.No. W-02/0003/ 2014-DPE(WC)- GL- XVI/2023Government of IndiaMinistry of FinanceDepartment of Public Enterprises Public Enterprises BhawanBlock 14, CGO Complex,Lodi Road, New Delhi- 110003Dated: the 7th July, 2023 OFFICE MEMORANDUM Subject:- Payment of DA to Board level/below Board level executives and non-unionized supervisors following IDA scales of pay in Central … [Read more...] about Payment of DA to Board level/ below Board level executives and non-unionized supervisors following IDA scales of pay in CPSEs on 1987 and 1992 basis

Extension in prescribed timelines for writing Annual Performance Appraisal Reports of top management incumbents of CPSEs for the year 2021-2022

Extension in prescribed timelines for writing Annual Performance Appraisal Reports of top management of CPSEs for the year 2021-22 F.No. 5(1)/2018-MGMTGovernment of IndiaMinistry of FinanceDepartment of Public Enterprises Block No. 14, CGO Complex,Lodhi Road. New Delhi 110003,Dated 04th May, 2023 OFFICE MEMORANDUM Subject: Extension in prescribed timelines for … [Read more...] about Extension in prescribed timelines for writing Annual Performance Appraisal Reports of top management incumbents of CPSEs for the year 2021-2022

Payment of DA to the CDA pattern employees of CPSEs drawing pays in 7th CPC pay scales

7th CPC DA from Jan 2023: 42% DA to CDA pattern employees of CPSEs: DPE OM dated 13th April, 2023 F. No. W-02/0038/2017 -DPE (WC) -GL-X/2023Government of IndiaMinistry of FinanceDepartment of Public Enterprises Public Enterprises Bhawan,Block 14, CGO Complex, Lodi Road,New Delhi-110003,Date: the 13th April, 2023 OFFICE MEMORANDUM Subject: Payment of DA to the CDA … [Read more...] about Payment of DA to the CDA pattern employees of CPSEs drawing pays in 7th CPC pay scales

Payment of DA to Board level/below Board level executives and non-unionized supervisors following IDA scales of pay in CPSEs on 1987 and 1992 basis

IDA pattern of 1992 pay scales Payment of Dearness Allowance from 01 Apr 2023: IDA Scales of pay in CPSEs on 1987 and 1992 Basis: DPE OM dated 13.04.2023 F.No.W-02/0003/ 2014-DPE(WC) -GL-IX/2023Government of IndiaMinistry of FinanceDepartment of Public Enterprises Public Enterprises BhawanBlock 14, CGO Complex,Lodi Road, New Delhi-110003Dated: the 13 April, … [Read more...] about Payment of DA to Board level/below Board level executives and non-unionized supervisors following IDA scales of pay in CPSEs on 1987 and 1992 basis

Extension in prescribed timelines for writing Annual Performance Appraisal Reports (APARs) of top management incumbents of CPSEs for the year 2021-2022

Extension in prescribed timelines for writing APARs of top management incumbents of CPSEs for the year 2021-2022 F. No. 5(1)/2018 -MGMTGovernment of IndiaMinistry of FinanceDepartment of Public Enterprises Block No. 14, CGO Complex,Lodhi Road, New Delhi 110003,Dated 09th March, 2023 OFFICER MEMORANDUM Subject: Extension in prescribed timelines for writing Annual … [Read more...] about Extension in prescribed timelines for writing Annual Performance Appraisal Reports (APARs) of top management incumbents of CPSEs for the year 2021-2022

Extension in prescribed timelines for writing APARs of top management incumbents of CPSEs for the year 2021-2022

Annual Performance Appraisal Reports Extend the timelines for writing APARs of top management incumbents of CPSEs for the year 2021-2022 F.No. 5(1)/2018-MGMTGovernment of IndiaMinistry of FinanceDepartment of Public Enterprises Block No. 14, CGO Complex,Lodhi Road, New Delhi-110003,Dated 27th December, 2022 OFFICE MEMORANDUM Subject: - Extension in prescribed … [Read more...] about Extension in prescribed timelines for writing APARs of top management incumbents of CPSEs for the year 2021-2022

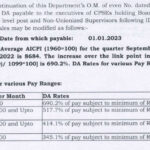

DA Rates for various Pay Ranges from 01.01.2023 CPSEs

IDA scales of pay in CPSEs F.No.W-02/0003/ 2014-DPE(WC) -GL-IV/2023Government of IndiaMinistry of FinanceDepartment of Public Enterprises Public Enterprises BhawanBlock 14, CGO Complex,Lodi Road, New Delhi - 110003Dated: the 4th January, 2023 OFFICE MEMORANDUM Subject:- Payment of DA to Board level/ below Board level executives and non-unionized supervisors … [Read more...] about DA Rates for various Pay Ranges from 01.01.2023 CPSEs

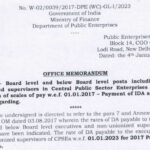

Payment of IDA at revised rates CPSEs Revision of scales of pay w.e.f. 1st Jan 2017

IDA from 1st January 2023 The rate of DA payable to the executives and non-unionized supervisors of CPSEs w.e.f. 01.01.2023 for 2017 Pay Scales is 37.2%. No. W-02 /0039/2017-DPE (WC)-GL-1/2023Government of IndiaMinistry of FinanceDepartment of Public Enterprises Public Enterprises BhawanBlock 14, CGO Complex,Lodi Road, New Delhi -110003Dated: the 4th January, … [Read more...] about Payment of IDA at revised rates CPSEs Revision of scales of pay w.e.f. 1st Jan 2017

Latest DoPT Orders 2024

CENTRAL GOVT HOLIDAY LIST 2024

Indian Railway Holiday List 2023 PDF | Postal Holidays List 2023 India Post | Bank Holidays List 2023 India | LIC Office Holiday List 2023 PDF Download | EPFO Holiday List 2023 PDF Download | ESIC Holiday List 2023 PDF Download | CGHS Holiday Calendar List 2023 | Post Office Holidays 2023 | Railway Holidays CG Office Holidays 2023 | TN Govt Holidays 2023 | KVS Holiday List 2023-2024 PDF