DOE

RULES FOR DEPOSIT OF GIFTS RECEIVED BY GOVERNMENT FUNCTIONARIES FROM DOMESTIC/UNKNOWN SOURCES – 2019

MINISTRY OF FINANCE

(DEPARTMENT OF EXPENDITURE)

New Delhi, the 1st August 2019

RULES FOR DEPOSIT OF GIFTS RECEIVED BY GOVERNMENT FUNCTIONARIES FROM DOMESTIC/UNKNOWN SOURCES – 2019

No. 25(23)/ E.Coord/ 2018 –

1. SHORT TITLE, COMMENCEMENT AND APPLICATION

- These rules may be called Rules for deposit of gifts received by Government functionaries from Domestic / Unknown sources – 2018.

- They shall come into force from the date on which these rules are notified.

- These rules shall apply to every person appointed to a civil service or posts (including a civilian in Defence Service) in connection with affairs of the Union.

- A strong room – Upahar Sangrahalaya will be established in the O/o Controller General of Accounts, D/o Expenditure, Ministry of Finance for deposit of gifts received by Government Functionaries from domestic / unknown sources.

2. Receipt of gifts by the Government Functionaries from domestic / unknown sources shall be governed by these rules. Provided receipt of gifts by the Government Functionaries from foreign sources / foreign government would continue to be governed by the Toshakhana Rules of Ministry of External Affairs.

3. GIFTS TO BE DEPOSITED IN THE UPAHAR SANGRAHALAYA

- Save as or otherwise provided in other parts of these rules, in cases where sanction of government is refused under CCS(Conduct) Rules or AIS (Conduct) Rules or any other corresponding rules, Government Functionaries shall not accept such gifts. However, the gifts which have been accepted and sanction is refused later on, shall be deposited in Upahar Sangrahalaya. Further, the gifts, which can be accepted in certain situations but cannot be retained, shall also be deposited in Upahar Sangrahalaya.

- The gifts received by the Government Functionaries from near relatives and personal friends on social occasions under rule 13(2) of CCS (Conduct) Rules, rule 11 (1) of AIS (Conduct) Rules and any other applicable rules shall not form part of these rules.

- The decision regarding disposal of articles of gifts deposited in the Upahar Sangrahalaya under clause

- will be taken by the Jt. Controller General of Accounts (Administration), Upahar Sangrahalaya, O/o CGA, D/o Expenditure, M/o Finance. Upahar Sangrahalaya, may at the discretion allow the recipient of the gift, the first option of purchasing them at the value fixed by the Upahar Sangrahalaya, O/o CGA, D/o Expenditure, M/o Finance.

- The gifts which are not of symbolic nature (i.e. which are of representative in nature of the State/Post) can be retained by Government Functionaries if the value thereof does not exceed the ceiling fixed by the Government of India.

- Gifts of such nature that are not covered under these rules shall continue to be governed by the corresponding extent rules as applicable to the Government Functionary concerned.

4. ARTICLES ONLY TO BE RECEIVED INTO UPAHAR SANGRAHALAYA THROUGH ACCOUNTS OFFICER (ADMINISTRATION) AND IN-CHARGE UPAHAR SANGRAHALAYA

