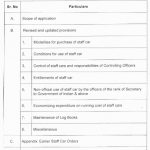

Use of staff car in Central Government offices No. 18(23)/E. Coord-2021Government of IndiaMinistry of FinanceDepartment of ExpenditureNorth Block, New Delhi Dated 1st Sep, 2022 Office Memorandum Subject: Compendium of instructions for use of staff car in Central Government offices - Regarding The Department of Expenditure, Ministry of Finance has from time to … [Read more...] about Compendium of instructions for use of staff car in Central Government offices

| 46% DA Order for Central Government Employees wef 1st July 2023 PDF |

4% DA for Central Government Employees wef 1st July 2023

Railway Employees Bonus 2023

Bonus for central government employees 2023 pdf

CENTRAL GOVERNMENT HOLIDAY LIST 2024

| 42% DA Order for Central Government Employees wef 1st January 2023 PDF |

| 42% DR Order for Central Government Pensioners wef 1st January 2023 PDF |

Finmin

Grant of eligible Bonus to Central Autonomous body Employees – Confederation writes to FinMin

Bonus 2020 The Confederation writes to the Minister of Finance about the qualifying Bonus to Central Autonomous Body Employees will be given with immediate effect to all Ministries to restore the Autonomous Body Employees - Bonus 2020. CONFEDERATION OF CENTRAL GOVT. EMPLOYEES & WORKERS1st Floor, North Avenue PO Building, New Delhi - 110001 No. … [Read more...] about Grant of eligible Bonus to Central Autonomous body Employees – Confederation writes to FinMin

All calendars, diaries, schedulers and similar other materials, which were earlier printed in physical format, will now be done digitally by Ministries / Departments /PSUs/ PSBs

All calendars, diaries, schedulers and similar other materials, which were earlier printed in physical format, will now be done digitally by Ministries /Departments/ PSUs/ PSBs Ministries /Departments /PSUs /PSBs and all other organs of the government to adopt innovative means to use digital or online methods Given the prevailing circumstances in which the world is … [Read more...] about All calendars, diaries, schedulers and similar other materials, which were earlier printed in physical format, will now be done digitally by Ministries / Departments /PSUs/ PSBs

FinMin working on salary standards re-appointed by retired central government Officials

Latest Central Government Employees News FinMin working on norms for salaries of retired central govt officials re-appointed on contract The finance ministry is working on guidelines for wage transfers to contractually re-elected central government employees and has suggested that appointments will stay 'no more' The Ministry of Finance of the Department of Expense, in … [Read more...] about FinMin working on salary standards re-appointed by retired central government Officials

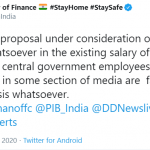

No proposal to reduce salary of Central Government employees – Ministry of Finance

Central Government Employees News Ministry of Finance Flag of India #StayHome #StaySafe@FinMinIndia - Tweet There is no proposal under consideration of Govt for any cut whatsoever in the existing salary of any category of central government employees. The reports in some section of media are false and have no basis whatsoever. The Ministry of Finance already … [Read more...] about No proposal to reduce salary of Central Government employees – Ministry of Finance

Cases of promotion taking place in the pre-revised pay structure between 1.1.2006 and the date of notification of RS(RP)Rules, 2008 and the subsequent merger of the pre-revised pay scales of the promotional and feeder posts in a common grade – Fixation of Pay

Promotion between 1.1.2006 and the date of notification of 6th CPC & merger of pay scales of the promotional and the feeder posts: JCM writes to FinMin Ph.: 23382286 National Council (Staff Side) Joint Consultative Machinery For Central Government Employees 13-C, Ferozshah Road, New Delhi - 110001 E Mail : [email protected] Shiva Gopal … [Read more...] about Cases of promotion taking place in the pre-revised pay structure between 1.1.2006 and the date of notification of RS(RP)Rules, 2008 and the subsequent merger of the pre-revised pay scales of the promotional and feeder posts in a common grade – Fixation of Pay

Finmin to initiate Budget exercise next week

Finmin to initiate Budget exercise next week Work on India’s first post-GST Union Budget 2018-19 will start next week with the finance ministry issuing timelines for different processes that will culminate with its presentation in February. Finance Minister Arun Jaitley arrived at the parliament on Wednesday for Budget. It may also be the current government's last … [Read more...] about Finmin to initiate Budget exercise next week

7th CPC Travelling Allowance – Finmin issued orders on 18.8.2017

7th CPC Travelling Allowance - Finmin issued orders on 18.8.2017 CTG and Transportation of personal effects on Transfer and Retirement will be regulated as under: F.No. 19030/1/2017-E.IV Government of India Ministry of Finance Department of Expenditure New Delhi, the 18th August, 2017 OFFICE MEMORANDUM Subject:- Travelling Allowance Rules - Implementation of the … [Read more...] about 7th CPC Travelling Allowance – Finmin issued orders on 18.8.2017

7th Pay Commission – Finmin: MACP on performance to be reconsidered ?

7th Pay Commission - Finmin: MACP on performance to be reconsidered ? New Delhi: Good-performing Central government employees will now get MACP if their performance is not upto the mark of "very good", the Finance Ministry officials told The Sen Times on condition of anonymity. They has said the government will reconsider the benchmark for performance appraisal for … [Read more...] about 7th Pay Commission – Finmin: MACP on performance to be reconsidered ?

7th Central Pay Commission – Resolution on Allowances, Dated 6th July, 2017

7th Pay Commission Allowances - Finmin issued Resolution 7th Central Pay Commission - Resolution on Allowances, Dated 6th July, 2017 MINISTRY OF FINANCE (Department of Expenditure) RESOLUTION New Delhi, the 6th July, 2017 No. 11-1/2016-IC.-The Seventh Central Pay Commission (the Commission) was set up by the Government of India vide Resolution No. 1/1/2013-E.III (A), … [Read more...] about 7th Central Pay Commission – Resolution on Allowances, Dated 6th July, 2017

Latest DoPT Orders 2023

CENTRAL GOVT HOLIDAY LIST 2023

Indian Railway Holiday List 2023 PDF | Postal Holidays List 2023 India Post | Bank Holidays List 2023 India | LIC Office Holiday List 2023 PDF Download | EPFO Holiday List 2023 PDF Download | ESIC Holiday List 2023 PDF Download | CGHS Holiday Calendar List 2023 | Post Office Holidays 2023 | Railway Holidays CG Office Holidays 2023 | TN Govt Holidays 2023 | KVS Holiday List 2023-2024 PDF