DoPT: The Fundamental Amendment Rules 2018 – Amendment in FR 22(I)(a)(1)

MINISTRY OF PERSONNEL, PUBLIC GRIEVANCES AND PENSIONS

(Department of Personnel and Training)

New Delhi, the 19th November, 2018

1. (1) These rules maybe called the Fundamental (Amendment) Rules, 2018.

(2) They shall come into force on the date of their publication in the Official Gazette.

2. In the Fundamental Rules. 1922, in rule 22. in sub-rule (1), in clause (a). for sub-clause (I). the following sub-clause shall be substituted, namely:-

“(1) where a Government servant holding a post, other than a tenure post, in a substantive or temporary or officiating capacity is promoted or appointed in a substantive. temporary or officiating capacity, as the case may be, subject to the fulfillment of the eligibility conditions as prescribed in the relevant Recruitment Rules, to another post carrying duties and responsibilities of greater importance than those attaching to the post held by him, his initial pay in the time-scale shall be fixed by giving one increment in the level from which the Government servant is promoted and he or she shall be placed at a cell equal to the figure so arrived at in the level of the post to which promoted or appointed and if no such cell is available in the level to which promoted or appointed, he shall be placed at the next higher cell in that level.

Save in cases of appointment on deputation to an ex cadre post. or to a post on ad hoc basis or on direct recruitment basis, the Government servant shall have the option, to be exercised within one month from the date of promotion or appointment, as the case may be, to have the pay fixed under this rule from the date of such promotion or appointment or to have the pay fixed initially at the next higher cell in the level of the post to which he or she is promoted on regular basis and subsequently, on the date of accrual of next increment in the level of the post from which Government Servant is promoted, his pay shall be re-fixed and two increments (one accrued on account of annual Increment and the second accrued on account of promotion) shall be granted in the level from which the Government Servant is promoted and he or she shall be placed. at a cell equal to the figure so arrived, in the level of the post to which he or she is promoted; and if no such cell is available in the level to which he or she is promoted, he or she shall be placed at the next higher cell in that level.

In cases where an ad hoc promotion is followed by regular appointment without break, the option is admissible from the date of initial appointment or promotion. to he exercised within one month from the date of such regular appointment.

In cases where an officer has retired as ad hoc before being regularised to that post and later on has been assessed during the process of regularisation and found fit by the competent authority along with his or her juniors, who are still in service and are eligible to avail of the option facility from a date on which the retired employee was still in service, the same option facility shall also be extended to the retired employee, to be exercised within three months from the date when his or her junior became eligible to avail of option facility and in cases where such retired employee was

himself the junior most, he or she may exercise the option facility within three months from the date when his or her immediate senior became eligible to avail of option facility:

Provided that where a Government servant is immediately before his promotion or appointment on regular basis to a higher post, drawing pay at the maximum of the level of the lower post, his initial pay in the level of the higher post shall be fixed at the cell equal to the figure so arrived at in the level of the post to which promoted or appointed by increasing his pay in respect of the lower post held by him on regular basis by an amount equal to the last increment in the level of the lower post and if no such cell is available in the level to which he is promoted or appointed, he shall be placed at the next higher cell in that level.”

[F.No. 13/1/20 17-Estt.(Pay-I)]

RAJEEV BAHREE, Under Secy.

Note: The Fundamental Rules came into force from 1st January, 1922 and these rules were amended earlier as per details below:-

1. Ministry of Finance Notification No.2(9)-E.III/61 dated 01.02.1963;

2. Ministry of Finance Notification No.1(1 )-E.III(A)/65 dated 20.02.1965;

3. Ministry of Finance Notification No. l(25)-E.IlI(a)/64 dated 30.11.1965;

4. Ministry of Finance Notification No. F.1(25)-E.ITT(A)/64 dated 01.10.1966;

5. Ministry of Finance Notification No. I (3)-E.TTI(a)/64-Pt.1I dated 18.07.1967;

6. Ministry of Finance Notification No. I (6)-E.TII(A)/68 dated 26.04.1968;

7. Ministry of Finance Notification No. l(25)-E.IIJ(A)/64 dated 27.05.1970;

8. Ministry of Finance Notification No. 18(13)-E.IV(A)/70 dated 29.01.1971;

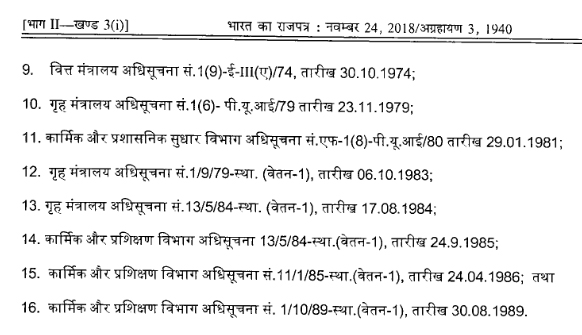

9. Ministry of Finance Notification No. l(9)-E.1II(A)/74 dated 30.10.1974;

10. Ministry of Home Affairs Notification No. l(6)-P.U.1179 dated 23.11.1979;

11. Department of Personnel and Administrative Reforms Notification No. F. I (8)-P.U.T/80 dated 29.01.1981;

12. Ministry of Home Affairs Notification No. l/9/79-Estt.(Pay-I) dated 06.10.1983;

13. Ministry of Home Affairs Notification No.1 3/5/84-Estt.(Pay-T) dated I 7.08.1984;

14. Department of Personnel and Training Notification No. I3/5/84-Estt.(Pay-I) dated 24.09.1985;

15. Department of Personnel and Training Notification No. Il/I /85-Estt.(Pay-t) dated 24.04.1986; and

16. Department of Personnel and Training Notification No. I / I 0/89-Estt.(Pay-I) dated 30.08.1989.

Source: DoPT

Leave a Reply