Implementation of the recommendations of 7th CPC – Grant of Special Compensatory Allowance subsumed under TLA

File No.No.6-23(02)/2019-PAT

F No.6-23(02)/2019-PAT

Government of India

Ministry of Communications

Department of Telecommunications

Sanchar Bhawan, 20, Ashoka Road,

New Delhi -110001

Dated: 07/02/2019

CIRCULAR No. 103

Subject: Implementation of the recommendations of 7th Central Pay Commission – Grant of Special Compensatory Allowances subsumed under Tough Location Allowance – reg.

The undersigned is directed to forward herewith a copy of Ministry of Finance, Department of Expenditure OM No.3/1/2017-E. II (B) dated 17th January, 2019 on the subject cited above for information/ necessary action and O.M. of even number dated 19th July, 2017 has already been circulated vide this office No.31 bearing No.6-23(11)/2017-PAT dated 01/08/2017 ( copy enclosed)

Encl: As above.

(Patanjali Prakash)

Assistant Director General (PAT)

Phone:23036245

No.3/1/2017-E,II(B)

Government of India

Ministry of Finance

Department of Expenditure

New Delhi, the 19th July, 2017.

OFFICE MEMORANDUM

Subject: Implementation of the recommendations of 7th Central Pay Commission – Grant of Special Compensatory Allowances subsumed under Tough Location Allowance.

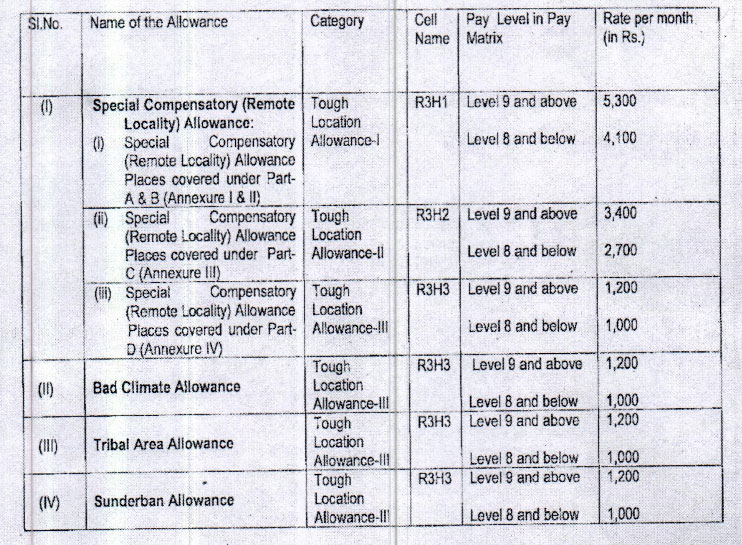

Consequent upon the acceptance of the recommendations of Seventh Central Pay Commission, in supersession of the existing orders for grant of Special Compensatory Allowances viz. Special Compensatory (Remote Locality) Allowance, Bad Climate Allowance, Special Compensatory Scheduled /Tribal Area Allowance and Sunderban Allowance which have been subsumed In Tough Location Allowance, the President is pleased to decide the rates of these Special Compensatory Allowances (subsumed in Tough Location Allowance) to Central Government employees as under :

- These rates shall increase by 25 per cent whenever the Dearness Allowance payable on the revised pay structure goes up by 50 per cent.

- The term ‘Pay Level‘ in the revised pay structure mean the ‘Level in the Pay Matrix.

- In respect of those employees who opt to continue in their pre-revised pay structure/Pay scales, the corresponding Level in the Pay Matrix of the post occupied on 01.01.2016 as indicated in CCS (Revised Pay) Rules, 2016 would determine the allowance under these orders.

- Sunderban Allowance categorised ‘as Tough Location Allowance-III shall be admissible to the Central Government civilian employees working in Sunderban areas South of Dampier Hodge’s llne, namely, Bhagatush Khali (Rampura), Kumlrmari (Bagna), Jhlnga Khali, Sajnakhali, Gosaba, Amlamathi (Bidya), Canning, Kultall, Plyali, Nalgaraha, Raidighi, Bhanchi, Pathar Paratlma, Bhagabatpur, Saptamukhl, Namkhane, Sikarpur, Kakdwlp, Sagar 1 Mouslni, Kalinagar, Haroa, Hlngalganj, Basanti, Kuemari, Kultola, Ghuslghata (Kulti) area. The allowance shall be admissible only upto the period for which the Government of West Bengal continues to pay this allowance to its employees.

- Scheduled tribal Area Allowance and Bad Climate Allowance categorise Tough Location Allowance III shall be admissible only in those States where Scheduled/ Tribal Area Allowance and Bad Climate Allowance are admissible and shall be discontinued in those States where it has been discontinued for the State Government employees with effect from the date(s) of such discontinuance.

- In the event of a place falling In more than one category, the higher rate of Tough Location Allowance will be applicable.

- Tough Location Allowances shall not be admissible along with Special Duty Allowance. However, employees have the option for continuing Special Compensatory (Remote Locality) allowance at old. rates of 6th CPC. where it was admissible, along with Special Duty Allowance at revised rate of 10% ·of Basic Pay. ·

- Employees may exercise their option to choose either Hard Area Allowance which Is admissible alongwith Island Special Duty Allowance or one of the Special Compensatory Allowance, subsumed under Tough Location Allowance as mentioned in Para 1 above ..

- These orders take effect from 1st July, 2017.

- These orders shall also apply to the civilian employees paid from the Defence Services Estimates and the expenditure will be chargeable to the relevant head of the Defence Services Estimates. In regard to Armed Forces personnel and Railway employees, separate orders will be issued by the Ministry of Defence and Ministry of Railways, respectively.

- In so far as the employees working in the Indian Audit and Accounts Department are concerned, these orders are issued with the concurrence of the Comptroller and Auditor General of India.

Hindi version is attached.

Leave a Reply