भारतीय प्रतिरक्षा मजदूर संघBharatiya Pratiraksha Mazdoor Sangh (AN ALL INDIA FEDERATION OF DEFENCE WORKERS)(AN INDUSTRIAL UNIT OF B.M.S.)(RECOGNISED BY MINISTRY OF DEFENCE, GOVT. OF INDIA) REF: BPMS/ PMO/ Memorandum/117(7/4/R) Dated: 06.05.2022 To, The Prime Minister,Govt of India,South Block, Raisina HillsNew Delhi - 110011 Subject:- Submission of … [Read more...] about Guaranteed Minimum Pension equal to half of last drawn salary in NPS and Linked with Dearness / inflation – BPMS Memorandum

| 46% DA Order for Central Government Employees wef 1st July 2023 PDF |

4% DA for Central Government Employees wef 1st July 2023

Railway Employees Bonus 2023

Bonus for central government employees 2023 pdf

CENTRAL GOVERNMENT HOLIDAY LIST 2024

| 42% DA Order for Central Government Employees wef 1st January 2023 PDF |

| 42% DR Order for Central Government Pensioners wef 1st January 2023 PDF |

Pension Scheme

Grant of Dearness Relief to Central Freedom Fighter Pensioners w.e.f. 01.07.2019

Grant of Dearness Relief to Central Freedom Fighter Pensioners w.e.f. 01.07.2019 No.45/08/2017-FF(P) Government of India/ Bharat Sarkar Ministry of Home Affairs/ Grih Mantralaya Freedom Fighters & Rehabilitation Division 2nd Floor, NDCC-11 Building, Jai Singh Road,New Delhi - 110 001, Dated,the 5th November, 2019. To The Pr. Chief Controller of … [Read more...] about Grant of Dearness Relief to Central Freedom Fighter Pensioners w.e.f. 01.07.2019

NPS National Pension Scheme for Traders and Self Employed Persons

NPS Ministry of Labour & Employment Prime Minister launches National Pension Scheme for Traders and Self Employed Persons 12 SEP 2019 The Prime Minister of India, Shri Narendra Modi launched at Ranchi today, the National Pension Scheme for Traders and Self Employed Persons, a pension scheme for the Vyaparis (shopkeepers /retail traders and self-employed persons) … [Read more...] about NPS National Pension Scheme for Traders and Self Employed Persons

Atal Pension Yojana (APY) is the guaranteed Pension Scheme of Government of India administered by PFRDA

Ministry of Finance Easy to Explain Benefits drive Atal Pension Yojana (APY) backed by Government of India's Guarantee;The Subscriber base under APY has crossed 1.24 crore mark; More than 27 lacs new subscribers have joined the Scheme during the Current Financial Year 2018-19 02 NOV 2018 The Atal Pension Yojana (APY) is the guaranteed Pension Scheme of Government of India … [Read more...] about Atal Pension Yojana (APY) is the guaranteed Pension Scheme of Government of India administered by PFRDA

Procedure for extending the benefits of Old GPF / Pension Scheme to those casual workers covered under the Scheme of 1993 and regularized on or after 01.01.2004

Old GPF / Pension Scheme to those casual workers regularized on or after 01.01.2004 - Procedure for extending the benefits: Instructions by CPAO CPAO GOVERNMENT OF INDIA MINISTRY OF FINANCE DEPARTMENT OF EXPENDITURE CENTRAL PENSION ACCOUNTING OFFICE TRIKOOT-II, BHIKAJI CAMA PLACE, NEW DELHI-110066 CPAO/IT&Tech/Clarificarion/P&PW/13 … [Read more...] about Procedure for extending the benefits of Old GPF / Pension Scheme to those casual workers covered under the Scheme of 1993 and regularized on or after 01.01.2004

Pension Scheme for Armed Forces

Whether Government proposes to restore the old Pension Scheme for Armed Forces that was in vogue till 1971 GOVERNMENT OF INDIA MINISTRY OF DEFENCE LOK SABHA UNSTARRED QUESTION NO: 5651 ANSWERED ON: 07.04.2017 Pension Scheme for Armed Forces RAGHAV LAKHANPAL Will the Minister of DEFENCE be pleased to state:- (a) whether the Government proposes to restore the … [Read more...] about Pension Scheme for Armed Forces

Pension Scheme for SSC Officers

GOVERNMENT OF INDIA MINISTRY OF DEFENCE LOK SABHA UNSTARRED QUESTION NO: 4987 ANSWERED ON: 31.03.2017 Pension Scheme for SSC Officers KRUPAL BALAJI TUMANE BHAVANA GAWALI (PATIL) HARIOM SINGH RATHORE Will the Minister of DEFENCE be pleased to state:- (a) whether the Government proposes to start a pension scheme for the Short Service Commission (SSC) officers in the … [Read more...] about Pension Scheme for SSC Officers

Confederation of Central Government employees: PRESS STATEMENT Dated 2nd September 2016

Confederation of Central Government employees: PRESS STATEMENT Dated 2nd September 2016 PRESS STATEMENT Dated 2nd September 2016 The initial report received at the Confederation Central Head Quarters indicate the participation of about ten lakhs Central Government employees in today’s nationwide general strike action of the Indian Working Class. Earlier, endorsing the call … [Read more...] about Confederation of Central Government employees: PRESS STATEMENT Dated 2nd September 2016

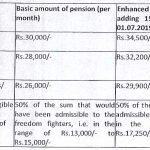

Enhancement of Pension for Freedom Fighters under the Swatantrata Sainik Samman Pension Scheme

Enhancement of Pension for Freedom Fighters under the Swatantrata Sainik Samman Pension Scheme The existing pension scheme for Central freedom fighter pensioners and their eligible dependents has been restructured as per the table below: Sl. No. Category of freedom fighters Present amount of pension (per month) Enhanced amount of pension(per … [Read more...] about Enhancement of Pension for Freedom Fighters under the Swatantrata Sainik Samman Pension Scheme

Union Minister of State Reply – No proposal to introduce any new pension scheme for retired Central Government employees

Union Minister of State Reply – No proposal to introduce any new pension scheme for retired Central Government employees Schemes for Retired Employees The pension of Central Civil Government servants appointed on or before 31.12.2003 is governed by the Central Civil Services (Pension) Rules 1972 or the corresponding Pension Rules of other Services/Departments such as All … [Read more...] about Union Minister of State Reply – No proposal to introduce any new pension scheme for retired Central Government employees

Latest DoPT Orders 2023

CENTRAL GOVT HOLIDAY LIST 2023

Indian Railway Holiday List 2023 PDF | Postal Holidays List 2023 India Post | Bank Holidays List 2023 India | LIC Office Holiday List 2023 PDF Download | EPFO Holiday List 2023 PDF Download | ESIC Holiday List 2023 PDF Download | CGHS Holiday Calendar List 2023 | Post Office Holidays 2023 | Railway Holidays CG Office Holidays 2023 | TN Govt Holidays 2023 | KVS Holiday List 2023-2024 PDF