Important Circular No. FC/ IH/ NPS/ CircularO/O the PCDA, WCChandigarh Dated: /08/2022 ToThe Officer in Charge1. Pay Section (Local)2. All AAO (Pay) WC, PAOs & AOGEsPCDA(WC) Chandigarh Sub:- Mandatory compliance of the provisions laid down in CCS (Implementation of NPS) Rules 2021. Ref:- DAD HQrs Circular No. At-II/NPS/ PAOs Performance/E-1997 dated … [Read more...] about NPS – Mandatory compliance of the provisions laid down in CCS Rules 2021

| 46% DA Order for Central Government Employees wef 1st July 2023 PDF |

4% DA for Central Government Employees wef 1st July 2023

Railway Employees Bonus 2023

Bonus for central government employees 2023 pdf

CENTRAL GOVERNMENT HOLIDAY LIST 2024

| 42% DA Order for Central Government Employees wef 1st January 2023 PDF |

| 42% DR Order for Central Government Pensioners wef 1st January 2023 PDF |

Government Employees

Rajasthan state Government employees Ad-hoc bonus for the financial year 2019-2020

Rajasthan Government employees Ad-hoc bonus GOVERNMENT OF RAJASTHANFINANCE DEPARTMENT(RULES DIVISION) ORDER No. F.6(5)FD(Rules) /2009 Jaipur, Dated:10 NOV 2020 Subject: Grant of ad-hoc bonus to State Government employees for the financial year 2019-2020. The matter relating to grant of ad-hoc bonus for the financial year 2019-20 to State Government … [Read more...] about Rajasthan state Government employees Ad-hoc bonus for the financial year 2019-2020

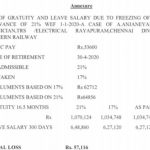

Computation of gratuity and leave encashment in the case of persons retired/ to be retired after Jan 1st 2020 Consequent upon the denial of DA/DR

Latest Central Government Employees No.NC-JCM-2020/ DOPT (DA) October 08, 2020 The Secretary,Government of India,Department of Personnel & Training,North Block,New Delhi Dear Sir, Sub: Computation of gratuity and leave encashment in the case of persons retired/ to be retired after 1.1.2020 Consequent upon the denial of DA/DR We invite your kind attention … [Read more...] about Computation of gratuity and leave encashment in the case of persons retired/ to be retired after Jan 1st 2020 Consequent upon the denial of DA/DR

Kerala Government issued an order to deduct the salary of government employees for six days every month

The Kerala Government issued an order to deduct the salary of government employees for six days every month for the next five months as part of raising funds for fighting the COVID-19 pandemic in the State. The order made it clear that there will be no salary cut for those staff who earn less than Rs.20,000 per month. The Kerala government has extended to cut salary of … [Read more...] about Kerala Government issued an order to deduct the salary of government employees for six days every month

Mission Karmayogi NPCSCB for Government Employees

Cabinet approves “Mission Karmayogi” - National Programme for Civil Services Capacity Building (NPCSCB) New National Architecture for Civil Services Capacity Building Comprehensive reform of the capacity building apparatus at individual, institutional and process levels for efficient public service delivery PM led HR Council to approve and monitor Civil Service Capacity … [Read more...] about Mission Karmayogi NPCSCB for Government Employees

Government will soon start the selection process for the new PFRDA chairman

Government will soon start the selection process for the new PFRDA chairman The government will soon start selection process for a new chairman of pension fund regulator PFRDA to succeed the present chief, Hemant G Contractor, whose term is slated to end in April. "The Finance Ministry will soon come out with an advertisement to find a successor to head the Pension Fund … [Read more...] about Government will soon start the selection process for the new PFRDA chairman

Employees Union urges the Lavasa Committee report to be implemented by the central government

Employees Union urges the Lavasa Committee report to be implemented by the central government A Jammu-based employees union on Sunday urged the Centre to implement the recommendations of the Ashok Lavasa Committee report ahead of the upcoming Lok Sabha polls to benefit lakhs of lower class employees and pensioners. A high-level committee headed by the former Finance … [Read more...] about Employees Union urges the Lavasa Committee report to be implemented by the central government

Grant of special increment in the form of personal pay to central government servants for participation in sporting events and tournaments of national or international importance, in the 7th CPC Scenario

Grant of special increment in the form of personal pay to central government servants for participation in sporting events and tournaments of national or international importance, in the 7th CPC Scenario - case of Shri Avinash Srivastava Umpire. F.No.13-04/2017-PAP Government of India Ministry of Communications Department of Posts (Establishment Division) Dak Bhawan, … [Read more...] about Grant of special increment in the form of personal pay to central government servants for participation in sporting events and tournaments of national or international importance, in the 7th CPC Scenario

NPS To OPS: Karnataka Government Employees Protest against NPS

NPS To OPS: Karnataka Government Employees Protest against NPS New Pension System To Old Pension Scheme Karnataka Government Employees Protest against NPS Karnataka State Government Employees demanded to scrap NPS and on Wednesday they took a streets in Karnataka's Belgaum City. As per the media news, thousands of agitating employees assembled in Kondaskoppa area of the … [Read more...] about NPS To OPS: Karnataka Government Employees Protest against NPS

Travel entitlements of Government employees for the purpose of LTC post Seventh Central Pay Commission (7th CPC)

Travel entitlements of Government employees for the purpose of LTC post Seventh Central Pay Commission (7th CPC) No. AN/XIV/ 19015/Govt. Orders/TA/DA/LTC/Medical/2018 28.11.2018 Sub: Travel entitlements of Government employees for the purpose of LTC post Seventh Central Pay Commission - clarification reg. A Copy of Government of India, Ministry of Personnel, … [Read more...] about Travel entitlements of Government employees for the purpose of LTC post Seventh Central Pay Commission (7th CPC)

Latest DoPT Orders 2023

CENTRAL GOVT HOLIDAY LIST 2023

Indian Railway Holiday List 2023 PDF | Postal Holidays List 2023 India Post | Bank Holidays List 2023 India | LIC Office Holiday List 2023 PDF Download | EPFO Holiday List 2023 PDF Download | ESIC Holiday List 2023 PDF Download | CGHS Holiday Calendar List 2023 | Post Office Holidays 2023 | Railway Holidays CG Office Holidays 2023 | TN Govt Holidays 2023 | KVS Holiday List 2023-2024 PDF