Superannuation of a Government servant No. TA-3-6/3/2020 -TA-III /CS-4308/127Ministry of FinanceDepartment of ExpenditureOffice of Controller General of AccountsMahalekha Niyantrak BhawanE-Block, GPO Complex, INA, New Delhi Dated 24.3.2023 OFFICE MEMORANDUM Subject: Timelines for completion of various activities in the process of authorisation of pension/family … [Read more...] about Timelines for completion of various activities in the process of authorisation of pension/family pension and gratuity on retirement on superannuation of a Government servant and death while in service

| 46% DA Order for Central Government Employees wef 1st July 2023 PDF |

4% DA for Central Government Employees wef 1st July 2023

Railway Employees Bonus 2023

Bonus for central government employees 2023 pdf

CENTRAL GOVERNMENT HOLIDAY LIST 2024

| 42% DA Order for Central Government Employees wef 1st January 2023 PDF |

| 42% DR Order for Central Government Pensioners wef 1st January 2023 PDF |

gratuity

Authorization of pension, gratuity and family pension of a Govt servant died after retirement without submission of pension form

Process of authorisation of pension and gratuity on retirement, Family pension on non-submission of forms due to infirmity and death: PCDA (Pension) Circular No. C-221 O/o The Principal Controller of Defence Accounts(Pension), Draupadighat, Prayagraj - 211014. Circular No. C-221 No. G1/C/0176/Vol-X/TechDated 06.02.2023 To(All Head of Department under Min of … [Read more...] about Authorization of pension, gratuity and family pension of a Govt servant died after retirement without submission of pension form

Rule 62 CCS Pension Rules 2021 Payment of Provisional Pension and gratuity in case of delay in issue of PPO authorizing regular pension

Rule 65 CCS Pension Rules 2021 फा.स./12(9)/2020-P&PW(C)-6450भारत सरकारकार्मिक, लोक शिकायत तथा पेंशन मंत्रालयपेंशन और पेंशनभोगी कल्याण विभाग(Desk-H) 8th Floor, Janpath Bhawan,Janpath, New Delhi,Dated the 23th February, 2022 OFFICE MEMORANDUM Sub: Payment of Provisional Pension and gratuity under Rule 62 of the Central Civil Services (Pension) Rules, 2021 in case … [Read more...] about Rule 62 CCS Pension Rules 2021 Payment of Provisional Pension and gratuity in case of delay in issue of PPO authorizing regular pension

Rationalization of financial transactions payment towards Gratuity and Commutation money – KVS

KVS Rationalization of financial payment KendriyaVidyalaya Sangathan (HQ)Institutional Area,Shaneed Jeet Singh Marg,New Delhi - 110016 F.10236/4/2021-22/ KVS/HQBudget/2813 Date:- 26.11.2021 The Deputy Commissioner/Director,Kendriya Vidyalaya Sangathan,All Regional Offices/ZIETs Subject:- Rationalization of financial transactions - reg. Madam/Sir, With … [Read more...] about Rationalization of financial transactions payment towards Gratuity and Commutation money – KVS

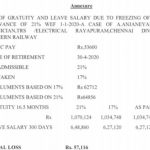

Payment of Dearness Allowance during the freezing period from 01.10.2020 up to 30.06.2021 CPSEs Employees

PSU: Gratuity & leave cash for those who retired during DA frozen period CPSE employees (IDA pattern) who retired on or after 01 .10.2021 and up to 30.06.2021, the amount of DA to be taken into account for calculation of gratuity and cash payment in lieu of leave will be deemed to be as per the notional DA rates W-02/0029/2021-DPE (WC)-GL-Xl21Government of … [Read more...] about Payment of Dearness Allowance during the freezing period from 01.10.2020 up to 30.06.2021 CPSEs Employees

Central Govt employees DA on Encashment of Leave and Gratuity

PCDA Message No. 17/2021 DA on Encashment of Leave & Gratuity - Regarding Lately, GoI, MoF, New Delhi letter, No. 1(5)/E.V/2020 dated 07/09/2021 regarding Central Govt employees retired during the period from January 2020 to June 2021- calculation of Gratuity and Cash payment in lieu of Leave - regarding’, is doing rounds in the environment, however, the same has … [Read more...] about Central Govt employees DA on Encashment of Leave and Gratuity

Central Civil Services Payment of Gratuity under National Pension System Rules 2021

CCS Rules 2021 - Payment of Gratuity under NPS MINISTRY OF PERSONNEL, PUBLIC GRIEVANCES AND PENSIONS(Department of Pension and Pensioners’ Welfare) NOTIFICATION New Delhi, the 23rd September, 2021 G.S.R. 658(E). In exercise of the powers conferred by the proviso to article 309 and clause (5) of article 148 of the Constitution and after consultation with the … [Read more...] about Central Civil Services Payment of Gratuity under National Pension System Rules 2021

Payment of retirement benefits to the retired employers on time DoPPW

Retirement benefits No. 3(6)/2021- P&PW(H)- 7083Government of IndiaMinistry of Personnel & Public GrievanceDepartment of Pension and pensioners’ Welfare 8th Floor, Janpath Bhavan,Janpath, New Delhi,Dated: 9th March, 2021 OFFICE MEMORANDUM Subject: Timely payment of retirement benefits to the retiring employees The undersigned is directed to say that … [Read more...] about Payment of retirement benefits to the retired employers on time DoPPW

Retirement Benefits in One Click Download PDF – DEPARTMENT OF PENSION & PENSIONERS WELFARE

Retirement Benefits for Pensioners GOVERNMENT OF INDIADEPARTMENT OF PENSION & PENSIONERS’ WELFARE Retirement Benefits in One Click Our Efforts Towards Dignified Retirement MINISTRY OF PERSONNEL, PUBLIC GRIEVANCESDEPARTMENT OF PENSION & PENSIONERS’ WELFARELOK NAYAK BHAWAN, KHAN MARKET,NEW DELHI-110003 Dr. Kshatrapati Shivaji, IAS TRIASSecretary. … [Read more...] about Retirement Benefits in One Click Download PDF – DEPARTMENT OF PENSION & PENSIONERS WELFARE

Computation of gratuity and leave encashment in the case of persons retired/ to be retired after Jan 1st 2020 Consequent upon the denial of DA/DR

Latest Central Government Employees No.NC-JCM-2020/ DOPT (DA) October 08, 2020 The Secretary,Government of India,Department of Personnel & Training,North Block,New Delhi Dear Sir, Sub: Computation of gratuity and leave encashment in the case of persons retired/ to be retired after 1.1.2020 Consequent upon the denial of DA/DR We invite your kind attention … [Read more...] about Computation of gratuity and leave encashment in the case of persons retired/ to be retired after Jan 1st 2020 Consequent upon the denial of DA/DR

Latest DoPT Orders 2023

CENTRAL GOVT HOLIDAY LIST 2023

Indian Railway Holiday List 2023 PDF | Postal Holidays List 2023 India Post | Bank Holidays List 2023 India | LIC Office Holiday List 2023 PDF Download | EPFO Holiday List 2023 PDF Download | ESIC Holiday List 2023 PDF Download | CGHS Holiday Calendar List 2023 | Post Office Holidays 2023 | Railway Holidays CG Office Holidays 2023 | TN Govt Holidays 2023 | KVS Holiday List 2023-2024 PDF