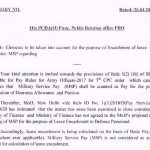

7th CPC leave encashment order - MSP - PCDA (O) advisory regarding elements to be taken into account for the purpose of Encashment of Leave ADVISORY NO. Dated:-26.04.2022 O/o PCDA(O) Pune, Public Relation office PRO Subject:- Elements to be taken into account for the purpose of Encashment of leave as per 7th CPC order: MSP regarding Your kind attention is … [Read more...] about 7th CPC Encashment of leave or Pay Rules for Army Officers 2017 to Military Service Pay – PCDA

| 46% DA Order for Central Government Employees wef 1st July 2023 PDF |

4% DA for Central Government Employees wef 1st July 2023

Railway Employees Bonus 2023

Bonus for central government employees 2023 pdf

CENTRAL GOVERNMENT HOLIDAY LIST 2024

| 42% DA Order for Central Government Employees wef 1st January 2023 PDF |

| 42% DR Order for Central Government Pensioners wef 1st January 2023 PDF |

Military Service Pay

One Rank One Pension (OROP) issue resolved and the Government announced hike in the Military Service Pay (MSP)

Our Soldiers Protect Our Borders in Tough Conditions - FM The issue of One Rank One Pension (OROP) has been resolved and the Government also announced substantial hike in the Military Service Pay (MSP) of all service personnel and special allowances given to Naval and Air Force personnel deployed in high risk duties. Ministry of Finance Defence budget hiked to Rs. … [Read more...] about One Rank One Pension (OROP) issue resolved and the Government announced hike in the Military Service Pay (MSP)

7th CPC: Allowance to Armed Forces

Ministry of Defence Allowance to Armed Forces 31 DEC 2018 Taking note of the rigours of military life, the 6th Central Pay Commission (CPC) had recommended an additional, separate element of Pay for the Defence Forces called Military Service Pay (MSP) which the CPC intended would also maintain the edge enjoyed by the Defence Forces over the civilian scales. The Commission … [Read more...] about 7th CPC: Allowance to Armed Forces

Demand on Higher Military Service Pay (MSP) – Parliament Q&A MILITARY SERVICE PAY

Demand on Higher Military Service Pay (MSP) - Parliament Q&A MILITARY SERVICE PAY In a written reply to a question regarding Military Service Pay in Parliament on 26.12.2018, the Minister of State for Defence Shri Subhash Bhamre said that the MSP was raised by the identical fitment of 2.57. We reproduced the answer and given below for your information… “Taking note … [Read more...] about Demand on Higher Military Service Pay (MSP) – Parliament Q&A MILITARY SERVICE PAY

7th CPC Central Government has rejected the main demand for higher Military Service Pay for Junior Commissioned Officers

7th CPC Central Government has rejected the main demand for higher Military Service Pay for Junior Commissioned Officers. 7th CPC Military Service Pay (MSP) Govt Rejects Main Demand 7th CPC Military Service Pay (MSP) - Govt Rejects Main Demand Central Government has rejected the main demand for higher Military Service Pay for Junior Commissioned Officers. As per the … [Read more...] about 7th CPC Central Government has rejected the main demand for higher Military Service Pay for Junior Commissioned Officers

Grant of Military Service Pay

Ministry of Defence Grant of Military Service Pay 12 MAR 2018 Delhi High Court in its order dated 28 November 2017 has not given any specific direction to grant Military Service Pay (MSP) equally to all ranks. It may be informed that the court in its order mentioned that the conduct of the petitioners in withholding material information and at the same time, trying to invoke … [Read more...] about Grant of Military Service Pay

Fixation of Pay of re-employed pensioners – treatment of Military Service Pay (MSP)

Fixation of Pay of re-employed pensioners - treatment of Military Service Pay (MSP) - reg. GOVERNMENT OF INDIA MINISTRY OF RAILWAYS RAILWAY BOARD No.E(G) 2013/EM 1-5 New Delhi, dated 06, March 2017 The General Secretary, National Federation of Indian Railwaymen. 3, Chelmsford Road, New Delhi. Sir. Sub: Fixation of Pay of re-employed pensioners - treatment of … [Read more...] about Fixation of Pay of re-employed pensioners – treatment of Military Service Pay (MSP)

Applicability of Railway Services (Revised Pay) Rules, 2008 for persons re-employed in Railway service after retirement from Defence Forces

Treatment of Military Service Pay(MSP) while fixing the pay of ex-servicemen re-employed on the Railways: Railway Board GOVERNMENT OF INDIA MINISTRY OF RAILWAYS RAILWAY BOARD No.E(G)2013/EM 1-5 New Delhi, dated 16/01/2017 The General Secretary, N.F.I.R., 3, Chelmsford Road, New Delhi - 110055. Dear Sir, Sub: Applicability of Railway Services (Revised Pay) Rules, … [Read more...] about Applicability of Railway Services (Revised Pay) Rules, 2008 for persons re-employed in Railway service after retirement from Defence Forces

MHA for Pay on Par with Army for Paramilitary

In its presentation before the ECOS, the MHA also batted for a ‘special pay’ on par with the army. The defence forces get a special allowance in the form of military service pay (MSP) over and above their salaries. MHA for Pay on Par with Army for Paramilitary – While recommending a ‘CAPF service pay’, the home ministry said, “CAPF fulfills all attributes required for … [Read more...] about MHA for Pay on Par with Army for Paramilitary

Discrimination in Structure of Military Service Pay – Defence Minister Reply

Discrimination in Structure of Military Service Pay – Defence Minister Reply Military Service Pay is paid as a compensation to the Armed Forces personnel as a recognition for the intangible aspects linked to the special conditions of their service. Defence Minister has clarified about Military Service Pay (MSP) is being paid to the Armed Forces Personnel w.e.f. 1st … [Read more...] about Discrimination in Structure of Military Service Pay – Defence Minister Reply

Latest DoPT Orders 2023

CENTRAL GOVT HOLIDAY LIST 2023

Indian Railway Holiday List 2023 PDF | Postal Holidays List 2023 India Post | Bank Holidays List 2023 India | LIC Office Holiday List 2023 PDF Download | EPFO Holiday List 2023 PDF Download | ESIC Holiday List 2023 PDF Download | CGHS Holiday Calendar List 2023 | Post Office Holidays 2023 | Railway Holidays CG Office Holidays 2023 | TN Govt Holidays 2023 | KVS Holiday List 2023-2024 PDF