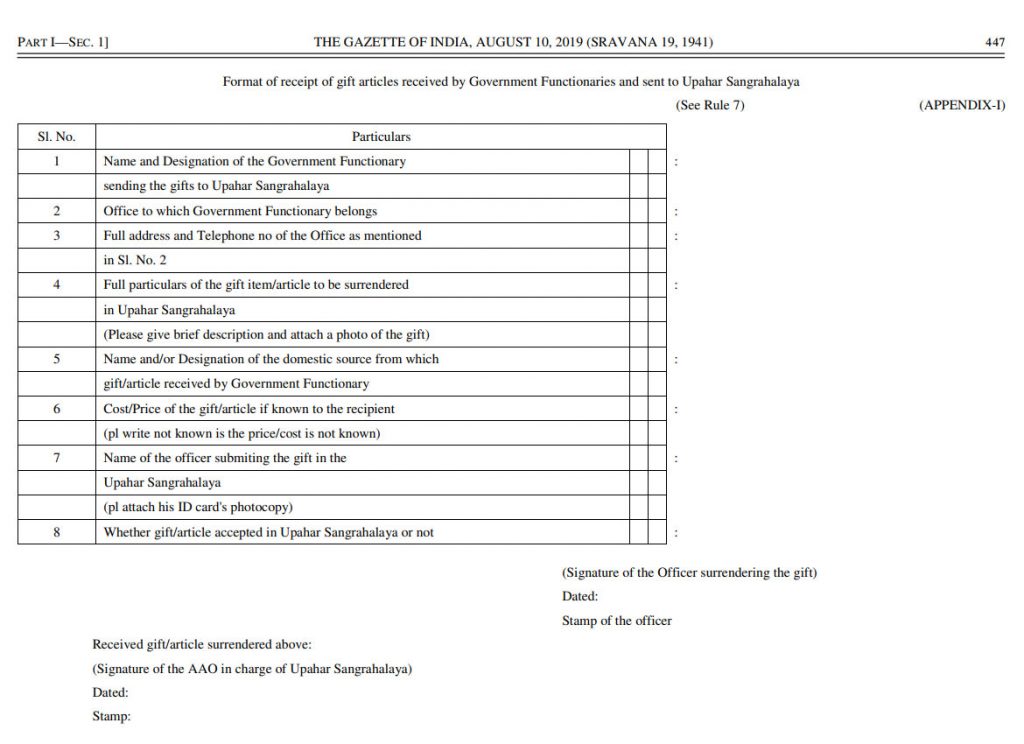

No articles may be received in the Upahar Sangrahalaya except through the Accounts Officer (Administration) and Assistant Accounts Officer (Upahar Sangrahalaya), who will see that a receipt for every article (Appendix I), describing in details as far as possible, is given to the person or section concerned. There shall be a printed receipt book, and receipt shall be made in triplicate. One copy will be given to the person sending the articles to the Upahar Sangrahalaya, another copy will be the authority for the Assistant Accounts Officer (Upahar Sangrahalaya) to receive the articles and the third copy will be the office copy for the Accounts Officer (Administration) who will, with the help of this copy, check and close the stock book on monthly basis.

5. JEWELLERY AND VALUABLES

Articles of jewellery and other valuables shall be kept in a safe or strong iron bound box with two locks, the key of one of which shall be in the custody of the Accounts Officer (Administration), O/o CGA, D/o Expenditure, M/o Finance and the other in the custody of Assistant Accounts Officer (Upahar Sangrahalaya)

6. COINS AND BULLION

Gold coins of Government mintage received in the Upahar Sangrahalaya are not to be treated as cash, but as stores and entered in the Stock Register and made over to the Security Printing & Minting Corporation of India Limited (SPMCIL). All gold and silver bullion and other kinds of coins should also be sent to the SPMCIL.

7. ANIMALS GIFTED

When animals form part of gifts, they should be made over to the nearest Army Service Corps, or handed over to the nearest Zoological Gardens by the recipients. Upahar Sangrahalaya in the O/o CGA would not accept animals gifted.

8. VALUATION OF ARTICLES DEPOSITED IN THE UPAHAR SANGRAHALAYA

All articles received in the Upahar Sangrahalaya shall be valued as soon as possible, and in any case, within a fortnight of receipt by a Board consisting of Joint Controller General of Accounts (Administration), Deputy Controller General of Accounts (Administration) and Accounts Officer (Administration) in consultation with the Customs Appraiser/Valuer as and when required. The value assessed by the Board/Valuer shall be treated as the fair price of the article. Before entering the value of articles in the Stock Register, the written orders of the Board must be secured for each valuation.

9. PURCHASE GRANTS AND GIFTS FOR DISTRIBUTION

Whenever an officer receives articles from the Upahar Sangrahalaya for presentation, or a special grant for the purchase of gifts, he shall be required to render a precise account of the manner in which he disposes off the articles received or purchased by him. Orders to this effect should be communicated to the officer concerned in every case where Upahar Sangrahalaya gifts are provided or their purchase sanctioned.

10. SALES OF ARTICLES FROM UPAHAR SANGRAHALAYA

- Upahar Sangrahalaya articles such as jewellery etc. which are not likely to be required for use or for display as laid down in Rule 14 of these rules, may be sold at their book value to anybody (an individual, a firm, a company or an association of persons) by Accounts Officer (Administration). Where an article has been in the Upahar Sangrahalaya for more than two years, it should be got revalued by the Board constituted in Rule 11 of these rules before it is sold by the Accounts Officer (Administration). The assistance of a Scheduled Bank may be necessary for the disposal of gold/diamond articles. The approval of the Board ibid must be obtained in all cases where it is proposed to sell articles at reduced price.

- Such of the remaining articles as are not likely to be required for presentation, or which are not needed for disposal under Rule 14, may in special cases, be sold by auction in the manner prescribed in sub-rule (iii) below.

- The procedure for the conduct of auction shall be as follows:-

- (a) The auction shall be conducted on Government e-Auction System (https://eauction.gov.in) by O/o Controller General of Accounts, Department of Expenditure, Ministry of Finance shall be open to all citizens of India.

- (b) Articles brought to auction of shall be disposed off at the first e-auction provided, the value appraised (including customs duty) by the Customs Appraiser/Valuer and the Board constituted under Rule 11, is realised. Should such value not be realised, they shall be brought to e-auction a second time whereupon they shall be sold to the highest bidder. In addition, a reserve price will also be fixed for such articles when brought to e-auction for the second time. In case when this reserve price is not realised even at the second auction the goods may be put to e-auction again after six months on Government e-Auction System.

- Sale proceeds of the articles disposed off in accordance with these shall be credited at once into the Government Account as miscellaneous receipts of Upahar Sangrahalaya.

