Bank Employees DA 2022 Dearness Allowance in banks for Aug, Sep and Oct 2022 @ 36.82 % of pay: IBA Order dated 01.08.2022 is showing an increase in DA slabs of ’54’ i.e, 526 Slabs for payment of DA for the quarter August, September and October 2022 Indian Banks’ Association HR & Industrial Relations HR&IR/MBR/ 76/D/2022-23/ 1 1414 August 1, 2022 All … [Read more...] about DA for Bank Employees for the months of August, September & October 2022 under XI BPS/ Joint Note dated 11.11.2020

| 46% DA Order for Central Government Employees wef 1st July 2023 PDF |

4% DA for Central Government Employees wef 1st July 2023

Railway Employees Bonus 2023

Bonus for central government employees 2023 pdf

CENTRAL GOVERNMENT HOLIDAY LIST 2024

| 42% DA Order for Central Government Employees wef 1st January 2023 PDF |

| 42% DR Order for Central Government Pensioners wef 1st January 2023 PDF |

IBA

Bank Employees Dearness Allowance for the months of May, June and July 2022 under XI BPS

Bank Employees Dearness Allowance Dearness Allowance for Workmen and Officer Employees in banks for the months of May, June and July 2022 Indian Banks’ Association HR & Industrial Relations HR&IR/MBR/76/ D/2022-23/11183April 30, 2022 All Members of the Association(Designated Officers) Dear Sir/ Madam, Dearness Allowance for Workmen and Officer … [Read more...] about Bank Employees Dearness Allowance for the months of May, June and July 2022 under XI BPS

IBA proposal to enhance the family pension to 30% of the last salary drawn by bank employees families

Bank Family Pension Revision 2021 | Bank Employees Family Pension Increased to 14% | PSU Bank employees | Employer contribution to NPS Press Information BureauGovernment of IndiaMinistry of Finance Banks’ contribution to NPS Corpus of PSU Bank employees to be enhanced to 14% Mumbai, 25 August 2021 In a bid to provide relief to families of bank employees, the … [Read more...] about IBA proposal to enhance the family pension to 30% of the last salary drawn by bank employees families

DA for Bank employees from August 2021 under XI BPS – IBA DA circular

Dearness Allowance for Workmen and Officer Employees in banks for the months of August, September & October 2021 Indian Banks' Association HR & Industrial Relations HR&IR/MBR/76/D/10194August 2, 2021 All Members of the Association(Designated Officers) Dear Sir/ Madam, Dearness Allowance for Workmen and Officer Employees in banks for the months … [Read more...] about DA for Bank employees from August 2021 under XI BPS – IBA DA circular

IBA Model Educational Loan Scheme for Pursuing Higher Education in India and Abroad, 2021

Indian Banks’ Association No. RB / ELS / 9623 February 15, 2021 The Chairman / Managing Director & Chief Executives of All Member Banks Dear Sir / Madam, IBA Model Educational Loan Scheme for Pursuing Higher Education in India and Abroad, 2021 In 2000, pursuant to the Finance Minister’s meeting with the Chief Executives of public sector banks, IBA had … [Read more...] about IBA Model Educational Loan Scheme for Pursuing Higher Education in India and Abroad, 2021

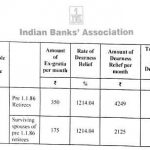

Dearness Relief payable for the period February 2021 to July 2021 to surviving pre 1.1.1986 retirees of banks (b) surviving spouses of pre 1.1.86 Retirees who are in receipt of Ex-gratia

Dearness Relief payable for the period February 2021 to July 2021 to surviving pre 1.1.1986 retirees of banks (b) surviving spouses of pre 1.1.86 Retirees who are in receipt of Ex-gratia Indian Banks’ Association HR & INDUSTRIAL RELATIONS No.CIR/HR&IR/D/ G2/2020-21/9590 February 1, 2021 Designated Officers of all Nationalised Banks and State Bank of … [Read more...] about Dearness Relief payable for the period February 2021 to July 2021 to surviving pre 1.1.1986 retirees of banks (b) surviving spouses of pre 1.1.86 Retirees who are in receipt of Ex-gratia

Revised Dearness Allowance for Bank Employees for the months of November, December 2020 & January 2021 under X BPS/ Joint Note dated 25.5.2015

Dearness Allowance for Bank Employees Indian Banks’ AssociationHR & Industrial Relations No.CIR/HR&IR/76/D/2020/9381December 2, 2020 All Members of the Association(Designated Officers) Dear Sir/ Madam, Dearness Allowance for Workmen and Officer Employees in banks for the months of November, December 2020 & January 2021 under X BPS/ Joint Note dated … [Read more...] about Revised Dearness Allowance for Bank Employees for the months of November, December 2020 & January 2021 under X BPS/ Joint Note dated 25.5.2015

BANK DA of Clerical Staff and Subordinate Staff w.e.f 1st Nov 2017

BANK DA of Clerical Staff and Subordinate Staff In substitution of Clause 7 of Bipartite Settlement dated 25th May 2015 with effect from 1st November 2017, the Dearness Allowance shall be payable as per the following rates: Clerical and Subordinate Staff 0.07 % of 'pay' per slab of four points. Note: Dearness Allowance in the above manner shall be paid for every … [Read more...] about BANK DA of Clerical Staff and Subordinate Staff w.e.f 1st Nov 2017

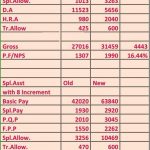

11th Bipartite Revised Pay Scale for Clerical and Subordinate Staff w.e.f 1st Nov, 2017

11th Bipartite Revised Pay Scale Revised Scales of Pay Clerical Staff and Subordinate Staff w.e.f 1st Nov, 2017: 11th BI-Partite Settlement Dtd. 11 Nov 2020 In modification of Clause 4 of Bipartite Settlement dated 25th May, 2015, with effect from 1st November, 2017 the scales of pay shall be as under: Clerical … [Read more...] about 11th Bipartite Revised Pay Scale for Clerical and Subordinate Staff w.e.f 1st Nov, 2017

Bank Employees DA for the months of November, December 2020 & January 2021 under X BPS/ Joint Note dated 25.5.2015

Bank Employees DA Dearness Allowance for Workmen and Officer Employees in banks for the months of November, December 2020 & January 2021 Indian Banks’ AssociationHR & Industrial Relations No.CIR/HR&IR/ 76/D/2020/9282November 3, 2020 All Members of the Association(Designated Officers) Dear Sir/ Madam, Dearness Allowance for Workmen and Officer … [Read more...] about Bank Employees DA for the months of November, December 2020 & January 2021 under X BPS/ Joint Note dated 25.5.2015

Latest DoPT Orders 2023

CENTRAL GOVT HOLIDAY LIST 2023

Indian Railway Holiday List 2023 PDF | Postal Holidays List 2023 India Post | Bank Holidays List 2023 India | LIC Office Holiday List 2023 PDF Download | EPFO Holiday List 2023 PDF Download | ESIC Holiday List 2023 PDF Download | CGHS Holiday Calendar List 2023 | Post Office Holidays 2023 | Railway Holidays CG Office Holidays 2023 | TN Govt Holidays 2023 | KVS Holiday List 2023-2024 PDF