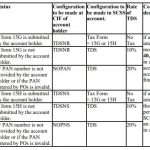

Senior Citizen Savings Scheme Even after submitting form 15G/15H for the current Financial Year, TDS has been deducted from SCSS account holders' interest payments. SB Order No. 37/2021 F. No. FS-13/7/2020-FSGovernment of IndiaMinistry of CommunicationsDepartment of Posts(Financial Services Division) Dak Bhawan New Delhi-110001Dated: 22.11.2021. To, All Head … [Read more...] about Deduction or Non-deduction of TDS in SCSS accounts in post office

| 46% DA Order for Central Government Employees wef 1st July 2023 PDF |

4% DA for Central Government Employees wef 1st July 2023

Railway Employees Bonus 2023

Bonus for central government employees 2023 pdf

CENTRAL GOVERNMENT HOLIDAY LIST 2024

| 42% DA Order for Central Government Employees wef 1st January 2023 PDF |

| 42% DR Order for Central Government Pensioners wef 1st January 2023 PDF |

TDS

Central Government relaxes TDS restrictions under section 194A of the Income tax Act 1961 – CBDT

Section 194 of income tax act 1961 - Central Government relaxes TDS restrictions under section 194A of the Income-tax Act, 1961. MINISTRY OF FINANCE(Department of Revenue)(CENTRAL BOARD OF DIRECT TAXES) NOTIFICATION New Delhi, the 17th September, 2021 INCOME TAX S.O. 3815(E). - In exercise of the powers conferred by sub-section (1F) of section 197A of the … [Read more...] about Central Government relaxes TDS restrictions under section 194A of the Income tax Act 1961 – CBDT

Non-deduction of income tax at source from a gallantry awardee’s pension: CPAO

Non-Deduction of Income Tax at source from Pension in respect of Gallantry Awardee GOVERNMENT OF INDIADEPARTMENT OF EXPENDITURECENTRAL PENSION ACCOUNTING OFFICETRIKOOT-II, BHIKAJI CAMA PLACE,NEW DELHI-1 10006 No. CPAO/IT&Tech/Gallantry Award/26/2020-21/06 Dated- 12.05.2021 Office Memorandum All the Authorized Banks involved in disbursement of pension are to … [Read more...] about Non-deduction of income tax at source from a gallantry awardee’s pension: CPAO

If interest on a housing loan is claimed under Section 24(b) of the Income Tax Act for FY2020-21, the lender’s (bank’s) PAN is required.

If interest on a housing loan is claimed under Section 24(b) of the Income Tax Act for FY2020-21, the lender's (bank's) PAN is required. PAN of lender (PAN of Bank) required, if interest on housing loan is claimed under Section 24(b) of Income Tax for FY 2020-21 Principal Controller of Defence Accounts(Central Command)Cariappa Road, Lucknow Cantt.-226002 No … [Read more...] about If interest on a housing loan is claimed under Section 24(b) of the Income Tax Act for FY2020-21, the lender’s (bank’s) PAN is required.

CBDT clarifies the TDS provisions on Mutual Fund dividend

Ministry of FinanceCBDT issues clarification on the applicability of TDS provisions on Mutual Fund dividend 04 FEB 2020 The Finance Bill, 2020 proposed to remove Dividend Distribution Tax (DDT) at the level of Company/ Mutual Fund and proposed to tax the same in the hands of share/ unit holder. It was also proposed to levy TDS at the rate of 10% on the dividend/ income … [Read more...] about CBDT clarifies the TDS provisions on Mutual Fund dividend

Deduction of TDS in respect of Cash Withdrawal above One Crore by a National Savings Schemes account holder – DoP

Deduction of TDS in respect of Cash Withdrawal above One Crore by a National Savings Schemes account holder - DoP SB Order No. 02/2020 F.No 109-27/2019-SBGovt. of India Ministry of CommunicationDepartment of Posts (F.S. Division) Dak Bhawan, New Delhi-110001 Dated: 09.01.2020 To, All Head of Circles / Regions Addl. Director General, APS, New Delhi Subject :- … [Read more...] about Deduction of TDS in respect of Cash Withdrawal above One Crore by a National Savings Schemes account holder – DoP

Income Tax department revises the Form 16 TDS certificate format issued by employers

Income Tax department revises the (Form 16) TDS certificate format issued by employers The Income Tax department has revised Form 16 by adding various details, including income from house property and remuneration received from other employers, thereby making it more comprehensive to help check tax avoidance. It will also include segregated information regarding … [Read more...] about Income Tax department revises the Form 16 TDS certificate format issued by employers

Central Board of Direct Taxes (CBDT) clarifies regarding issue of Prosecution Notices

Ministry of Finance Central Board of Direct Taxes (CBDT) clarifies regarding issue of Prosecution Notices 21 JAN 2019 The Central Board of Direct Taxes (CBDT) has stated that certain news items that appeared in a section of media regarding enmasse issue of prosecution notices to small companies for TDS default are completely misleading and full of factual inaccuracies. CBDT … [Read more...] about Central Board of Direct Taxes (CBDT) clarifies regarding issue of Prosecution Notices

Calculation of Income tax an Employee Below 60 Age A.Y.2018-19

Calculation of Income tax an Employee Below 60 Age A.Y.2018-19 ANNEXURE-I SOME ILLUSTRATIONS Example 1 For Assessment Year 2018-19 (A) Calculation of Income tax in the case of an employee(Male or Female) below the age of sixty years and having gross salary income of: i) Rs.2,50,000/- , ii) Rs.5,00,000/- , iii) Rs.10,00,000/- iv) Rs.55,00,000/-. and v) … [Read more...] about Calculation of Income tax an Employee Below 60 Age A.Y.2018-19

Deduction of TDS in respect of Senior Citizens who have Invested In Sr.Citizen Savings Scheme

Deduction of TDS in respect of Senior Citizens who have Invested In Sr.Citizen Savings Scheme F.No 79-01/2016-SB Government of India Ministry of Communications Department of Posts DakBhawan, Sansad Marg, New Delhi-110001 Date: 29.06.2018 To All Heads of Circles/Regions Addl. Director General, APS, New Delhi. Subject - Deduction of TDS in respect of Senior … [Read more...] about Deduction of TDS in respect of Senior Citizens who have Invested In Sr.Citizen Savings Scheme

Latest DoPT Orders 2023

CENTRAL GOVT HOLIDAY LIST 2023

Indian Railway Holiday List 2023 PDF | Postal Holidays List 2023 India Post | Bank Holidays List 2023 India | LIC Office Holiday List 2023 PDF Download | EPFO Holiday List 2023 PDF Download | ESIC Holiday List 2023 PDF Download | CGHS Holiday Calendar List 2023 | Post Office Holidays 2023 | Railway Holidays CG Office Holidays 2023 | TN Govt Holidays 2023 | KVS Holiday List 2023-2024 PDF