Grant of notional increment (as due on 1st Jan./ 1st July) to the officers/ employees superannuated on 31st Dec./ 30th June and revision of pensionary benefits: CPWD

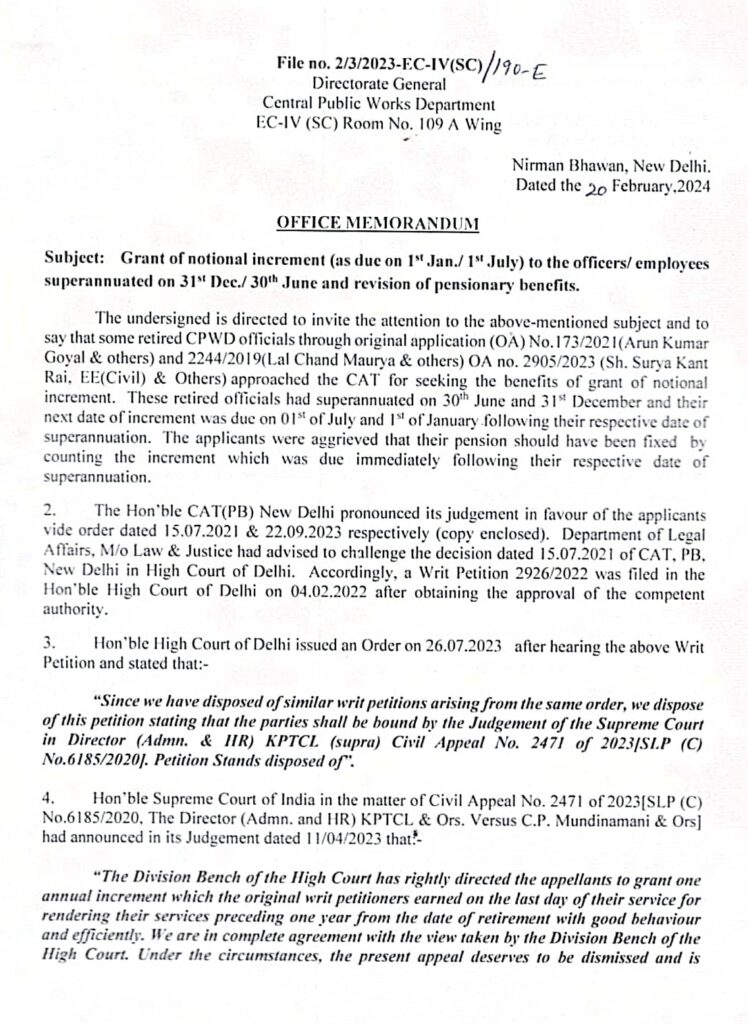

File no. 2/3/2023-EC-IV(SC) /190-E

Directorate General

Central Public Works Department

EC-IV (SC) Room No. 109 A Wing

Nirman Bhawan, New Delhi.

Dated the 20 February.2024

OFFICE MEMORANDUM

Subject: Grant of notional increment (as due on 1st Jan./ 1st July) to the officers/ employees superannuated on 31st Dec./ 30th June and revision of pensionary benefits.

The undersigned ts directed to invite the attention to the above-mentioned subject and to say that some retired CP WD officials through original application (OA) No.173/2021 (Arun Kumar Goyal & others) and 2244/2019 (Lal Chand Maurya & others) OA no. 2905/2023 (Sh. Surva Kant Rai. EE(Civil) & Others) approached the CAT for seeking the benefits of grant of notional increment. These retired officials had superannuated on 30th June and 31st December and their next date of increment was due on 01st of July and 01st of January following their respective date of superannuation. The applicants were aggrieved that their pension should have been fixed by counting the increment which was due immediately following their respective date of superannuation.

2. The Hon’ble CAT(PB) New Delhi pronounced its judgement in favour of the applicants vide order dated 15.07.2021 & 22.09.2023 respectively (copy enclosed). Department of Legal Affairs, M/o Law & Justice had advised to challenge the decision dated 15.07.2021 of CAT, PB. New Delhi in High Court of Delhi. Accordingly, a Writ Petition 2926/2022 was filed in the Hon’ble High Court of Delhi on 04.02.2022 after obtaining the approval of the competent authority.

3. Hon’ble High Court of Delhi issued an Order on 26.07.2023 after hearing the above Writ Petition and stated that:-

“Since we have disposed of similar writ petitions arising from the same order, we dispose of this petition stating that the parties shall be bound by the Judgement of the Supreme Court in Director (Admn. & HR) KPTCL (supra) Civil Appeal No. 2471 of 2023{[SLP (C) No.6185/2020). Petition Stands disposed of”.

4, Hon’ble Supreme Court of India in the matter of Civil Appeal No. 2471 of 2023[ SLP (C) No.6185/2020, The Director (Admn. and HR) KPTCL & Ors. Versus C.P. Mundinamani & Ors] had announced in its Judgement dated | 1/04/2023 that*

“The Division Bench of the High Court has rightly directed the appellants to grant one annual increment which the original writ petitioners earned on the last day of their service for rendering their services preceding one year from the date of retirement with good behaviour and efficiently. We are in complete agreement with the view taken by the Division Bench of the High Court. Under the circumstances, the present appeal deserves to be dismissed and is accordingly dismissed. However, in the facts and circumstances of the case, there shall be no order as to costs. 1.A. No. 149091/2022 stands disposed of in terms of the above”.

5. Since the order dated 26.07.2023 of the Delhi High Court referred to the Judgement of Supreme Court (Civil Appeal No. 2471 of 2023[SLP (C) No.6185/2020) and keeping in view the vast implications of the implementation of the judgement, it was decided to refer the matter to DoPT being the Nodal Department for seeking their comments/ advice through MoHUA tor furthers order in this case.

6. DoPT in its observation stated that “The matter has been examined in this Department. It is advised that in the instant case MoHUA may, in consultation with D/o Legal Affairs, take an administrative decision regarding compliance of the Order dated 26.07.2023 of the Hon’ble High Court of Delhi referred above.”

7. As per the advice of DoPT the matter was again referred to DOLA for its advice wherein DOLA advised as under:-

“Since the case at hand raises identical issue as that in the case of the KPTCL v. CP. Mundinamani, 2023 SCC Online SC 401 which has been decided in favour of the applicants by the Hon’ble Supreme court and has attained finality, it would not be a fit case for preferring an SLP against order dated 26.07.2023 passed by the Hon’ble High Court, Dethi and it is further advised that the order be implemented at the earliest so that there is no contempt proceedings initiated against the department.“

8. Accordingly, the matter was sent for the approval of Mo HUA (being the competent authority) for implementing the CAT Judgement dated 15.07.2021 & 22.09.2023. The MoHUA has approved the implementation of judgement of CAT in respect of CPWD petitioners for granting of one notional increment to the petitioners vide efile No. 9110820 dated 09/02/2024.

9. Therefore, the concerned offices of CPWD where the CPWD petitioner were posted at the time of their retirement, are advised to implement the Judgement of the CAT in its order (for OA NO. 173/2021; OA No. 2244/2019 and OA No. 2905/2023) dated 15.07.2021 & 22.09.2023 for all those CPWD officials who were party in this matter(list attached), after verification of the records of the petitioners.

10. This issues with the approval of Competent Authority.

(Kamkhanmang Palte)

Deputy Director (Admin.)-III

Copy to: (Through CPWD website)

Leave a Reply