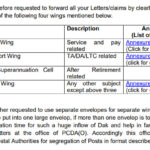

PCDA Pune handling the Pay and Allowances The Principal Controller of Defence Accounts (Officers) in Pune has announced a change in the way letters are addressed to their office. With a daily influx of 5000 Dak (letters), it has become a challenge for the office to segregate and process the mail, leading to delays in adjusting claims and letters from Army Officers. The … [Read more...] about Handling the Pay and Allowances in respect of all the Commissioned Officers of India Army

| 46% DA Order for Central Government Employees wef 1st July 2023 PDF |

4% DA for Central Government Employees wef 1st July 2023

Railway Employees Bonus 2023

Bonus for central government employees 2023 pdf

CENTRAL GOVERNMENT HOLIDAY LIST 2024

| 42% DA Order for Central Government Employees wef 1st January 2023 PDF |

| 42% DR Order for Central Government Pensioners wef 1st January 2023 PDF |

Pay and Allowances

Pay and allowances to Armed forces through Family Allotment Money Order

Pay and allowances to Armed forces through Family Allotment Money Order Ministry of DefencePay and Allowance to Personnel Posted in Field Areas 27 NOV 2019 The Pay and Allowances of all armed forces personnel are being credited by their respective Pay Accounts Offices into their Bank Account each month, irrespective of their place of posting. These Bank … [Read more...] about Pay and allowances to Armed forces through Family Allotment Money Order

Cabinet Cabinet approves revision of pay and allowances of Lieutenant Governors of Union Territories

Cabinet Cabinet approves revision of pay and allowances of Lieutenant Governors of Union Territories 11 APR 2018 The Union Cabinet chaired by Prime Minister Shri Narendra Modi has given its approval for revision of pay and allowances of Lieutenant Governors of Union Territories. It will bring the pay and allowances of LGs at par with that of the Secretary to the … [Read more...] about Cabinet Cabinet approves revision of pay and allowances of Lieutenant Governors of Union Territories

Annual Report on Pay and Allowances

Annual Report on Pay and Allowances Government of India Ministry of Finance Department of Expenditure Pay Research Unit The Pay Research Unit brings out a publication entitled Brochure on Pay and Allowances of Central Government Civilian Employees. The Brochure provides statistical information regarding expenditure incurred by the different Ministries / Departments of … [Read more...] about Annual Report on Pay and Allowances

CGDA: S K Kohli appointed as Controller General of Defence Accounts

CGDA: S K Kohli appointed as Controller General of Defence Accounts New Delhi: Senior bureaucrat S K Kohli was today appointed as Controller General of Defence Accounts (CGDA). The Appointments Committee of Cabinet has approved Kohli’s empanelment for promotion to the post of CGDA, an order issued by Department of Personnel and Training said. He is an Indian Defence … [Read more...] about CGDA: S K Kohli appointed as Controller General of Defence Accounts

Reviewing Pay and Allowances of Armed Forces Personnel

Reviewing Pay and Allowances of Armed Forces Personnel The Government entrusted the task to a Pay Commission in 1973, at the time of setting up of 3rd Central Pay Commission. The Government had set up a Post War Pay Committee in 1947, a departmental pay committee (Raghuramiah Committee) during 1959-60 and another Departmental Committee in 1967 for review of pay and … [Read more...] about Reviewing Pay and Allowances of Armed Forces Personnel

Government expenditure on Central Government Employees and actual impact on government finances

Government expenditure on CG employees and actual impact on government finances Comrades, There are various reports in the media about the impact of the 7th CPC recommendations on the common man and the government resources at large, the reports suggest that additional amount of Rs one lakh crores of public money has been spent for implementation of the 7th CPC … [Read more...] about Government expenditure on Central Government Employees and actual impact on government finances

Central Government Employees Likely To Get 30-Day Bonus in Festive Season

Central Government Employees Likely To Get 30-Day Bonus in Festive Season New Delhi: Ahead of the festival season, the government is likely to give an ad-hoc bonus of up to Rs 3,500 to Group C central government employees and personnel of the armed and para military forces. The government may sanction grant of non-productivity linked bonus (ad-hoc bonus) … [Read more...] about Central Government Employees Likely To Get 30-Day Bonus in Festive Season

Facilities to Defence Personnel

Facilities to Defence Personnel Pay and allowances and other benefits / facilities are provided to the Armed Forces Personnel as per Government orders issued from time to time. Apart from pay, the Armed Forces Personnel deployed on borders in tough conditions, are being given certain compensatory allowances i.e. Field Area Allowance, Siachen Allowance, High Altitude … [Read more...] about Facilities to Defence Personnel

Payment of Salary and other Personal Payments, Salary by Cash on optional basis or through Cheque / Electronically through Bank – instructions

Payment of Salary and other Personal Payments, Salary by Cash on optional basis or through Cheque / Electronically through Bank – instructions No. 2-1/2007-08/PA (Tech-I) D-813-897 GOVERNMENT OF INDIA MINISTRY OF COMMUNICATION & IT DEPARTMENT OF POSTS PA WING: TECH-I BRANCH DAK BHAVAN: SANSAD MARG NEW DELHI-110001 Dated:11-12-2014 OFFICE MEMORANDUM Sub : Payment … [Read more...] about Payment of Salary and other Personal Payments, Salary by Cash on optional basis or through Cheque / Electronically through Bank – instructions

Latest DoPT Orders 2023

CENTRAL GOVT HOLIDAY LIST 2023

Indian Railway Holiday List 2023 PDF | Postal Holidays List 2023 India Post | Bank Holidays List 2023 India | LIC Office Holiday List 2023 PDF Download | EPFO Holiday List 2023 PDF Download | ESIC Holiday List 2023 PDF Download | CGHS Holiday Calendar List 2023 | Post Office Holidays 2023 | Railway Holidays CG Office Holidays 2023 | TN Govt Holidays 2023 | KVS Holiday List 2023-2024 PDF