11. DISPOSAL OF ARTICLES BY TRANSFER/LOAN FROM UPAHAR SANGRAHALAYA

Upahar Sangrahalaya articles may also be disposed off by way of giving on loan or transferred temporarily or permanently from Upahar Sangrahalaya stores under the orders of Joint Controller General of Accounts (Administration) for use in the Rashtrapati Bhawan, New Delhi; Rashtrapati Niwas, Shimla; Vice President’s Secretariat, Prime Minister’s Official Residence, New Delhi, the various Museums at Delhi and Government Departments. In addition, the items may be displayed in sealed glass enclosures at prominent spaces (corridors/meeting halls etc.) in Ministries/Departments of Central Government to whom the items have been loaned or permanently transferred. In addition, Upahar Sangrahalaya articles may also be given as gifts or loaned to Autonomous Bodies, Charitable Institutions and leading institutions and organizations under the control of Government for display as exhibits. Receipts for articles transferred/loaned or received back should be obtained/given in all cases.

12. UPAHAR SANGRAHALAYA BOOKS AND REGISTERS

The Assistant Accounts Officer, (Administration) shall maintain:-

- An EVALUATION REGISTER in the prescribed format (Appendix-II) would be kept in the Upahar Sangrahalaya for the entry of gifts received from Government Functionaries for evaluation (if required) as soon as the articles are received. After valuation, all articles received shall be brought in the Stock of Upahar Sangrahalaya and taken into the Stock Register. No article shall be issued without the written authority of the Accounts Officer/Assistant Accounts Officer in-charge of Upahar Sangrahalaya.

- A STOCK REGISTER in the prescribed format (Appendix -III) would be kept for the receipt of articles after evaluation, through EVALUATION REGISTER. This Register would record transactions relating to the receipt, issue and disposal of gifts. All articles received shall be brought on the Stock Register. No article shall be issued without the written authority of the Accounts Officer/Assistant Accounts Officer (Upahar Sangrahalaya).

- The details of the payments made for the article at the time of disposal would be entered in Stock Register.

13. MONTHLY CHECKING OF ACCOUNTS AND STOCK REGISTER

In the last day of every Month or, if that falls on a Sunday or a holiday, on the previous day, the Accounts Officer (Upahar Sangrahalaya) shall examine and sign the Stock Register.

14. UPAHAR SANGRAHALAYA SECURITY

The Upahar Sangrahalaya would be in a Strong Room which shall be under double lock. The room shall be secured by grills on the Windows and Door. Closed circuit cameras must be installed in the Upahar Sangrahalaya Strong Room. Security Agency responsible for security of Mahalekha Niyantrak Bhawan may be deputed for its security. The key of one lock will be in the possession of the Accounts Officer (Administration), O/o CGA, while that of the other lock will be kept by Assistant Accounts Officer (Upahar Sangrahalaya), O/o CGA. A duplicate set of these keys shall be lodged with the Joint Controller General of Accounts (Administration), O/o CGA, D/o Expenditure, M/o Finance. They should be examined annually and a certificate to that effect recorded by the Accounts Officer (Administration), O/o CGA in the register of duplicate keys.

15. RESPONSIBILITY OF ASSISTANT ACCOUNTS OFFICER (UPAHAR SANGRAHALAYA)

Subject to the control and supervision of the Accounts Officer (Administration), the Assistant Accounts Officer (Upahar Sangrahalaya), will be held responsible for the safety of all cash and store, the property of Government placed in his charge and for their preservation from rust, dampness, worms and moth etc.

16. SECURITY TO BE FURNISHED BY ASSISTANT ACCOUNTS OFFICER (UPAHAR SANGRAHALAYA)

To safeguard against loss to Upahar Sangrahalaya property, due to negligence or fraud, the Assistant Accounts Officer (Upahar Sangrahalaya), shall furnish security of Rs. 10,000/- in Government paper in the name of the Controller General of Accounts, Department of Expenditure, Ministry of Finance as required under General Financial Rules. The interest accruing on this security shall be payable to the Assistant Accounts Officer (Upahar Sangrahalaya) as it becomes due and provided there are no claims against him.

17. AUDIT OF STORES AND REGISTERS

The Stores and Registers referred to in these Rules will be subject to Internal Audit annually by the Internal Audit Wing, O/o Chief Controller of Accounts, Ministry of Finance, Department of Expenditure. The Stores and Registers shall also be subject to the statutory audit by the C&AG of India.

18. VERIFICATION OF STORES

For the purpose of ready reference and physical verification, a label or stock card will be maintained with each article or class of articles in store. The stock card should also indicate whether duty has been paid on its importation into the Country or not.All articles in stores shall be physically verified at least once a year by an Accounts Officer in the Office of CGA other than Accounts Officer (Administration) working in the O/o CGA, D/o Expenditure, Ministry of Finance. It is not necessary that all the articles should be verified at one time, verification may be done gradually throughout the year. The result of verification shall immediately be entered in the Stock Register under the dated initials of the Accounts Officer, which in the case of shortages, should be communicated to the C&AG’s External Audit Team at the time of Audit.

19. INTERPRETATION

Where any doubt arises as to the interpretation of these rules, it shall be referred to the Government in the Office of Controller General of Accounts, Department of Expenditure for decision.

ANNIE G. MATHEW

Additional Secretary

Source: DoE